Supercuts 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGIS CORP

FORM 10-K

(Annual Report)

Filed 08/28/09 for the Period Ending 06/30/09

Address 7201 METRO BLVD

MINNEAPOLIS, MN 55439

Telephone 9529477777

CIK 0000716643

Symbol RGS

SIC Code 7200 - Services-Personal Services

Industry Personal Services

Sector Services

Fiscal Year 06/30

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

REGIS CORP FORM 10-K (Annual Report) Filed 08/28/09 for the Period Ending 06/30/09 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 7201 METRO BLVD MINNEAPOLIS, MN 55439 9529477777 0000716643 RGS 7200 - Services-Personal Services Personal Services Services 06/30 http://www.edgar-... -

Page 2

... number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered 41-0749934 (I.R.S. Employer Identification No.) 55439 (Zip Code) Common Stock, par value $0.05 per share Preferred Share Purchase Rights New York... -

Page 3

...last sold as of the last business day of the Registrant's most recently completed second fiscal quarter, December 31, 2008, was approximately $606,160,026. The Registrant has no non-voting common equity. As of August 21, 2009, the Registrant had 57,104,388 shares of Common Stock, par value $0.05 per... -

Page 4

... Other Information Part III. Item 10. Item 11. Item 12. Item 13. Item 14. Part IV. Item 15. Exhibits and Financial Statement Schedules Signatures 2 142 146 Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and... -

Page 5

... Franchising Program Salon Markets and Marketing Salon Education and Training Programs Salon Staff Recruiting and Retention Salon Design Salon Management Information Systems Salon Competition Hair Restoration Business Strategy Affiliated Ownership Interest Corporate Trademarks Corporate Employees... -

Page 6

..., Supercuts, Cost Cutters, and Sassoon. The Company's hair restoration centers are located in the United States and Canada. During fiscal year 2009, the number of customer visits at the Company's company-owned salons approximated 104 million. The Company had approximately 59,000 corporate employees... -

Page 7

... hair restoration services will continue to increase as the overall population continues to focus on personal health and beauty, as well as convenience. Salon Business Strategy: The Company's goal is to provide high quality, affordable hair care services and products to a wide range of mass market... -

Page 8

... company-owned and franchise salons, traffic volume, signage and other leasehold factors in a given center or area. Because the Company's various salon concepts target slightly different mass market customer groups, more than one of the Company's salon concepts may be located in the same real estate... -

Page 9

... its customers' hair care needs by providing competitively priced services and products with professional and knowledgeable stylists. The Company's operations and marketing emphasize high quality services to create customer loyalty, to encourage referrals and to distinguish the Company's salons from... -

Page 10

... services was as follows: 2009 2008 2007 Haircutting and styling (including shampooing & conditioning) Hair coloring Hair waving Other 73% 72% 72% 17 18 18 4 4 4 6 6 6 100% 100% 100% High Quality, Professional Products. The Company's salons sell nationally recognized hair care and beauty products... -

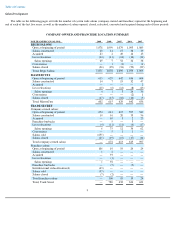

Page 11

... last five years, as well as the number of salons opened, closed, relocated, converted and acquired during each of these periods. COMPANY-OWNED AND FRANCHISE LOCATION SUMMARY NORTH AMERICAN SALONS: 2009 2008 2007 2006 2005 REGIS SALONS Open at beginning of period Salons constructed Acquired Less... -

Page 12

... Contents NORTH AMERICAN SALONS: 2009 2008 2007 2006 2005 SMARTSTYLE/COST CUTTERS IN WAL-MART Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open... -

Page 13

... NORTH AMERICAN SALONS: 2009 2008 2007 2006 2005 Franchise salons: Open at beginning of period Salons constructed Acquired(2) Less relocations Salon openings Conversions Franchise buybacks Interdivisional reclassification(4) Salons closed Total franchise salons Total, Promenade INTERNATIONAL SALONS... -

Page 14

... were located in strip centers. The customer mix at Regis Salons is approximately 78 percent women and both appointments and walk-in customers are common. These salons offer a full range of custom styling, cutting, hair coloring and waving services as well as professional hair care products. Service... -

Page 15

... $8,300. Average annual salon revenues in a company-owned Supercuts salon which has been open five years or more are approximately $269,000. The Supercuts franchise salons provide consistent, high quality hair care services and professional products to customers at convenient times and locations and... -

Page 16

... service hair salon. Salons are usually located on prominent high-street locations and offer a full range of custom hairstyling, cutting, coloring and waving, as well as professional hair care products. The initial capital investment required is approximately £450,000. Average annual salon revenues... -

Page 17

...managers and stylists with extensive technical training for Supercuts franchises. For further description of the Company's education and training programs, see the "Salon Education and Training Programs" section of this document. Salon Markets and Marketing: The Company maintains various advertising... -

Page 18

... managers and stylists is competitive within the industry. Stylists benefit from the Company's high-traffic locations and receive a steady source of new business from walk-in customers. In addition, the Company offers a career path with the opportunity to move into managerial and training positions... -

