Singapore Airlines 2014 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168

NOTES TO THE FINANCIAL STATEMENTS

31 March 2014

SINGAPORE AIRLINES

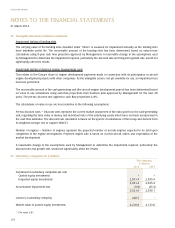

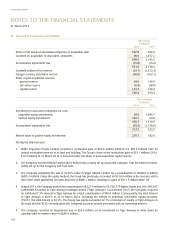

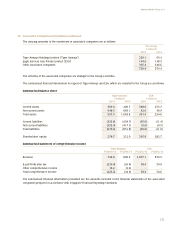

24 Associated Companies (in $ million)

The Group

31 March

2014 2013

Share of net assets of associated companies at acquisition date 567.8 466.0

Goodwill on acquisition of associated companies 98.8 1,677.2

666.6 2,143.2

Accumulated impairment loss (15.0) (15.0)

651.6 2,128.2

Goodwill written off to reserves (23.1) (1,612.3)

Foreign currency translation reserve (96.0) (183.1)

Share of post-acquisition reserves

- general reserve 64.0 140.0

- fair value reserve (0.4) (38.6)

- capital reserve 133.3 120.2

729.4 554.4

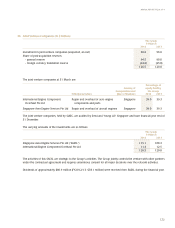

The Company

31 March

2014 2013

Investment in associated companies (at cost)

Unquoted equity investments 36.0 1,646.7

Quoted equity investments 340.7 63.8

376.7 1,710.5

Accumulated impairment loss (63.2) (1,178.0)

313.5 532.5

Market value of quoted equity investments 270.7 182.6

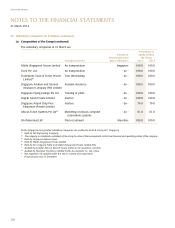

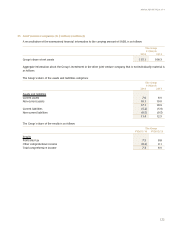

During the financial year:

1. RCMS Properties Private Limited recorded a revaluation gain of $65.6 million (FY2012/13: $62.3 million) from its

annual revaluation exercise of its land and building. The Group’s share of the revaluation gain of $13.1 million (2013:

$12.5 million) at 31 March 2014 is included under the share of post-acquisition capital reserve.

2. The Company invested INR245 million ($4.9 million) into a newly set up associated company, Tata SIA Airlines Limited,

jointly set up by the Company and Tata Sons.

3. The Company completed the sale of its 49% stake in Virgin Atlantic Limited for a consideration of USD361.0 million

($455.3 million). Under the equity method, the Group has previously accounted for $116.6 million in the reserves, which

have been offset against the net sales proceeds of $488.1 million, resulting in a gain of $371.5 million (Note 10).

4. In April 2013, the Company paid a total consideration of $227.9 million for 53,702,775 Rights Shares and 189,390,367

Convertible Securities in Tiger Airways Holdings Limited (“Tiger Airways”). In December 2013, the Company acquired

an additional 7.3% interest in Tiger Airways for a total consideration of $49.0 million. Consequently, the total interest

in Tiger Airways is 40.0% as at 31 March 2014. Including the interest in perpetual convertible capital securities

(“PCCS”), the total interest is 52.1%. The Group has equity accounted 52.1% of its share of results of Tiger Airways on

the basis that the PCCS currently gives the Company access to returns associated with an ownership interest.

5. The Company recorded an impairment loss of $53.9 million on its investment in Tiger Airways to write down its

carrying value to market value of $286.9 million.