Entergy 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements continued

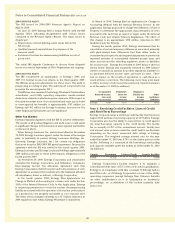

Note 3. Income Taxes

Income tax expenses from continuing operations for 2010, 2009,

and 2008 for Entergy Corporation and Subsidiaries consist of

the following (in thousands):

2010 2009 2008

Current:

Federal $ 145,161 $ (433,105) $ 451,517

Foreign 131 154 256

State 19,313 (108,552) 146,171

Total 164,605 (541,503) 597,944

Deferred and non-current - net 468,698 1,191,418 23,022

Investment tax credit

adjustments - net (16,064) (17,175) (17,968)

Income tax expense from

continuing operations $617,239 $ 632,740 $602,998

Total income taxes for Entergy Corporation and subsidiaries

differ from the amounts computed by applying the statutory income

tax rate to income before taxes. The reasons for the differences for

the years 2010, 2009, and 2008 are (in thousands):

2010 2009 2008

Net income attributable to

Entergy Corporation $1,250,242 $1,231,092 $1,220,566

Preferred dividend

requirements of subsidiaries 20,063 19,958 19,969

Consolidated net income 1,270,305 1,251,050 1,240,535

Income taxes 617,239 632,740 602,998

Income before income taxes $1,887,544 $1,883,790 $1,843,533

Computed at statutory

rate (35%) $ 660,640 $ 659,327 $ 645,237

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 40,530 65,241 9,926|

Regulatory differences -

utility plant items 14,931 57,383 45,543

Amortization of investment

tax credits (15,980) (16,745) (17,458)

Writeoff of

reorganization costs (19,974) – –

Tax law change-Medicare

Part D 13,616 – –

Decommissioning

trust fund basis – (7,917) (417)

Capital gains (losses) – (28,051) (74,278)

Flow-through/permanent

differences (26,370) (49,486) 14,656

Provision for uncertain

tax positions (43,115) (17,435) (27,970)

Valuation allowance – (40,795) 11,770

Other - net (7,039) 11,218 (4,011)