Page 19

... dollar spent by implementing cost-effective solutions and services. Salon Competition: The hair care industry is highly fragmented and competitive. In every area in which the Company has a salon, there are competitors offering similar hair care services and products at similar prices. The Company... -

Page 20

...care products and services, Hair Club offers a solution for anyone experiencing or anticipating hair loss. The Company's operations consist of 95 locations (33 franchise locations) in the United States and Canada. The domestic hair restoration market is estimated to generate over $4 billion annually... -

Page 21

... market. Women now represent approximately 35 percent of new customers. Currently, all locations offer hair systems, hair therapy and hair care products. Among the hair restoration centers' product offerings are hair transplants. The hair restoration centers employ a hub and spoke strategy for hair... -

Page 22

... any unauthorized use, the Company's success and continuing growth are the result of the quality of its salon location selections and real estate strategies. Corporate Employees: During fiscal year 2009, the Company had approximately 59,000 full- and part-time employees worldwide, of which... -

Page 23

... without payment of reasonable compensation. The Company believes that the current trend is for government regulation of franchising to increase over time. However, such laws have not had, and the Company does not expect such laws to have, a significant effect on the Company's operations. In Canada... -

Page 24

...the school, the beauty schools must maintain eligibility requirements established by the U.S Department of Education. (d) Financial Information about Foreign and North American Operations Financial information about foreign and North American markets is incorporated herein by reference to Management... -

Page 25

... in laws. Due to the number of people we employ, laws that increase minimum wage rates or increase costs to provide employee benefits may result in additional costs to our company. Compliance with new, complex and changing laws may cause our expenses to increase. In addition, any non-compliance... -

Page 26

... raise prices, our ability to grow same-store sales and increase our revenue and earnings may be impaired. If our joint ventures are unsuccessful our financial results may be affected. We have entered into joint venture arrangements with other companies in the hair salon and beauty school businesses... -

Page 27

...,000 square feet. The Salt Lake City facility may be expanded to 290,000 square feet to accommodate future growth. The Company operates all of its salon locations and hair replacement centers under leases or license agreements. Substantially all of its North American locations in regional malls are... -

Page 28

... 8 of this Form 10K. Item 3. Legal Proceedings The Company is a defendant in various lawsuits and claims arising out of the normal course of business. Like certain other large retail employers, the Company has been faced with allegations of purported class-wide consumer and wage and hour violations... -

Page 29

...Matters; Performance Graph Regis common stock is listed and traded on the New York Stock Exchange under the symbol "RGS." The accompanying table sets forth the high and low closing bid quotations for each quarter during fiscal years 2009 and 2008 as reported by the New York Stock Exchange (under the... -

Page 30

Table of Contents Comparison of 5 Year Cumulative Total Return Assumes Initial Investment of $100 June 2009 2004 2005 2006 2007 2008 2009 Regis S & P 500 S & P 400 Midcap Dow Jones Consumer Service Index Peer Group (b) Share Repurchase Program 100.00 100.00 100.00 100.00 100.00 88.00 106.... -

Page 31

...a) Revenues from salons, schools or hair restorations centers acquired each year were $82.1, $110.0, $105.1, $158.3, and $172.5 million during fiscal years 2009, 2008, 2007, 2006, and 2005, respectively. Revenues from the 51 accredited cosmetology schools contributed to Empire Education Group, Inc... -

Page 32

...MANAGEMENT'S OVERVIEW Regis Corporation (RGS) owns or franchises beauty salons and hair restoration centers. As of June 30, 2009, we owned, franchised or held ownership interests in over 12,900 worldwide locations. Our locations consisted of 10,026 system wide North American and international salons... -

Page 33

... and Cost Cutters. Our international salon operations include 444 salons located in Europe, primarily in the United Kingdom. Hair Club for Men and Women includes 95 North American locations, including 33 franchise locations. During fiscal year 2009, we had approximately 59,000 corporate employees... -

Page 34

... number of new locations in untapped markets domestically and internationally. However, the success of our hair restoration business is not dependent on the same real estate criteria used for salon expansion. In an effort to provide confidentiality for our customers, hair restoration centers operate... -

Page 35

... number of salons in each reporting unit as a percent of total company-owned salons. The Company calculates the estimated fair value of the reporting units based on discounted future cash flows that utilize estimates in annual revenue growth, gross margins, fixed expense rates, allocated corporate... -

Page 36

... fair values of the Regis salon concept and Hair Restoration Centers to be appropriate based on the historical level of revenue growth, operating income and cash flows, it is reasonably likely these reportable segments may become impaired in future periods. The term "reasonably likely" refers to... -

Page 37

...of Contents A summary of the Company's goodwill balance as of June 30, 2009 by reporting unit is as follows: Reporting Unit As of June 30, 2009 (Dollars in thousands) Regis MasterCuts SmartStyle Supercuts Promenade Total North America Salons Hair Restoration Centers Consolidated Goodwill $ $ 136... -

Page 38

... the acquired hair salon brand. Residual goodwill further represents our opportunity to strategically combine the acquired business with our existing structure to serve a greater number of customers through our expansion strategies. Identifiable intangible assets purchased in fiscal year 2009, 2008... -

