Singapore Airlines 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

NOTES TO THE FINANCIAL STATEMENTS

31 March 2014

SINGAPORE AIRLINES

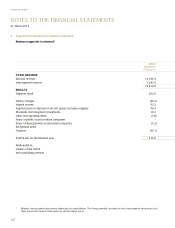

3 Significant Accounting Judgments and Estimates (continued)

(b) Key sources of estimation uncertainty (continued)

(i) Impairmentofproperty,plantandequipment–aircrafteet

Impairment is recognised when events and circumstances indicate that the aircraft may be impaired and the

carrying amounts of the aircraft exceed the recoverable amounts. Recoverable amount is defined as the higher of

an aircraft’s fair value less costs to sell and its value-in-use. The fair value less costs to sell computation is based

on available data from binding sales transactions in an arm’s length transaction of similar assets or observable

market prices less incremental costs for disposing the asset. In determining the recoverable amounts of the

aircraft, certain estimates regarding the current fair market value of the aircraft are made. The current fair market

value is determined based on desktop valuations from an independent appraisal for fleet with similar operational

lives. When value-in-use calculations are undertaken, the Group uses discounted cash flow projections based on

financial budgets approved by the Management covering a specified period.

(ii) Depreciationofproperty,plantandequipment–aircrafteet

Aircraft are depreciated on a straight-line basis at rates which are calculated to write down their cost to their

estimated residual values at the end of their operational lives. Certain estimates regarding the operational lives

and residual values of the fleet are made by the Group based on past experience and these are in line with the

industry. The operational lives and residual values are reviewed on an annual basis. The carrying amount of the

Group’s and the Company’s aircraft fleet at 31 March 2014 was $9,788.4 million (2013: $10,546.1 million) and

$8,228.6 million (2013: $8,553.9 million) respectively.

During the year, the Group revised the estimated useful lives of its certain overhaul assets to better reflect the

economic useful life with effect from 1 April 2013. The effect of this change is a reduction in depreciation expense

of approximately $33.8 million for the financial year ended 31 March 2014.

(iii) Passenger revenue recognition

Passenger sales are recognised as operating revenue when the transportation is provided. The value of unused

tickets is included as sales in advance of carriage on the statement of financial position and recognised as revenue

at the end of two years. This is estimated based on historical trends and experiences of the Group whereby ticket

uplift occurs mainly within the first two years. The carrying amount of the Group’s and the Company’s sales in

advance of carriage at 31 March 2014 was $1,446.3 million (2013: $1,434.3 million) and $1,376.4 million

(2013: $1,367.7 million) respectively.

(iv) Frequent Flyer programme

The Company operates a frequent flyer programme called “KrisFlyer” that provides travel awards to programme

members based on accumulated mileage. A portion of passenger revenue attributable to the award of frequent

flyer benefits is deferred until they are utilised. The deferment of the revenue is estimated based on historical

trends of breakage and redemption, which is then used to project the expected utilisation of these benefits.

Any remaining unutilised benefits are recognised as revenue upon expiry. The carrying amount of the Group’s and

the Company’s deferred revenue at 31 March 2014 was $572.9 million (2013: $532.5 million).

During the financial year, the Company introduced the Pay With Miles option to the KrisFlyer programme.

Based on expected higher utilisation, the Company made a downward revision to the estimated breakage rate.

The impact of the revision in estimate is a decrease of $64.0 million in revenue for the financial year ended

31 March 2014.