Total income

taxes as reported $ 617,239 $ 632,740 $ 602,998

Effective income tax rate 32.7% 33.6% 32.7%

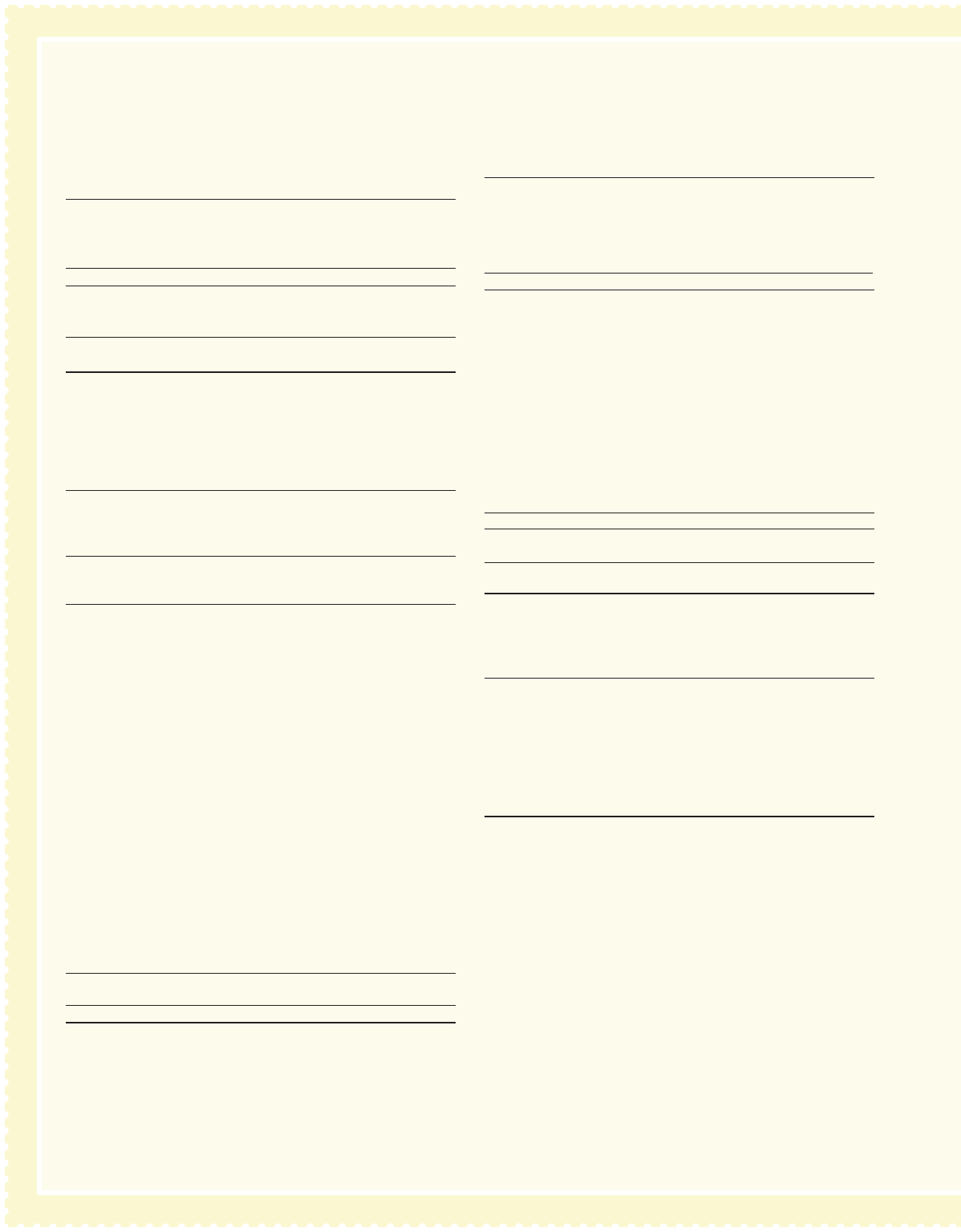

Significant components of accumulated deferred income taxes

and taxes accrued for Entergy Corporation and Subsidiaries as of

December 31, 2010 and 2009 are as follows (in thousands):

2010 2009

Deferred tax liabilities:

Plant-related basis differences $ (5,947,760) $ (5,520,095)

Net regulatory assets (liabilities) (1,074,133) (1,147,710)

Power purchase agreements (265,429) (862,322)

Nuclear decommissioning trusts (439,481) (855,608)

Other (679,302 (456,053)

Total (8,406,105) (8,841,788)

Deferred tax assets:

Accumulated deferred investment

tax credit 111,170 118,587

Pension and other post-employment benefits 161,730 356,284

Nuclear decommissioning liabilities 285,889 313,648

Sale and leaseback 256,157 260,934

Provision for regulatory adjustments 100,504 103,403

Provision for contingencies 28,554 98,514

Unbilled/deferred revenues 18,642 31,995

Customer deposits 15,724 13,073

Net operating loss carryforwards 123,710 148,979

Capital losses 56,602 45,787

Other 19,009 160,264

Valuation allowance (70,089) (47,998)

Total 1,107,602 1,603,470

Noncurrent accrued taxes (including

unrecognized tax benefits) $ (1,261,455) $ (473,064)

Accumulated deferred income

taxes accrued $(8,559,958) $(7,711,382)

Entergy’s estimated tax attribute carryovers and their expira-

tion dates as of December 31, 2010 are as follows:

Carryover Description Carryover Amount Year(s) of expiration

Federal net operating losses $ 10 billion 2023 - 2029

State net operating losses $ 7.5 billion 2011 - 2030

Federal capital losses $ 60.7 million 2014

State capital losses $ 855 million 2011 - 2015

Federal minimum

tax credits $ 29 million never

Other federal and

state credits $ 70 million 2011 - 2030

As a result of the accounting for uncertain tax positions,

the amount of the deferred tax assets reflected in the financial

statements is less than the amount of the tax effect of the federal

and state net operating loss carryovers, tax credit carryovers,

and other tax attributes reflected on income tax returns.

Because it is more likely than not that the benefit from certain

state net operating and capital loss carryovers will not be

utilized, a valuation allowance of $28 million and $34 million has

been provided on the deferred tax assets relating to these state

net operating and capital loss carryovers, respectively.

80