Page 39

... consider new claims and developments associated with existing claims for each open policy period. As certain claims can take years to settle, the Company has multiple policy periods open at any point in time. Income Taxes In determining income for financial statement purposes, management must... -

Page 40

... by an increase in average ticket price, resulted in a decrease in consolidated same-store sales of 3.1 percent. The revenue decrease was partially offset by $32.2 million of product sold to the purchaser of Trade Secret. The Company expects fiscal year 2010 same-store sales to be in the range of... -

Page 41

...of Operations as a Percent of Revenues For the Years Ended June 30, 2009 2008 2007 Service revenues Product revenues Royalties and fees Operating expenses: Cost of service(1) Cost of product(2) Site operating expenses General and administrative Rent Depreciation and amortization Goodwill impairment... -

Page 42

... (Dollars in thousands) 2009 North American salons: Regis MasterCuts SmartStyle Supercuts(1) Promenade(1)(6) Other(3) Total North American Salons(5) International salons(1)(2) Beauty schools(3) Hair restoration centers(1) Consolidated revenues Percent change from prior year Salon same-store sales... -

Page 43

... that Regis Corporation will supply product to the purchaser of Trade Secret at cost for a transition period of approximately six months following the date of the sale, with possible extension to not more than eleven months. For the fiscal year ended June 30, 2009, the Company generated revenue of... -

Page 44

... 30, 2007. Additionally, hair restoration service revenues contributed to the increase in consolidated service revenues during the twelve months ended June 30, 2007 due to strong recurring and new customer revenues and increases in hair transplant management fees. Same-store sales were negatively... -

Page 45

... prior fiscal year due to a same-store product sales increase of 0.2 percent during the twelve months ended June 30, 2007, related to product diversion, reduced promotions and increased appeal of mass retail hair care lines by the consumer. Royalties and Fees. Consolidated franchise revenues, which... -

Page 46

...fiscal year 2006, partially offset by a decreased number of franchise salons, as discussed above. Gross Margin (Excluding Depreciation) Our cost of revenues primarily includes labor costs related to salon employees and hair restoration center employees, the cost of product used in providing services... -

Page 47

... in product margin as a percent of product revenues as compared to the corresponding period of the prior fiscal year. Trade Secret, Inc. was sold by Regis Corporation on February 16, 2009. The agreement included a provision that Regis Corporation will supply product to the purchaser at cost for... -

Page 48

...and hair restoration centers, such as on-site advertising, workers' compensation, insurance, utilities and janitorial costs. Site operating expenses were as follows: Increase (Decrease) Over Prior Fiscal Year Expense as % of Consolidated Years Ended June 30, Site Operating Dollar Percentage Revenues... -

Page 49

... schools. The planned basis point increase in G&A costs as a percent of consolidated revenues during fiscal year 2007 was primarily due to increases in salon supervisor salaries, benefits, travel expenses, professional fees and the timing of promotional salon and hair restoration advertising... -

Page 50

... locations, including those salons under the Company approved plan to close up to 80 underperforming United Kingdom company-owned salons. The basis point improvement in D&A as a percent of consolidated revenues during fiscal year 2008 was primarily due to same-store sales increasing at a faster rate... -

Page 51

... revenues as compared to the corresponding periods of the prior fiscal year. The lease termination costs are associated with the Company's plan to close up to 160 (112 from continuing operations) underperforming company-owned salons in fiscal year 2009. During fiscal year 2009 we closed 71 salons... -

Page 52

...expense as a percent of consolidated revenues during fiscal year 2007 was primarily due to increased debt levels due to the Company's repurchase of $79.7 million of our outstanding common stock, acquisitions and the timing of income tax payments during the fiscal year. Interest Income and Other, net... -

Page 53

..., the Company earned employment credits of $0.8 and $1.8 million during fiscal years 2006 and 2005, respectively. On May 26, 2007, President Bush signed into law the Small Business and Work Opportunity Tax Act of 2007. Whereas under the Tax Relief and Health Care Act of 2006 the Work Opportunity and... -

Page 54

... utilize estimates in annual revenue growth, gross margins, capital expenditures, income taxes and long-term growth for determining terminal value. The discounted cash flow model utilizes projected financial results based on Provalliance's business plans and historical trends. The increased debt and... -

Page 55

... of company-owned salon revenues to remain relatively constant. Accordingly, this provides us certain protection against inflationary increases, as payroll expense and related benefits (our major expense components) are variable costs of sales. In addition, we may increase pricing in our salons to... -

Page 56

... the twelve months ended June 30, 2009, including 83 franchise buybacks. The organic decrease was due primarily to same-store sales decrease of 2.9 percent, partially offset by the construction of 168 company-owned salons in North America and $32.2 million of product sales to the purchaser of Trade... -

Page 57

... due to negative same-store sales and lease termination costs associated with the Company's plan to close underperforming company-owned salons. In addition, the basis point decrease was due to an increase in North American revenues of $32.2 million related to product sales to the purchaser of... -

Page 58

... the four company-owned international salons constructed. The foreign currency impact during fiscal year 2009 resulted from the strengthening of the United States dollar against the British Pound and Euro as compared to the exchange rates for fiscal year 2008. Franchise revenues decreased primarily... -

