Supercuts 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

continues to fluctuate and regularly trades below our book value per share. Adverse changes in expected operating results, an extended period of

the Company's stock trading significantly below book value per share, and unfavorable changes in other economic factors may result in further

impairment of goodwill. The Company concluded there were no triggering events between the annual impairment testing and June 30, 2009.

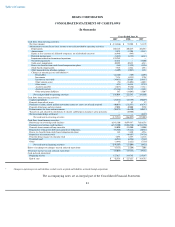

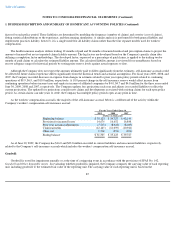

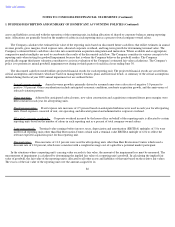

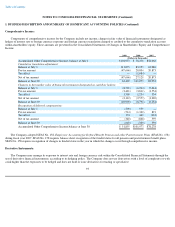

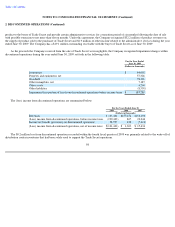

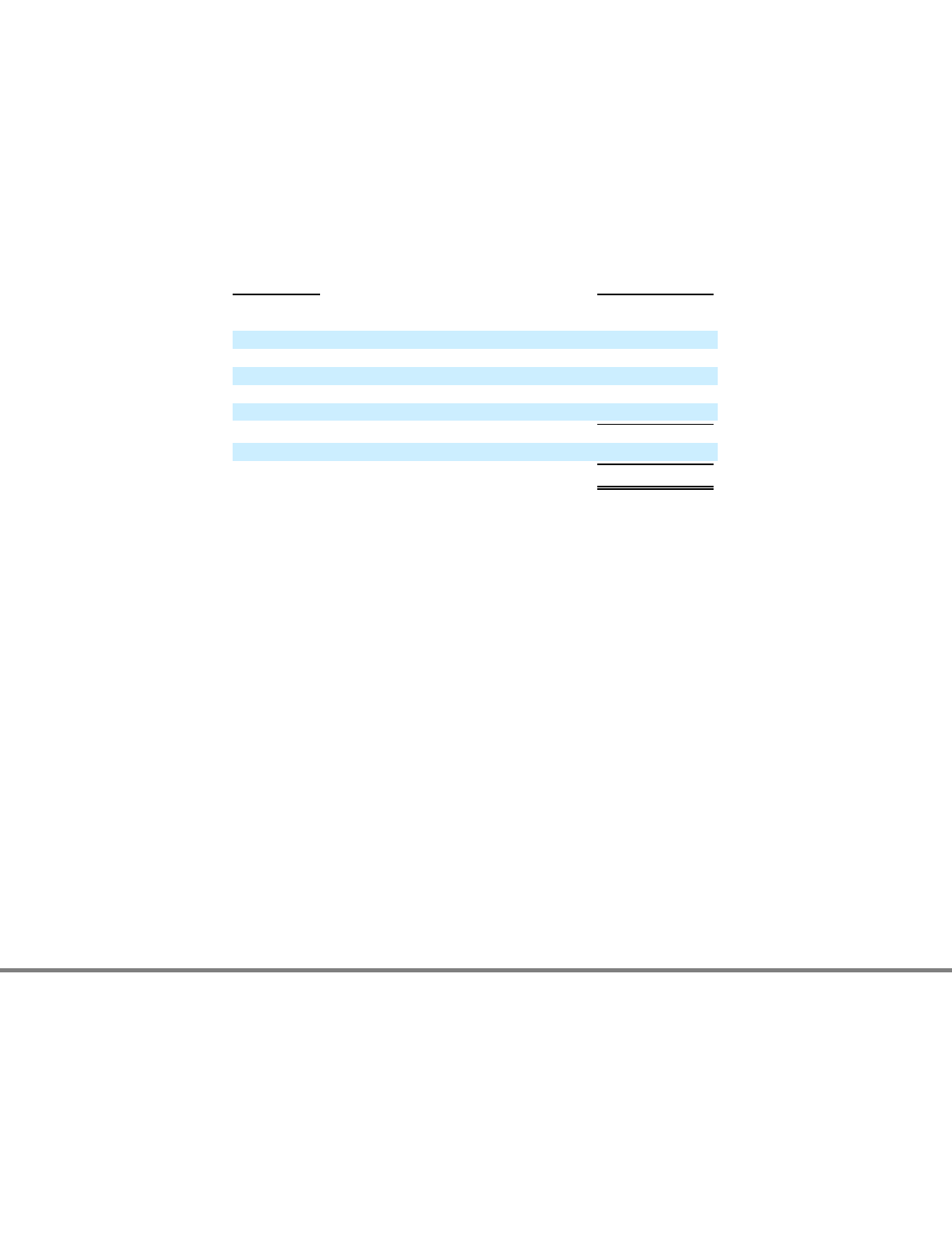

A summary of the Company's goodwill balance as of June 30, 2009 by reporting unit is as follows:

Prior to the annual goodwill impairment analysis for fiscal year 2009, the fair value of the Company's stock declined such that it began

trading below book value per share. Due to the adverse changes in operating results and the continuation of the Company's stock trading below

book value per share, the Company performed an interim impairment test of goodwill during the three months ended December 31, 2008.

As a result of the Company's interim impairment test of goodwill during the three months ended December 31, 2008, a $41.7 million

impairment charge for the full carrying amount of goodwill within the salon concepts in the United Kingdom was recorded within continuing

operations. The recent performance challenges of the International salon operations indicated that the estimated fair value was less than the

current carrying value of this reporting unit's net assets, including goodwill.

See Note 2 of the Consolidated Financial Statements for discussion on the $78.1 million goodwill impairment of Trade Secret recorded

within discontinued operations during the three months ended December 31, 2008.

During the three months ended March 31 of fiscal years 2008, and 2007, the Company performed its annual goodwill impairment analysis

on its reporting units. Based on the Company's testing, a $23.0 million impairment charge was recorded during fiscal year 2007 related to its

beauty school business and no impairment charge was recorded during fiscal year 2008.

On August 1, 2007 (fiscal year 2008), the Company merged its 51 accredited cosmetology schools into EEG, creating the largest beauty

school operator in North America. During the three months ended March 31, 2007, the terms of the transaction indicated that the estimated fair

value of the accredited cosmetology schools was less than the current carrying value of this reporting unit's net assets, including goodwill. Thus,

a $23.0 million pre-tax ($19.6 million after tax), non-cash impairment loss was recorded during the three months ended March 31, 2007.

88

Reporting Unit

As of June 30, 2009

(Dollars in thousands)

Regis

$

136,274

MasterCuts

4,652

SmartStyle

47,783

Supercuts

120,360

Promenade

305,986

Total North America Salons

615,055

Hair Restoration Centers

149,367

Consolidated Goodwill

$

764,422