Singapore Airlines 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

164

NOTES TO THE FINANCIAL STATEMENTS

31 March 2014

SINGAPORE AIRLINES

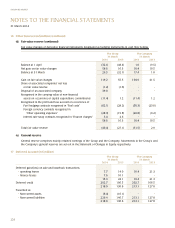

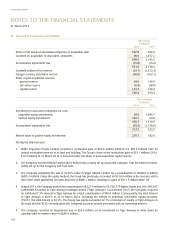

22 Intangible Assets (in $ million) (continued)

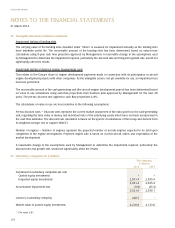

Impairment testing of landing slots

The carrying value of the landing slots classified under “others” is assessed for impairment annually as the landing slots

have indefinite useful life. The recoverable amount of the landing slots has been determined based on value-in-use

calculations using 8-year cash flow projection approved by Management. A reasonable change to the assumptions used

by Management to determine the impairment required, particularly the discount rate and long-term growth rate, would not

significantly affect the results.

Impairment testing of deferred engine development costs

This relates to the Group’s share of engine development payments made in connection with its participation in aircraft

engine development projects with other companies. As the intangible asset is not yet available for use, an impairment test

has been performed.

The recoverable amount of the cash-generating unit (the aircraft engine development project) has been determined based

on value in use calculations using cash flow projections from business plan approved by Management for the next 48

years. The pre-tax discount rate applied to cash flow projections is 8%.

The calculations of value in use are most sensitive to the following assumptions:

Pre-tax discount rates – Discount rates represent the current market assessment of the risks specific to the cash-generating

unit, regarding the time value of money and individual risks of the underlying assets which have not been incorporated in

the cash flow estimates. The discount rate calculation is based on the specific circumstances of the Group and derived from

its weighted average cost of capital (“WACC”).

Number of engines – Number of engines represent the projected number of aircraft engines expected to be sold upon

completion of the engine development. Projected engine sale is based on current aircraft orders and expectation of the

market development.

A reasonable change to the assumptions used by Management to determine the impairment required, particularly the

discount rate and growth rate, would not significantly affect the results.

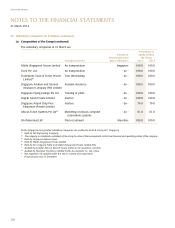

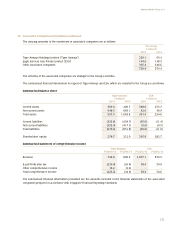

23 Subsidiary Companies (in $ million)

The Company

31 March

2014 2013

Investment in subsidiary companies (at cost)

Quoted equity investments # #

Unquoted equity investments 2,031.4 2,055.4

2,031.4 2,055.4

Accumulated impairment loss (9.8) (25.3)

2,021.6 2,030.1

Loans to a subsidiary company 420.5 -

Market value of quoted equity investments 4,210.8 4,123.8

# The value is $1.