Page 59

... basis point improvement in international salon operating income as a percent of international salon revenues during fiscal year 2007 was primarily due to improved product margins and severance expenses incurred in fiscal 2006 that did not occur in fiscal 2007. A same-store product sales increase of... -

Page 60

... in hair restoration operating income as a percent of hair restoration revenues during fiscal year 2007 was due to strong recurring and new customer revenues and increases in hair transplant management fees, partially offset by an increase in professional fees and advertising and marketing expenses... -

Page 61

... stores, acquire salons and purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working capital requirements. As a result of the convertible senior notes and common stock issuances subsequent to the fiscal year ended June 30, 2009... -

Page 62

... investments in those markets, partially offset by lower common stock and additional paid-in capital balances stemming from share repurchases during the twelve months ended June 30, 2008. During the twelve months ended June 30, 2007, equity increased primarily as a result of net income and increased... -

Page 63

... in the number of salons, partially offset by the Company's planned initiatives to reduce inventory levels in fiscal year 2007. Receivables increased during the twelve months ended June 30, 2007 primarily due to credit card receivables and increased student enrollment in the beauty school segment as... -

Page 64

...beauty school and two hair restoration centers (one of which was a franchise buyback) during fiscal year 2007. During fiscal year 2007, loans and investments, net, included $9.9 million related to an equity investment the Company made in October 2006, $8.2 million related to a cost method investment... -

Page 65

...) consisted of the following number of locations in each concept: Years Ended June 30, 2008 Constructed Acquired 2009 Constructed Acquired 2007 Constructed Acquired Regis MasterCuts Trade Secret(1) SmartStyle Supercuts Promenade International Beauty schools Hair restoration centers 20 14 10 71... -

Page 66

... including a leverage ratio, fixed charge ratio and minimum net equity test. We used the proceeds from the term loan to pay down our revolving line of credit facility. We were in compliance with all covenants and other requirements of our credit agreement and senior notes as of June 30, 2009. 64 -

Page 67

...Fixed Charges, limiting the Company's Restricted Payments to $20 million if the Company's Leverage Ratio is greater than 2.0x and the addition of a risk based capital fee calculated on the daily average outstanding principal amount equal to an annual rate of 1.0 percent that commences one year after... -

Page 68

...points over LIBOR on floating coupon rates. The private placement senior term notes includes financial covenants including debt to EBITDA ratios, fixed charge coverage ratios and minimum net equity tests (as defined within the Private Shelf Agreement), as well as other customary terms and conditions... -

Page 69

... Profit Sharing Plan and a salary deferral program, $8.4 million (including $0.4 million in interest) related to established contractual payment obligations under retirement and severance payment agreements for a small number of retired employees. This table excludes the short-term liabilities... -

Page 70

...ordinary course of business. These contracts primarily relate to our commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services, and agreements to indemnify officers, directors and employees in the performance of their work. While our... -

Page 71

... the planned closure of salons and the related realization of the anticipated costs, benefits and time frame; or other factors not listed above. The ability of the Company to meet its expected revenue growth is dependent on salon acquisitions, new salon construction and same-store sales increases... -

Page 72

... net investments in its foreign subsidiaries and, to a lesser extent, changes in the Canadian dollar exchange rate. The Company has established policies and procedures that govern the management of these exposures through the use of derivative financial instrument contracts. By policy, the Company... -

Page 73

... to June 30, 2009 in conjunction with the repayment of the private placement senior term notes as discussed in Note 17 to the Consolidated Financial Statements. Pay variable rates, receive fixed rates The Company had interest rate swap contracts under which it paid variable rates of interest (based... -

Page 74

..., into United States dollars. Different exchange rates from period to period impact the amounts of reported income and the amount of foreign currency translation recorded in accumulated other comprehensive income. As part of its risk management strategy, the Company frequently evaluates its foreign... -

Page 75

.... The exposure to Canadian dollar exchange rates on the Company's fiscal year 2009 cash flows primarily includes payments in Canadian dollars from the Company's Canadian salon operations for retail inventory exported from the United States. The Company seeks to manage exposure to changes in the... -

Page 76

... provides information about the Company's forecasted sales transactions in U.S. dollar equivalents. (The information is presented in U.S. dollars because that is the Company's reporting currency.) The table summarizes information on transactions that are sensitive to foreign currency exchange rates... -

Page 77

...: Management's Statement of Responsibility for Financial Statements and Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Balance Sheet as of June 30, 2009 and 2008 Consolidated Statement of Operations for each of the three years... -

Page 78

... because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Management has assessed the Company's internal control over financial reporting as of June 30, 2009, based on criteria established in Internal Control-Integrated Framework issued... -

Page 79

... their cash flows for each of the three years in the period ended June 30, 2009 in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as... -

Page 80

... of Contents REGIS CORPORATION CONSOLIDATED BALANCE SHEET (Dollars in thousands, except per share data) June 30, 2009 2008 ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Deferred income taxes Income tax receivable Other current assets Total current assets Property... -

