Singapore Airlines 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

ANNUAL REPORT FY2013/14

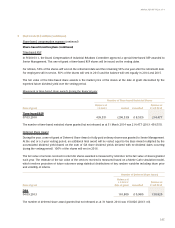

10 Exceptional Items (in $ million)

The Group

FY2013/14 FY2012/13

Gain on divestment of an associated company 371.5 -

Impairment of freighters (293.4) -

Impairment of property, plant and equipment of Singapore Flying College (29.4) -

Provision for penalties and costs incurred by Singapore Airlines Cargo (87.0) (19.9)

(38.3) (19.9)

During the financial year, the Company completed the sale of its 49% stake in Virgin Atlantic Limited for a consideration of

USD361.0 million ($455.3 million). Under the equity method, the Group has previously accounted for $116.6 million in the

reserves, which have been offset against the net sales proceeds (after certain post-closing adjustments) of $488.1 million,

resulting in a gain of $371.5 million.

Singapore Airlines Cargo (“SIA Cargo”) recorded an impairment loss of $293.4 million on four surplus freighters that have

been removed from the operating fleet.

Singapore Flying College (“SFC”) recognised an impairment loss of $29.4 million on their assets, with the impending closure

of the college’s operations in Maroochydore, Australia. Please refer to Note 21 for more details on the impairment losses.

The provision for penalties and costs of $87.0 million pertained to provision for settlements between SIA Cargo and the

plaintiffs in the United States air cargo class action for USD62.8 million ($78.3 million) and the plaintiffs in the Australian air

cargo class action for AUD5.6 million ($6.4 million), as well as penalties and costs of CHF1.7 million ($2.3 million) imposed

by the Swiss Competition Commission in respect of the air cargo issues. The United States and Australian class action

settlements are subject to the respective Courts’ approvals. As for the Swiss Competition Commission decision, SIA Cargo

and the Company have filed an appeal to the Swiss Federal Administrative Tribunal seeking its annulment.

During the previous financial year, SIA Cargo confirmed its acceptance of settlement agreements with the Australian

Competition and Consumer Commission for an amount of AUD12.2 million ($15.5 million) and the New Zealand Commerce

Commission for an amount of NZD4.4 million ($4.4 million). The penalties and costs were recommended by the parties and

endorsed by the respective Courts, bringing the Commissions’ air cargo investigations and proceedings in Australia and

New Zealand to a close for SIA Cargo.

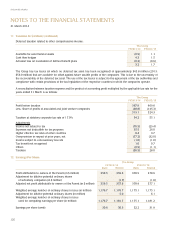

11 Taxation (in $ million)

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2014 and 2013 are:

The Group

FY2013/14 FY2012/13

Current taxation

Provision for the year 164.9 122.9

Overprovision in respect of prior years (43.2) (6.8)

121.7 116.1

Deferred taxation

Movement in temporary differences (144.2) (62.9)

Overprovision in respect of prior years (34.0) (25.2)

(178.2) (88.1)

(56.5) 28.0