Entergy 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Management’s Financial Discussion and Analysis continued

to the reliability standards would result in increased capital

expenditures by the Utility operating companies.

The Entergy Regional State Committee (E-RSC), which is

comprised of representatives from all of the Utility operating

companies’ retail regulators, has been formed to consider

several of these issues related to Entergy’s transmission system.

Among other things, the E-RSC in concert with the FERC plan to

conduct a cost/benefit analysis comparing the ICT arrangement

and a proposal under which Entergy would join the Southwest

Power Pool RTO. The scope of the study was expanded in

July 2010 to consider Entergy joining the Midwest ISO RTO as

another alternative.

In September 2010, as modified in October 2010, the Utility

operating companies filed a request for a two-year interim

extension, with certain modifications, of the ICT arrangement,

which was scheduled to expire on November 17, 2010. The

filing stated that, if approved by the E-RSC during its October

20-21, 2010 meeting, the Utility operating companies will make

a subsequent filing with the FERC to provide the E-RSC with the

authority to, upon unanimous approval of all E-RSC members,

(1) propose modifications to cost allocation methodology for

transmission projects and (2) add transmission projects to the

construction plan. On October 13, 2010, the LPSC issued an order

approving proposals filed by Entergy Louisiana and Entergy Gulf

States Louisiana to modify the current ICT arrangement and to

give the E-RSC authority in the two areas as described above. On

October 20, 2010, the E-RSC unanimously voted in favor of the

proposal granting the E-RSC authority in the two areas described

above. The Utility operating companies have filed the necessary

revisions to the Entergy OATT to implement the E-RSC’s new

authority. In November 2010 the FERC approved extension of

the ICT arrangement for two years. In December 2010 the FERC

approved the proposal to provide the E-RSC with authority in the

two areas described above.

On September 30, 2010, the consultant presented its cost/

benefit analysis of the Entergy and Cleco regions joining the SPP

RTO. The cost/benefit analysis indicates that the Entergy region,

including entities beyond the Utility operating companies, would

realize a net cost of $438 million to a net benefit of $387 million,

primarily depending upon transmission cost allocation issues.

Addendum studies, including studies related to Entergy Arkansas

and the Utility operating companies joining the Midwest ISO,

are due to be completed by the end of the first quarter 2011.

Pursuant to a schedule established by an LPSC ALJ, Entergy Gulf

States Louisiana and Entergy Louisiana expect to make a filing

in May 2011 that sets forth the results of the analysis of the

available options and preliminary recommendations regarding

which option is in the public interest. The other Utility operating

companies expect to make similar filings at that time.

Notice to SERC Reliability Corporation Regarding

Reliability Standards

Entergy has notified the SERC Reliability Corporation (SERC) of

potential violations of certain North American Electric Reliability

Corporation (NERC) reliability standards, including certain

Critical Infrastructure Protection, Facility Connection, and

System Protection Coordination standards. Entergy is working

with the SERC to provide information concerning these potential

violations. The Energy Policy Act of 2005 provides authority to

impose civil penalties for violations of the Federal Power Act and

FERC regulations.

U.S. Department of Justice Investigation

In September 2010, Entergy was notified that the U.S. Department

of Justice had commenced a civil investigation of competitive

issues concerning certain generation procurement, dispatch,

and transmission system practices and policies of the Utility

operating companies. The investigation is ongoing.

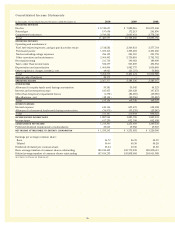

Market and Credit Risk Sensitive Instruments

Market risk is the risk of changes in the value of commodity

and financial instruments, or in future net income or cash flows,

in response to changing market conditions. Entergy holds

commodity and financial instruments that are exposed to the

following significant market risks:

n The commodity price risk associated with the sale of

electricity by the Entergy Wholesale Commodities business.

n The interest rate and equity price risk associated with

Entergy’s investments in pension and other postretirement

benefit trust funds. See Note 11 to the financial statements for

details regarding Entergy’s pension and other postretirement

benefit trust funds.

n The interest rate and equity price risk associated with

Entergy’s investments in nuclear plant decommissioning trust

funds, particularly in the Entergy Wholesale Commodities

business. See Note 17 to the financial statements for details

regarding Entergy’s decommissioning trust funds.

n The interest rate risk associated with changes in interest rates

as a result of Entergy’s issuances of debt. Entergy manages

its interest rate exposure by monitoring current interest rates

and its debt outstanding in relation to total capitalization.

See Notes 4 and 5 to the financial statements for the details of

Entergy’s debt outstanding.

The Utility business has limited exposure to the effects of

market risk because it operates primarily under cost-based rate

regulation. To the extent approved by their retail rate regulators,

the Utility operating companies hedge exposure to natural gas

price volatility.

Entergy’s commodity and financial instruments are exposed to

credit risk. Credit risk is the risk of loss from nonperformance

by suppliers, customers, or financial counterparties to a contract

or agreement. Entergy is also exposed to a potential demand on

liquidity due to credit support requirements within its supply or

sales agreements.

Commodity Price Risk

POWER GENERATION

As a wholesale generator, Entergy Wholesale Commodities’ core

business is selling energy, measured in MWh, to its customers.

Entergy Wholesale Commodities enters into forward contracts

with its customers and sells energy in the day ahead or spot

markets. In addition to selling the energy produced by its plants,

Entergy Wholesale Commodities also sells unforced capacity from

its nuclear plants to load-serving entities, which allows those

companies to meet specified reserve and related requirements

placed on them by the ISOs in their respective areas. Entergy

Wholesale Commodities’ forward fixed price power contracts

consist of contracts to sell energy only, contracts to sell capacity

only, and bundled contracts in which it sells both capacity and

energy. While the terminology and payment mechanics vary

in these contracts, each of these types of contracts requires

47