Supercuts 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

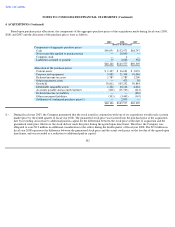

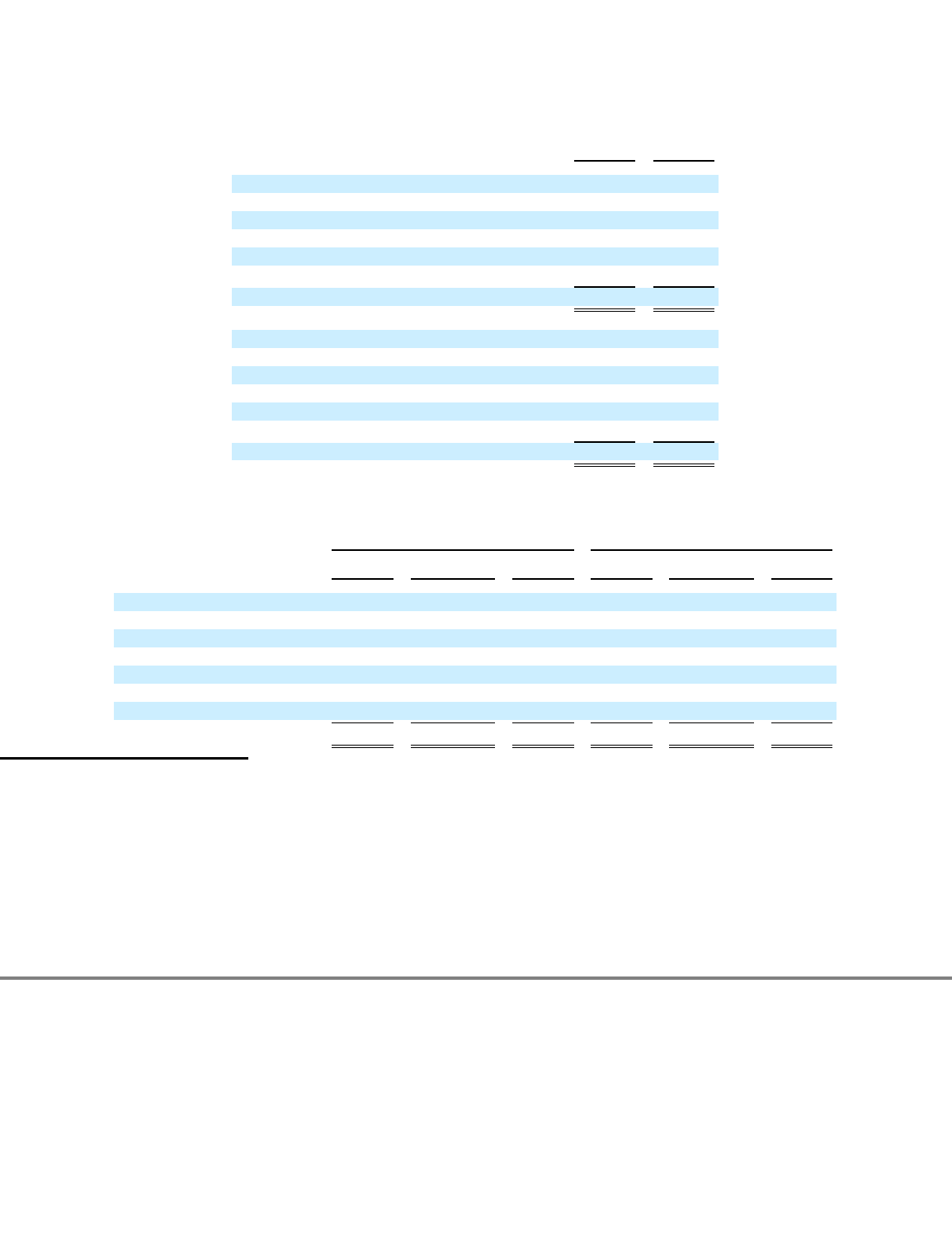

3. OTHER FINANCIAL STATEMENT DATA (Continued)

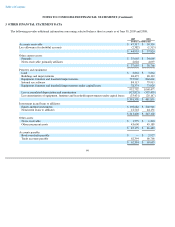

The following provides additional information concerning the other intangibles, net, balance sheet account as of June 30, 2009 and 2008:

(1)

2009

2008

(Dollars in thousands)

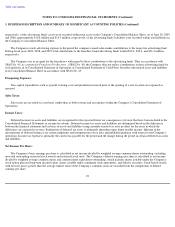

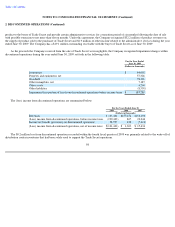

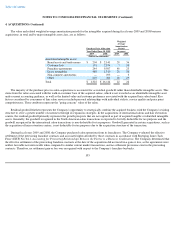

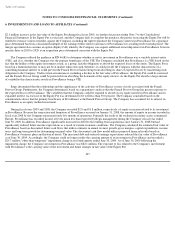

Accrued expenses:

Payroll and payroll related costs

$

82,153

$

94,418

Insurance

21,228

52,345

Deferred revenues

9,026

10,062

Taxes payable, primarily income taxes

8,741

13,094

Other

35,490

37,686

$

156,638

$

207,605

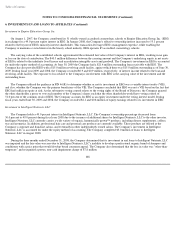

Other noncurrent liabilities:

Deferred income taxes

$

58,338

$

55,900

Deferred rent

53,294

57,751

Deferred benefits

49,262

48,732

Insurance

23,804

—

Equity put option

24,161

24,803

Other

27,428

30,454

$

236,287

$

217,640

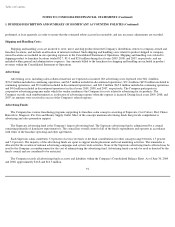

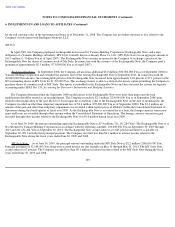

June 30, 2009

June 30, 2008

Cost

Accumulated

Amortization(1)

Net

Cost

Accumulated

Amortization(1)

Net

(Dollars in thousands)

Amortized intangible assets:

Brand assets and trade names

$

79,064

$

(9,964

)

$

69,100

$

81,407

$

(8,072

)

$

73,335

Customer lists

52,045

(23,252

)

28,793

51,316

(17,444

)

33,872

Franchise agreements

20,691

(6,299

)

14,392

27,115

(6,363

)

20,752

Lease intangibles

14,615

(3,737

)

10,878

14,771

(2,887

)

11,884

Non

-

compete agreements

121

(60

)

61

785

(631

)

154

Other

6,887

(3,150

)

3,737

7,974

(3,680

)

4,294

$

173,423

$

(46,462

)

$

126,961

$

183,368

$

(39,077

)

$

144,291

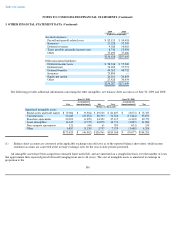

Balance sheet accounts are converted at the applicable exchange rates effective as of the reported balance sheet dates, while income

statement accounts are converted at the average exchange rates for the year-to-date periods presented.

All intangible assets have been assigned an estimated finite useful life, and are amortized on a straight-line basis over the number of years

that approximate their expected period of benefit (ranging from one to 40 years). The cost of intangible assets is amortized to earnings in

proportion to the

100