Singapore Airlines 2014 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

203

ANNUAL REPORT FY2013/14

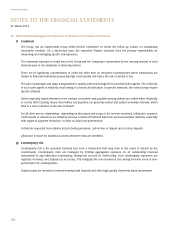

40 Related Party Transactions (in $ million) (continued)

Deferred Share Award

Aggregate Awards

released to

participant since

commencement

Awards oftime-based

granted Balance RSP to end of

Balance as at during the as at financial year

Name of participant 1 April 2013 financial year 31 March 2014 under review

Goh Choon Phong - 41,020 41,020 -

Mak Swee Wah - 16,470 16,470 -

Ng Chin Hwee - 16,470 16,470 -

PSP Base Awards R2

Aggregate

Aggregate ordinary shares

Base Base Base Awards released to

Awards Awards granted since participant since

granted vested commencement commencement

during the during the Balance as at of PSP to end of of PSP to end of

Balance as at financial financial 31 March financial year financial year

Nameofparticipant 1April2013 year year 2014 underreview underreview*

Goh Choon Phong 140,141 82,500 15,887 206,754 258,000 46,912

Mak Swee Wah 65,588 33,000 15,887 82,701 147,888 66,053

Ng Chin Hwee 65,588 33,000 15,887 82,701 133,182 49,840

R1 The actual number of RSP Final Awards of fully paid ordinary shares will range from 0% to 150% of the Base Awards and is contingent on

the Achievements against Targets over the two-year performance periods relating to the relevant awards.

R2 The actual number of PSP Final Awards of fully paid ordinary shares will range from 0% to 200% of the Base Awards and is contingent on

the Achievements against Targets over the three-year performance periods relating to the relevant awards.

# Final Awards granted during the financial year is determined by applying the achievement factor to the Base Awards that have vested during

the financial year.

* During the financial year, 30,746, 158,877 and 7,170 treasury shares were issued to Director and key executives of the Company pursuant to

the RSP, time-based RSP and PSP respectively.

41 Reclassifications

Certain comparative figures have been reclassified to conform with current year’s presentation after adopting Revised FRS

19 Employee Benefits as disclosed in Note 2. As a result of the reclassification, the Group and the Company’s long-term

liabilities increased by $163.7 million and $156.4 million respectively. Correspondingly, current liabilities decreased by the

same amounts.

The effect of this restatement is not significant and consequently a restated balance sheet as at 1 April 2012 has not been presented.

42 Subsequent Events

On 8 April 2014, the Company issued $200 million in aggregate principal amount of 3.145% notes due 2021 and $300

million in aggregate principal amount of 3.750% notes due 2024 under the $2 billion multicurrency medium term note

programme. The notes will mature on 8 April 2021 and 8 April 2024 respectively.

On 8 May 2014, the Company agreed to subscribe to 400 million shares of Scoot Pte. Ltd. at a price of $1 per share, to

support Scoot’s investment in its new fleet of 787 aircraft. The subscription date is expected to be before 30 June 2014.