Singapore Airlines 2014 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

185

ANNUAL REPORT FY2013/14

36 Contingent Liabilities (in $ million) (continued)

(b) Passengers: Civil Class Actions

The Company and several other airlines have been named in civil class action lawsuits in the United States and Canada

alleging an unlawful agreement to fix surcharges and fares on transpacific flights. These cases are currently in the

procedural stages and none has been tried thus far on their respective substantive legal merits. As these lawsuits have

neither been tried nor the alleged damages quantified, it is premature to make a provision in the financial statements.

On 1 September 2011, legal proceedings were filed by the IATA Agents Association of India (“IATA Agents”) and

Osaka Air Travels Ltd. (collectively, “Petitioners”) before the High Court of Kerala, India, principally against the Ministry

of Civil Aviation and the Directorate General of Civil Aviation (“DGCA”), the Company, SilkAir and other airlines.

The proceedings sought to quash a DGCA order dated 28 July 2011 which stated that the payment of commission to

designated agents by airlines is entirely a commercial arrangement between the two, and does not require interference

by the DGCA. On 27 November 2012, the High Court dismissed the suit against the airline defendants. An appeal

challenging the order of dismissal was filed by the Petitioners on 14 January 2013. As there were several procedural

defects made by the Petitioners, this matter has not been taken up by Court to date. Once the defects are corrected by

the Petitioners, the matter will be listed for hearing.

37 Financial Instruments (in $ million)

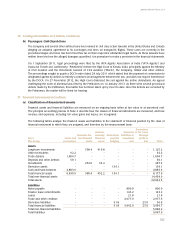

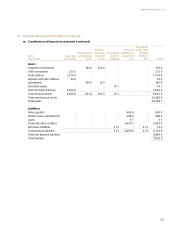

(a) Classification of financial instruments

Financial assets and financial liabilities are measured on an ongoing basis either at fair value or at amortised cost.

The principal accounting policies in Note 2 describe how the classes of financial instruments are measured, and how

revenue and expenses, including fair value gains and losses, are recognised.

The following tables analyse the financial assets and liabilities in the statement of financial position by the class of

financial instrument to which they are assigned, and therefore by the measurement basis:

Derivatives

Held-to- Financial atfairvalue

Available-for- maturity Derivatives liabilitiesat through

2014 Loans and sale financial financial used for amortised profit or

The Group receivables assets assets hedging cost loss Total

Assets

Long-term investments - 708.4 416.8 - - - 1,125.2

Other receivables 92.2 - - - - - 92.2

Trade debtors 1,604.7 - - - - - 1,604.7

Deposits and other debtors 50.1 - - - - - 50.1

Investments - 252.0 35.4 - - - 287.4

Derivative assets - - - 134.1 - - 134.1

Cash and bank balances 4,883.9 - - - - - 4,883.9

Total financial assets 6,630.9 960.4 452.2 134.1 - - 8,177.6

Total non-financial assets 14,464.9

Total assets 22,642.5

Liabilities

Notes payable - - - - 800.0 - 800.0

Finance lease commitments - - - - 143.2 - 143.2

Loans - - - - 21.8 - 21.8

Trade and other creditors - - - - 2,977.9 - 2,977.9

Derivative liabilities - - - 31.8 - 25.0 56.8

Total financial liabilities - - - 31.8 3,942.9 25.0 3,999.7

Total non-financial liabilities 5,068.2

Total liabilities 9,067.9