Singapore Airlines 2014 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176

NOTES TO THE FINANCIAL STATEMENTS

31 March 2014

SINGAPORE AIRLINES

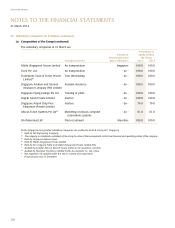

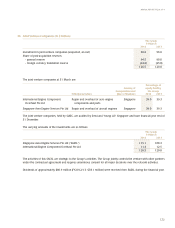

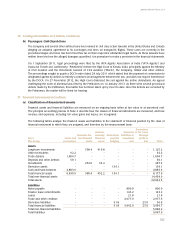

26 Long-TermInvestments(in$million)

The Group The Company

31 March 31 March

2014 2013 2014 2013

Available-for-sale investments

Quoted

Government securities 0.6 0.5 0.6 0.5

Equity investments 315.3 132.0 315.3 132.0

Unquoted

Non-equity investments 293.6 123.5 293.6 123.5

Equity investments, at cost 108.1 108.1 28.0 28.0

Accumulated impairment loss (9.2) (9.2) (9.2) (9.2)

708.4 354.9 628.3 274.8

Held-to-maturity investments

Quoted non-equity investments 243.5 222.4 243.5 222.4

Unquoted non-equity investments 173.3 129.6 173.3 129.6

416.8 352.0 416.8 352.0

1,125.2 706.9 1,045.1 626.8

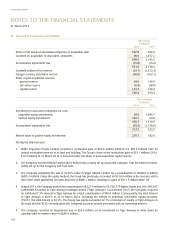

The Group’s non-equity investments comprise investments in corporate bonds, credit-linked notes, fixed-rate notes and

investment funds.

The interest rate for quoted government securities is 7.00% (FY2012/13: 7.00%) per annum. The interest rates for quoted

and unquoted non-equity investments range from 2.37% to 4.65% (FY2012/13: 2.63% to 5.60%) per annum and 2.55%

to 4.02% (FY2012/13: 2.28% to 4.02%) per annum respectively.

During the financial year, the Company acquired additional shares in Virgin Australia and consequently increased its

interest to 20.8% as at 31 March 2014. The Company also entered into an equity derivative representing an additional

interest of 1.34% of shares in Virgin Australia. The derivative is a share purchase option which confers no ownership rights

or carries any voting rights and has been recognised within the derivative assets in the statements of financial position.

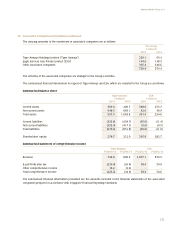

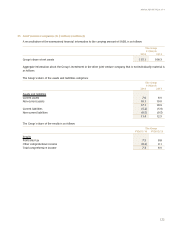

27 Other Receivables (in $ million)

The Group’s other receivables are stated at amortised cost and are expected to be received over a period of two to three

years. The entire balance of other receivables is denominated in USD.

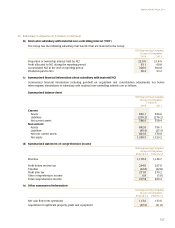

28 Inventories (in $ million)

The Group The Company

31 March 31 March

2014 2013 2014 2013

Technical stocks and stores 215.8 248.5 150.4 173.9

Catering and general stocks 27.2 26.4 18.8 18.8

Total inventories at lower of cost and net realisable value 243.0 274.9 169.2 192.7

The cost of inventories recognised as an expense amounts to $115.5 million (FY2012/13: $102.9 million). In addition,

the Group wrote down $22.3 million (FY2012/13: $32.3 million) of inventories, which is recognised as other operating

expenses in the profit and loss account.