Singapore Airlines 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CORPORATE GOVERNANCE REPORT

For FY2013/14 the aggregate total remuneration paid to the Relevant Key Management Personnel (who are not Directors or the

CEO) amounted to $3,714,704.

For FY2013/14, there were no termination, retirement or post-employment benefits granted to Directors, the CEO and Relevant

Key Management Personnel other than the standard contractual notice period termination payment in lieu of service, and the post-

retirement travel benefits for the CEO and Relevant Key Management Personnel.

Accountability and Audit (Principle 10)

The Board, through its announcements of quarterly and full-year results, aims to provide shareholders with a balanced and

understandable assessment of the Company’s performance and prospects. Management provides the Board with monthly

management accounts for the Board’s review.

The Company has clear policies and guidelines for dealings in securities by Directors and employees. The Company imposes a trading

embargo on its Directors and employees from trading in its securities for the period of two weeks prior to the announcement of

quarterly results; and a period of one month prior to the announcement of year-end results. In addition, Directors and employees are

cautioned to observe the insider trading laws at all times; and to avoid dealing in the Company’s securities for short-term considerations.

Risk Management and Internal Controls (Principle 11)

A dedicated Risk Management Department looks into and manages the Group’s risk management policies. The Risk Management

Report can be found on page 46.

Annually, a report is submitted by the Risk Management Department to the Board, which provides a comprehensive review of

the risks faced by the Group. The review includes the identification of risks overseen by the main Board and its various Board

Committees, as well as the current assessment and outlook of the various risk factors.

The Board had received assurance from the CEO and Senior Vice President Finance on the adequacy and effectiveness of the

Company’s internal control systems, and that the financial records have been properly maintained and the financial statements

give a true and fair view of the Company’s operations and finances.

There were no employees who were immediate family members of a Director or the CEO, and whose remuneration exceeded

$50,000, during FY2013/14.

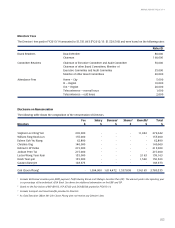

Fee Salary Bonuses1 Shares2 Benefits3 Total

Relevant Key Management Personnel4 % % % % % %

Between $1,750,000 to $2,000,000

Mak Swee Wah - 34 25 37 4 100

Ng Chin Hwee - 34 25 37 4 100

1 Includes EVA-based incentive plan (EBIP) payment, Profit-Sharing Bonus and Strategic Incentive Plan (SIP). The amount paid in the reporting year

is a percentage of the individual’s EVA Bank. See above for additional information on the EBIP and SIP.

2 Based on the Fair Values of RSP ($9.15), PSP ($7.82) and DSA ($8.38) granted in FY2013/14.

3 Includes value of transport and travel benefits provided to employees.

4 The above table reflects the remuneration of the employees who hold the rank of Executive Vice President and above, who are the Relevant Key

Management Personnel of the Company.

056

SINGAPORE AIRLINES