Page 81

Table of Contents REGIS CORPORATION CONSOLIDATED STATEMENT OF OPERATIONS (In thousands, except per share data) Years Ended June 30, 2008 2009 2007 Revenues: Service Product Royalties and fees $1,833,958 556,205 39,624 2,429,787 1,044,719 283,038 190,456 291,661 347,792 115,655 41,661 5,732 2,... -

Page 82

..., 2007 Net income Foreign currency translation adjustments Changes in fair market value of financial instruments designated as cash flow hedges, net of taxes Stock repurchase plan Proceeds from exercise of stock options Stock-based compensation Shares issued through franchise stock incentive program... -

Page 83

... current assets Other assets Accounts payable Accrued expenses Other noncurrent liabilities Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Proceeds from sale of assets Purchases of salon, school and hair restoration center net assets, net of cash... -

Page 84

...stores, mass merchants and high-street locations. The hair restoration centers, including both company-owned and franchise locations, are typically located in leased space within office buildings. The Company maintains ownership interest in salons and beauty schools through equity-method investments... -

Page 85

... weighted average cost of product sold, adjusted for an estimated shrinkage factor, and the cost of product used in salon services is determined by applying estimated gross profit margins to service revenues. The estimated gross profit margins related to service inventories are updated semi-annually... -

Page 86

... net of tax) related to our investment in Provalliance and investment in and loans to Intelligent Nutrients, LLC. Self-insurance Accruals: The Company uses a combination of third party insurance and self-insurance for a number of risks including workers' compensation, health insurance, employment... -

Page 87

...has multiple policy periods open at any point in time. As the workers' compensation accrual is the majority of the self-insurance accrual, below is a rollforward of the activity within the Company's workers' compensation self-insurance accrual: For the Years Ended June 30, 2009 2008 2007 (Dollars in... -

Page 88

... number of salons in each reporting unit as a percent of total company-owned salons. The Company calculates the estimated fair value of the reporting units based on discounted future cash flows that utilize estimates in annual revenue growth, gross margins, fixed expense rates, allocated corporate... -

Page 89

... fair values of the Regis salon concept and Hair Restoration Centers to be appropriate based on the historical level of revenue growth, operating income and cash flows, it is reasonably likely these reportable segments may become impaired in future periods. The term "reasonably likely" refers to... -

Page 90

...annual impairment testing and June 30, 2009. A summary of the Company's goodwill balance as of June 30, 2009 by reporting unit is as follows: Reporting Unit As of June 30, 2009 (Dollars in thousands) Regis MasterCuts SmartStyle Supercuts Promenade Total North America Salons Hair Restoration Centers... -

Page 91

... Company leases most salon and hair restoration center locations under operating leases. Rent expense is recognized on a straight-line basis over the lease term. Tenant improvement allowances funded by landlord incentives, rent holidays, and rent escalation clauses which provide for scheduled rent... -

Page 92

...royalties, initial franchise fees and net rental income (see Note 10). Royalties are recognized as revenue in the month in which franchisee services are rendered or products are sold to franchisees. The Company recognizes revenue from initial franchise fees at the time franchise locations are opened... -

Page 93

... years 2009, 2008, and 2007, no amounts were received in excess of the Company's related expense. Advertising Funds: The Company has various franchising programs supporting its franchise salon concepts consisting of Supercuts, Cost Cutters, First Choice Haircutters, Magicuts, Pro Cuts and Beauty... -

Page 94

.... Preopening Expenses: Non-capital expenditures such as payroll, training costs and promotion incurred prior to the opening of a new location are expensed as incurred. Sales Taxes: Sales taxes are recorded on a net basis (rather than as both revenue and an expense) within the Company's Consolidated... -

Page 95

... Income. 2009 2008 2007 (Dollars in thousands) Accumulated Other Comprehensive Income, balance at July 1 Cumulative translation adjustment: Balance at July 1 Pre-tax amount Tax affect Net of tax amount Balance at June 30 Changes in fair market value of financial instruments designated as cash... -

Page 96

... The Company's primary employee stock-based compensation grant occurs during the fourth quarter. Effective July 1, 2005, the Company adopted SFAS No. 123 (revised 2004), Share-Based Payment (SFAS No. 123R), using the modified prospective method of application. Under this method, compensation expense... -

Page 97

...) 1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Total compensation cost for stock-based payment arrangements totaled $7.5, $6.8 and $4.9 million for the fiscal years ended June 30, 2009, 2008 and 2007, respectively. SFAS No. 123R requires that the cash retained... -

Page 98

... . SFAS No. 141(R) also includes a substantial number of new disclosure requirements. SFAS No. 141(R) will be effective for the Company's fiscal year 2010 and must be applied prospectively to all new acquisitions closing on or after July 1, 2009. Early adoption is prohibited. SFAS No. 141... -

Page 99

... Company concluded, after a comprehensive review of strategic and financial options, to divest Trade Secret. The sale of Trade Secret included 655 company-owned salons and 57 franchise salons, all of which had historically been reported within the Company's North America reportable segment. The sale... -

Page 100

... from the sale of Trade Secret were negligible, the Company recognized impairment charges within discontinued operations during the year ended June 30, 2009 set forth in the following table: For the Year Ended June 30, 2009 (Dollars in thousands) Inventories $ Property and equipment, net Goodwill... -

