Singapore Airlines 2014 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

NOTES TO THE FINANCIAL STATEMENTS

31 March 2014

SINGAPORE AIRLINES

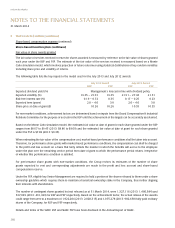

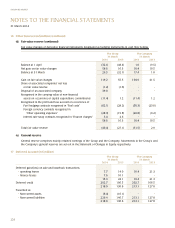

19 Long-TermLiabilities(in$million)

The Group The Company

31 March 31 March

2014 2013 2014 2013

Notes payable

Non-current 800.0 800.0 800.0 800.0

Loans

Current 8.2 5.7 - -

Non-current 13.6 - - -

21.8 5.7 - -

Finance lease commitments

Current 52.5 67.8 - -

Non-current 90.7 140.6 - -

143.2 208.4 - -

Maintenance reserve

Current 10.6 4.3 10.6 4.3

Non-current - 3.9 - 3.9

10.6 8.2 10.6 8.2

Total long-term liabilities 904.3 944.5 800.0 803.9

Notes payable

Notes payable at 31 March 2014 comprise unsecured notes and bonds issued by the Company.

$500 million fixed rate notes due 2020 (“Series 001 Notes”) bear fixed interest at 3.22% per annum and are repayable

on 9 July 2020. The fair value of notes payable amounted to $507.9 million as at 31 March 2014 (2013: $513.4 million)

for the Company.

$300 million bonds bear fixed interest at 2.15% per annum and are repayable on 30 September 2015. The fair value of

notes payable amounted to $305.9 million as at 31 March 2014 (2013: $306.8 million) for the Company.

Loans

The short-term loan is a revolving credit facility denominated in USD taken by a subsidiary company. The loan is unsecured

and bears a fixed interest at 2.50% (FY2012/13: 2.30%) per annum. The current revolving credit facility shall be repayable

within 12-months after the reporting date.

The long-term loan denominated in USD taken by a subsidiary company is unsecured and bears an average floating rate

of 1.47% per annum (FY2012/13: nil), re-priced quarterly. This loan is repayable by 29 April 2022.

The fair value of the loans amounted to $22.8 million as at 31 March 2014 (2013: $5.7 million).

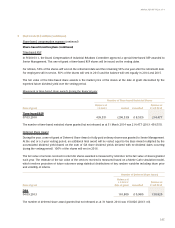

Finance lease commitments

SIA Cargo holds four B747-400 freighters under finance leases, which mature between 2015 and 2018, without any

options for renewal. Three leases have options for SIA Cargo to purchase the aircraft at the end of the lease period of

12 years. The fourth lease has an option for SIA Cargo to purchase the aircraft at the end of the 15th year of the lease period.

Sub-leasing is allowed under the lease agreements.

Interest on three of SIA Cargo’s finance lease commitments are charged at a margin above the London Interbank Offered

Rate (“LIBOR”). These ranged from 0.27% to 1.12% (FY2012/13: 0.34% to 1.41%) per annum. The interest rate on the

fourth finance lease commitment is fixed at 5.81% (FY2012/13: 5.81%) per annum.