Singapore Airlines 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

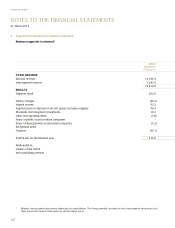

NOTES TO THE FINANCIAL STATEMENTS

31 March 2014

SINGAPORE AIRLINES

2 Summary of Significant Accounting Policies (continued)

(ad) Employee benefits (continued)

(i) Equity compensation plans (continued)

This cost is recognised in the profit and loss account as share-based compensation expense, with a corresponding

increase in the share-based compensation reserve, over the vesting period in which the service conditions are

fulfilled, ending on the date on which the relevant employees become fully entitled to the award (“the vesting

date”). Non-market vesting conditions are included in the estimation of the number of shares under options that

are expected to become exercisable on the vesting date. At the end of each reporting period, the Group revises

its estimates of the number of shares under options that are expected to become exercisable on the vesting date

and recognises the impact of the revision of the estimates in the profit and loss account, with a corresponding

adjustment to the share-based compensation reserve over the remaining vesting period.

No expense is recognised for options or awards that do not ultimately vest, except for options or awards where

vesting is conditional upon a market condition, which are treated as vested irrespective of whether or not the

market condition is satisfied, provided that all other performance and/or service conditions are satisfied.

The share-based compensation reserve is transferred to general reserve upon cancellation or expiry of the vested

options or awards. When the options are exercised or awards are released, the share-based compensation reserve

is transferred to share capital if new shares are issued.

(ii) Defined benefit plans

The net defined benefit liability is the aggregate of the present value of the defined benefit obligation at the end

of the reporting period reduced by the fair value of plan assets (if any).

The cost of providing benefits under the defined benefits plans is determined separately for each plan using the

projected unit credit method.

Defined benefit costs comprise the following:

- Service cost

- Net interest on the net defined benefit liability

- Remeasurements of net defined benefit liability

Service costs which include current service costs, past service costs and gains or losses on non-routine settlements are

recognised as expense in profit or loss. Past service costs are recognised when plan amendment or curtailment occurs.

Net interest on the net defined benefit liability is the change during the period in the net defined benefit liability

that arises from the passage of time which is determined by applying the discount rate to the net defined benefit

liability. Net interest on the net defined benefit liability is recognised as expense in profit or loss.

Remeasurements comprising actuarial gains and losses, and return on plan assets are recognised immediately

in other comprehensive income in the period in which they arise. Remeasurements are recognised in retained

earnings within equity and are not reclassified to profit or loss in subsequent periods.