Page 101

...provides additional information concerning selected balance sheet accounts as of June 30, 2009 and 2008: 2009 2008 (Dollars in thousands) Accounts receivable Less allowance for doubtful accounts Other current... 69,693 Investment in and loans to affiliates: Equity-method investments Noncurrent loans ... -

Page 102

...the average exchange rates for the year-to-date periods presented. All intangible assets have been assigned an estimated finite useful life, and are amortized on a straight-line basis over the number of years that approximate their expected period of benefit (ranging from one to 40 years). The cost... -

Page 103

... and by major intangible asset class, are as follows: Weighted Average Amortization Period (In years) June 30, 2009 2008 Amortized intangible assets: Brand assets and trade names Customer lists Franchise agreements Lease intangibles Non-compete agreements Other Total 39 10 22 20 4 18 26 39 10... -

Page 104

...the purchase prices were as follows: 2009 2008 2007 (Dollars in thousands) Components of aggregate purchase prices: Cash Note receivable applied to purchase price Common stock Liabilities assumed or payable Allocation of the purchase prices: Current assets Property and equipment Deferred income tax... -

Page 105

... further represents the Company's opportunity to strategically combine the acquired business with the Company's existing structure to serve a greater number of customers through its expansion strategies. In the acquisitions of international salons and hair restoration centers, the residual goodwill... -

Page 106

...) 5. GOODWILL The table below contains details related to the Company's recorded goodwill for the years ended June 30, 2009 and 2008 is as follows: Salons Hair Restoration North America Beauty International Schools Centers (Dollars in thousands) Consolidated Balance at June 30, 2007 Goodwill... -

Page 107

... 30, 2009 and 2008: Empire Education Group, Inc. PureBeauty/ Intelligent Beauty First Nutrients, LLC MY Style (1) (Dollars in thousands) Hair Club for Men, Ltd. Provalliance Total Balance at June 30, 2007 Investment acquired Acquisition of remaining interest Loans to affiliates Equity in income... -

Page 108

... 1,962 Summarized Statement of Operations Information: Gross revenue $153,693 Gross profit 134,281 Operating income 7,990 Net income 3,611 As of June 30, 2007, the Company did not have ownership interest in Provalliance or Empire Education Group, Inc. Investment in Provalliance On January 31, 2008... -

Page 109

... utilize estimates in annual revenue growth, gross margins, capital expenditures, income taxes and long-term growth for determining terminal value. The discounted cash flow model utilizes projected financial results based on Provalliance's business plans and historical trends. The increased debt and... -

Page 110

... hair care and personal care products are currently available. These products are offered at the Company's corporate and franchise salons, and eventually in other independently owned salons. The Company's investment in Intelligent Nutrients, LLC is accounted for under the equity method of... -

Page 111

... of the Exchangeable Note increased from approximately 14.8 percent to 27.1 percent of the 800 outstanding shares of MY Style for 21,700,000 Yen. This exchange feature is akin to a deep-in-the-money option permitting the Company to purchase shares of common stock of MY Style. The option is embedded... -

Page 112

...in Hair Club for Men, Ltd. through its acquisition of Hair Club in fiscal year 2005. The Company accounts for its investment in Hair Club for Men, Ltd. under the equity method of accounting. Hair Club for Men, Ltd. operates Hair Club centers in Illinois and Wisconsin. During the fiscal year 2009 the... -

Page 113

... to the valuation techniques the Company used to determine their fair values. Fair Value Measurements Using Inputs Considered as Level 1 Level 2 Level 3 (Dollars in thousands) Fair Value at June 30, 2009 ASSETS Noncurrent assets Derivative instruments LIABILITIES Long-term liabilities Derivative... -

Page 114

...asset groups measured at fair value for an impairment assessment. 8. FINANCING ARRANGEMENTS The Company's long-term debt as of June 30, 2009 and 2008 consists of the following: Maturity Dates (fiscal year) Interest rate % 2009 2008 Amounts outstanding 2009 2008 (Dollars in thousands) Senior term... -

Page 115

..., fixed rate, senior term notes outstanding under a Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range from November 2009 through December 2017. The Private Shelf Agreement includes financial covenants including debt to EBITDA ratios, fixed charge coverage... -

Page 116

..., fixed-charge ratio and minimum net equity test. The Company used the proceeds from the term loan to pay down the Company's revolving credit facility. Revolving Credit Facility The Company has an unsecured $350.0 million revolving credit facility with rates tied to LIBOR plus 60.0 basis points. The... -

Page 117

.... Generally, derivative contract arrangements settle on a net basis. The Company assesses the effectiveness of its hedges on a quarterly basis using the critical terms method in accordance with SFAS No. 133. The Company has primarily utilized derivatives which are designated as either cash flow or... -

Page 118

... foreign currency contracts to manage foreign currency rate fluctuations associated with certain forecasted intercompany transactions and international business travel. The Company's primary forward foreign currency contracts hedge approximately 50.0 percent of payments in Canadian dollars for... -

