Entergy 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

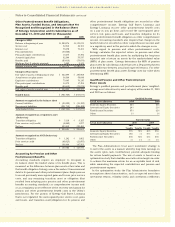

Assets and liabilities are classified in their entirety based

on the lowest level of input that is significant to the fair value

measurement. The following tables set forth by level within the fair

value hierarchy a summary of the investments held for the qualified

pension and other postretirement plans measured at fair value on

a recurring basis at December 31, 2010 and December 31, 2009

(in thousands):

2010 Qualified Pension Trust

Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $ – $ 8,354 $– $ 8,354

Common 1,375,531 – – 1,375,531

Common collective trusts(a) – 657,075 – 657,075

Fixed income securities:

Interest-bearing cash 103,731 – – 103,731

U.S. government securities 75,124 187,957 – 263,081

Corporate debt instruments:

Preferred – 88,709 – 88,709

All others – 210,051 – 210,051

Registered investment

companies(c) – 385,020 – 385,020

Other:

International securities – 101,257 – 101,257

State and local obligations – 7,048 – 7,048

Other:

Insurance company

general account

(unallocated contracts) – 33,439 – 33,439

Total investments $1,554,386 $1,678,910 $– $3,233,296

Cash 321

Other pending transactions (14,954)

Less: Other postretirement

assests included in total

investments (2,395)

Total fair value of

qualified pension assets $3,216,268

2009 Qualified Pension Trust

Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $ – $ 5,318 $– $ 5,318

Common 1,336,454 – – 1,336,454

Common collective trusts(b) – 431,703 – 431,703

Fixed income securities:

U.S. government securities 60,048 100,025 – 160,073

Corporate debt instruments:

Preferred – 164,448 – 164,448

All others – 202,377 – 202,377

Registered investment

companies(c) – 264,643 – 264,643

Other – 6,084 – 6,084

Other:

Insurance company

general account

(unallocated contracts) – 32,422 – 32,422

Total investments $1,396,502 $1,207,020 $– $2,603,522

Cash 1,382

Interest receivable 6,422

Other pending transactions (1,716)

Less: Other postretirement

assests included in total

investments (2,336)

Total fair value of

qualified pension assets $2,607,274

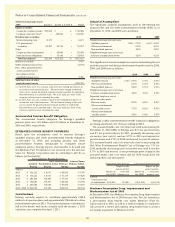

(a) In 2010, there were two common collective trusts holding investments in

accordance with stated objectives. The investment strategy of the both

trusts was to capture the growth potential of equity markets by replicating

the performance of a specified index. Net asset value per share of the

common collective trusts estimated fair value.

(b) In 2009, there were two common collective trusts holding investments in

accordance with stated objectives. The investment strategy of the first trust

was to capture the growth potential of equity markets by replicating the

performance of a specified index. Fair value for this trust was estimated at

net asset value per share. The other common collective trust was invested

in short-term fixed income securities and other securities with debt-like

characteristics and a high degree of liquidity. This common collective trust

fund used the amortization cost method of valuation pursuant to Rule 2a7

of the Investment Company Act of 1940, which allowed it to maintain a

stable net asset value of $1.00 per share.

(c) In 2009 and 2010, the registered investment companies held investments

in domestic and international bond markets and estimated fair value using

net asset value per share.

Other Postretirement Trusts

2010 Level 1 Level 2 Level 3 Total

Equity securities:

Common collective trust(a) $ – $211,835 $– $211,835

Fixed income securities:

Interest-bearing cash 4,014 – – 4,014

U.S. government

securities 37,823 52,326 – 90,149

Corporate debt instruments – 37,128 – 37,128

Other:

International securities – 1,756 – 1,756

State and local obligations – 56,960 – 56,960

Total investments $41,837 $360,005 $– $401,842

Other pending transactions 193

Plus: Other postretirement

assets included in the

investments of the

qualified pension trust 2,395

Total fair value of other

postretirement assets $404,430

97