Supercuts 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

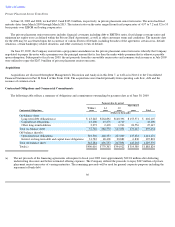

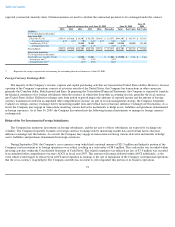

Investing Activities

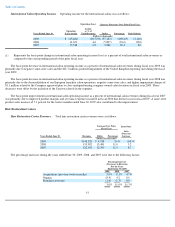

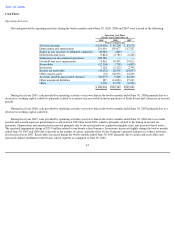

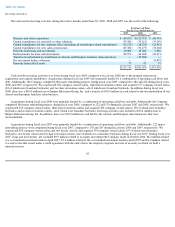

Net cash used in investing activities during the twelve months ended June 30, 2009, 2008 and 2007 was the result of the following:

Cash used by investing activities was lower during fiscal year 2009 compared to fiscal year 2008 due to the planned reduction in

acquisitions and capital expenditures. Acquisitions during fiscal year 2009 were primarily funded by a combination of operating cash flows and

debt. Additionally, the Company completed 280 major remodeling projects during fiscal year 2009, compared to 186 and 222 during fiscal years

2008 and 2007, respectively. We constructed 182 company-owned salons, eight hair restoration centers and acquired 177 company-

owned salons

(83 of which were franchise buybacks) and two hair restoration centers, all of which were franchise buybacks. In addition during fiscal year

2008, there was a $36.4 million loan to Empire Education Group, Inc. and a transfer of $10.9 million in cash related to the deconsolidation of our

schools and European franchise salon business.

Acquisitions during fiscal year 2008 were primarily funded by a combination of operating cash flows and debt. Additionally the Company

completed 186 major remodeling projects during fiscal year 2008, compared to 222 and 170 during fiscal years 2007 and 2006, respectively. We

constructed 325 company-owned salons, three hair restoration centers and acquired 382 company-owned salons (150 of which were franchise

buybacks) and six hair restoration centers, all of which were franchise buybacks. Investing activities also included a $36.4 million loan to

Empire Education Group, Inc. In addition, there was $10.9 million in cash held by the schools and European salon businesses that were

deconsolidated.

Acquisitions during fiscal year 2007 were primarily funded by a combination of operating cash flows and debt. Additionally, 222 major

remodeling projects were completed during fiscal year 2007, compared to 170 and 205 during fiscal years 2006 and 2005, respectively. We

constructed 420 company-owned salons and two beauty schools and acquired 354 company-owned salons (97 of which were franchise

buybacks), one beauty school and two hair restoration centers (one of which was a franchise buyback) during fiscal year 2007. During fiscal year

2007, loans and investments, net, included $9.9 million related to an equity investment the Company made in October 2006, $8.2 million related

to a cost method investment made in April 2007, $3.1 million related to the cost method investment made in April 2007 and $4.0 million related

to a note receivable issued under a credit agreement with the entity that is the majority corporate investor of an entity in which we hold a

minority interest.

62

Investing Cash Flows

For the Years Ended June 30,

2009 2008 2007

(Dollars in thousands)

Business and salon acquisitions

$

(40,051

)

$

(132,971

)

$

(68,747

)

Capital expenditures for remodels or other additions

(35,081

)

(35,212

)

(35,299

)

Capital expenditures for the corporate office (including all technology

-

related expenditures)

(13,113

)

(18,310

)

(21,452

)

Capital expenditures for new salon construction

(25,380

)

(32,277

)

(33,328

)

Proceeds from loans and investments

19,008

10,000

5,250

Disbursements for loans and investments

(20,971

)

(46,400

)

(30,673

)

Transfer of cash related to contribution of schools and European franchise salon operations

—

(

10,906

)

—

Net investment hedge settlement

—

—

(

8,897

)

Proceeds from sale of assets

77

47

97

$

(115,511

)

$

(266,029

)

$

(193,049

)