Page 119

...at June 30, Classification 2009 2008 (In thousands) Type Designated as hedging instruments-Cash Flow Hedges: Interest rate swaps $ 3,605 $ 873 - $ - $ - Forward foreign currency contracts (392) 245 Cost of sales (142) (257) Treasury lock contracts (242) (259) Interest (income) expense (24) 4 Total... -

Page 120

... other, net $(1,482) $(529) 10. COMMITMENTS AND CONTINGENCIES: Operating Leases: The Company is committed under long-term operating leases for the rental of most of its company-owned salon and hair restoration center locations. The original terms of the leases range from one to 20 years, with many... -

Page 121

... but not reported on an actuarial basis. 11. LEASE TERMINATION COSTS In July 2008, the Company approved a plan to close up to 160 underperforming company-owned salons in fiscal year 2009. Approximately 100 locations were regional mall based concepts, another 40 locations were strip center concepts... -

Page 122

... The Company offered employment to associates affected by such closings at nearby Regis-owned salons. The decision was a result of a comprehensive evaluation of the Company's salon portfolio, further continuing the Company's initiatives to enhance profitability. As of June 30, 2009, 69 stores ceased... -

Page 123

... following: 2009 2008 2007 U.S. statutory rate State income taxes, net of federal income tax benefit Tax effect of goodwill impairment Foreign income taxes at other than U.S. rates Work Opportunity and Welfare-to-Work Tax Credits Adjustment of prior year deferred income taxes Other, net 35.0% 35... -

Page 124

... provided United States income taxes on such earnings. The Company files tax returns and pays tax primarily in the United States, Canada, the U.K., and the Netherlands as well as states, cities, and provinces within these jurisdictions. In the United States, fiscal years 2006 and after remain open... -

Page 125

... financial position. 14. BENEFIT PLANS Profit Sharing Plan: Prior to March 1, 2007, the Company maintained a Profit Sharing Plan (the Profit Sharing Plan) which covered substantially all non-highly compensated field supervisors, warehouse and corporate office employees. The Profit Sharing Plan was... -

Page 126

...Sharing Plan) which covered company officers, field supervisors, warehouse and corporate office employees who were highly compensated. Contributions to the Executive Profit Sharing Plan were at the discretion of the Company. Prior to January 22, 2002, such contributions were invested in common stock... -

Page 127

...during the period in which payments are made, as provided in the agreement, he will not engage in any business competitive with the business conducted by the Company. Additionally, the Company has a survivor benefit plan for the former Vice Chairman's spouse, payable upon his death, at a rate of one... -

Page 128

... expenses and administration of the plans, for the three years ended June 30, 2009, 2008 and 2007, included the following: 2009 2008 2007 (Dollars in thousands) Profit sharing plan Executive Profit Sharing Plan ESPP FSPP Deferred compensation contracts 15. SHAREHOLDERS' EQUITY Net Income Per Share... -

Page 129

... Company's measure of compensation cost for its incentive stock plans, as well as an estimate of future compensation expense related to these awards. On October 24, 2000, the shareholders of Regis Corporation adopted the Regis Corporation 2000 Stock Option Plan (2000 Plan), which allows the Company... -

Page 130

...any shares acquired through exercise of the options. Stock options are granted at not less than fair market value on the date of grant. The Board of Directors determines the 2000 Plan participants and establishes the terms and conditions of each option. The Company also has outstanding stock options... -

Page 131

...of share-based instruments in fiscal years 2009 and 2008 was $3.9 and $8.9 million, respectively. As of June 30, 2009, the total unrecognized compensation cost related to all unvested stock-based compensation arrangements was $30.9 million. The related weighted average period over which such cost is... -

Page 132

... of the strike price at the time of the grant. The Company uses historical data to estimate pre-vesting forfeiture rates. Compensation expense included in income before income taxes related to stock-based compensation was $7.5, $6.8 and $4.9 million for the three years ended June 30, 2009, 2008, and... -

Page 133

... this program. 16. SEGMENT INFORMATION As of June 30, 2009, the Company owned, franchised or held ownership interests in over 12,900 worldwide locations. The Company's locations consisted of 9,582 North American salons (located in the United States, Canada and Puerto Rico), 444 international salons... -

Page 134

...targeted at the mass market consumer. Hair restoration centers are located primarily in office and professional buildings within larger metropolitan areas. Based on the way the Company manages its business, it has reported its North American salons, international salons, and hair restoration centers... -

Page 135

... the Year Ended June 30, 2009(1) Salons North America Hair Restoration Consolidated Unallocated International Corporate Centers (Dollars in thousands) Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative... -

Page 136

... Year Ended June 30, 2008(1)(2) Salons North America International Hair Restoration Unallocated Corporate Centers (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative... -

Page 137

... 30, 2007(1) Salons North America International Hair Restoration Beauty Schools Centers (Dollars in thousands) Unallocated Corporate Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 138

..., senior obligations of the Company and interest will be payable semi-annually at a rate of 5.0 percent per year. The notes will mature on July 15, 2014. The notes will be convertible subject to certain conditions at an initial conversion rate of 64.6726 shares of the Company's common stock per... -

