Entergy 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

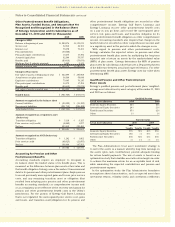

Other Postretirement Benefit Obligations,

Plan Assets, Funded Status, and Amounts Not Yet

Recognized and Recognized in the Balance Sheet

of Entergy Corporation and its Subsidiaries as of

December 31, 2010 and 2009 (in thousands):

2010 2009

Change in APBO

Balance at beginning of year $1,280,076 $1,155,072

Service cost 52,313 46,765

Interest cost 76,078 75,265

Plan amendments (50,548) –

Plan participant contributions 14,275 17,394

Actuarial (gain)/loss 92,340 59,537

Benefits paid (83,613) (79,076)

Medicare Part D subsidy received 5,449 5,119

Balance at end of year $1,386,370 $1,280,076

Change in Plan Assets

Fair value of assets at beginning of year $ 362,399 $ 295,908

Actual return on plan assets 36,364 58,038

Employer contributions 75,005 70,135

Plan participant contributions 14,275 17,394

Benefits paid (83,613) (79,076)

Fair value of assets at end of year $ 404,430 $ 362,399

Funded status $ (981,940) $ (917,677)

Amounts recognized in the balance sheet

Current liabilities $ (30,225) $ (31,189)

Non-current liabilities (951,715) (886,488)

Total funded status $ (981,940) $ (917,677)

Amounts recognized as a regulatory asset

(before tax)

Transition obligation $ 5,118 $ 9,325

Prior service cost/(credit) (8,442) 1,877

Net loss 253,415 239,400

$ 250,091 $ 250,602

Amounts recognized as AOCI (before tax)

Transition obligation $ 1,242 $ 1,862

Prior service credit (48,925) (21,855)

Net loss 198,466 147,563

$ 150,783 $ 127,570

Accounting for Pension and Other

Postretirement Benefits

Accounting standards require an employer to recognize in

its balance sheet the funded status of its benefit plans. This is

measured as the difference between plan assets at fair value and

the benefit obligation. Entergy uses a December 31 measurement

date for its pension and other postretirement plans. Employers are

to record previously unrecognized gains and losses, prior service

costs, and any remaining transition asset or obligation (that

resulted from adopting prior pension and other postretirement

benefits accounting standards) as comprehensive income and/

or as a regulatory asset reflective of the recovery mechanism for

pension and other postretirement benefit costs in the Utility’s

jurisdictions. For the portion of Entergy Gulf States Louisiana

that is not regulated, the unrecognized prior service cost, gains

and losses, and transition asset/obligation for its pension and

other postretirement benefit obligations are recorded as other

comprehensive income. Entergy Gulf States Louisiana and

Entergy Louisiana recover other postretirement benefit costs

on a pay as you go basis and record the unrecognized prior

service cost, gains and losses, and transition obligation for its

other postretirement benefit obligation as other comprehensive

income. Accounting standards also requires that changes in the

funded status be recorded as other comprehensive income and/

or a regulatory asset in the period in which the changes occur.

With regard to pension and other postretirement costs,

Entergy calculates the expected return on pension and other

postretirement benefit plan assets by multiplying the long term

expected rate of return on assets by the market-related value

(MRV) of plan assets. Entergy determines the MRV of pension

plan assets by calculating a value that uses a 20-quarter phase-in

of the difference between actual and expected returns. For other

postretirement benefit plan assets Entergy uses fair value when

determining MRV.

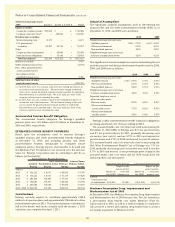

Qualified Pension and Other Postretirement

Plans’ Assets

Entergy’s qualified pension and postretirement plans’ weighted-

average asset allocations by asset category at December 31, 2010

and 2009 are as follows:

Qualified Pension

Actual Asset Allocation 2010 2009

Domestic Equity Securities 44% 46%

International Equity Securities 20% 21%

Fixed-Income Securities 35% 32%

Other 1% 1%

Postretirement

Actual Asset Allocation 2010 2009

Non- Non-

Taxable Taxable Taxable Taxable

Domestic Equity Securities 39% 39% 40% 36%

International Equity Securities 18% –% 19% –%

Fixed-Income Securities 43% 60% 41% 63%

Other –% 1% –% 1%

The Plan Administrator’s trust asset investment strategy is

to invest the assets in a manner whereby long term earnings on

the assets (plus cash contributions) provide adequate funding

for retiree benefit payments. The mix of assets is based on an

optimization study that identifies asset allocation targets in order

to achieve the maximum return for an acceptable level of risk,

while minimizing the expected contributions and pension and

postretirement expense.

In the optimization study, the Plan Administrator formulates

assumptions about characteristics, such as expected asset class

investment returns, volatility (risk), and correlation coefficients

95