Page 139

...Condition and Results of Operations in Part II, Item 6 in this Form 10-K for explanations of items which impacted fiscal year 2009 revenues, operating and net income. September 30 Quarter Ended December 31 March 31 June 30 (Dollars in thousands, except per share amounts) Year Ended 2008 Revenues... -

Page 140

...03 1.95 0.16 Refer to Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 6 in this Form 10-K for explanations of items which impacted fiscal year 2008 revenues, operating and net income. (a) Operating income and net income increase as a result of... -

Page 141

... of Disclosure Controls and Procedures The Company maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and... -

Page 142

...& Ethics, that applies to all employees, including the Company's chief executive officer, chief financial officer, directors and executive officers. The Code of Business Conduct & Ethics is available on the Company's website at www.regiscorp.com , under the heading "Corporate Governance / Guidelines... -

Page 143

...Contents Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Information regarding the Company's equity compensation plans will be set forth in the section titled "Equity Compensation Plan Information" of the Company's 2009 Proxy Statement, and is... -

Page 144

...and Hair Club Group Inc. (Incorporated by reference to Exhibit 2 of the Company's Report on Form 10-Q filed on February 9, 2005, for the quarter ended December 31, 2004.) Stock Purchase Agreement dated as of January 26, 2009 between Regis Corporation, Trade Secret, Inc. and Premier Salons Beauty Inc... -

Page 145

... Company and Prudential Insurance Company of America. (Incorporated by reference to Exhibit 10(aa) of the Company's Report on Form 10-K filed on September 12, 2001, for the year ended June 30, 2001.) Note Purchase Agreement, dated March 1, 2002, between the Company and purchasers listed in Schedule... -

Page 146

... Term Incentive Compensation Plan, effective July 1, 2004. (Incorporated by reference to Exhibit 10(ll) of the Company's Report on Form 10-K filed on September 9, 2005, for the year ended June 30, 2005.) Consulting Agreement, dated April 18, 2007, between the Company and Empire Beauty School Inc... -

Page 147

... 10(g) of the Company's Report on Form 10-Q filed February 9, 2009.) Separation Agreement and Release between Kris Bergly and the Company dated May 13, 2009. List of Subsidiaries of Regis Corporation. Consent of PricewaterhouseCoopers LLP. Chairman of the Board of Directors, President and Chief... -

Page 148

... duly authorized. REGIS CORPORATION By /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer By /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice President, Chief Financial and Administrative Officer (Principal Financial... -

Page 149

-

Page 150

... . Employee and Employer agree that Employee's last day of work will be April 17, 2009, and that Employee's termination shall be effective as of that date (hereinafter "Employment End Date"). 2. Payments . Employer and Employee agree that in consideration for Employee's agreement to the terms... -

Page 151

... 29, 2009. The purpose of this paragraph is to require that Employee not trade in Employer common stock during the current restricted trading period. With respect to Employee's deferred compensation benefit, pursuant to the Senior Officer Employment and Deferred Compensation Agreement dated December... -

Page 152

...Separation Agreement. 4. Benefits . The Employee is a participant in various employee benefit plans sponsored by Employer. Except as otherwise provided for herein, the payment of benefits, including the amounts and timing thereof, will be governed by the terms of the employee benefit plans. Employer... -

Page 153

...spouse, legal counsel and accountant, or as required by law and/or governmental authorities. Employer may disclose the terms of this Separation Agreement to its officers and directors, outside auditors, and to employees or agents of it or its parent corporation who have a legitimate need to know the... -

Page 154

... assert against the Employer will be derived only from an alleged breach of the terms of the Separation Agreement or of any employee benefit plan in which Employee is a participant. 16. Entire Agreements . This Separation Agreement and Release and the employee benefit plans in which Employee is... -

Page 155

... Action . Employee acknowledges that he has been advised of his right to be represented by his own attorney, that he has read and understands the terms of this Separation Agreement, and that he is voluntarily entering into this Separation Agreement to resolve his disputes against the Employer. 19... -

Page 156

... have executed this Separation Agreement and Release as of the day and year first above written. Dated: May 13,2009 /s/ Kris Bergly Kris Bergly...day of May, 2009. /s/ Lora J. Martin-Poulos Notary Public EMPLOYER: REGIS CORPORATION Dated: May 13, 2009 By: /s/Eric A. Bakken Eric A. Bakken Its: Senior... -

Page 157

...Company Name Country or State of Incorporation/Formation The Barbers, Hairstyling for Men & Women, Inc. WCH, Inc. We Care Hair Realty, Inc. Supercuts, Inc. Supercuts Corporate Shops, Inc. Tulsa's Best Haircut LLC (50.0 percent Supercuts, Inc.) RPC Acquisition Corp. Regis Corp. Regis Insurance Group... -

Page 158

...33-44867 and 33-89882) of Regis Corporation of our report dated August 28, 2009 relating to the consolidated financial statements and the effectiveness of internal control over financial reporting, which appears in this Form 10-K. /s/ PRICEWATERHOUSECOOPERS LLP PricewaterhouseCoopers LLP Minneapolis... -

Page 159

... fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. (b) August 28, 2009 /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive... -

Page 160

... summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. (b) August 28, 2009 /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice...