Entergy 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Management’s Financial Discussion and Analysis continued

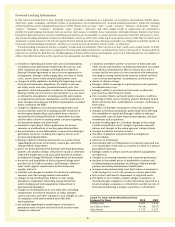

SUMMARY OF CONTRACTUAL OBLIGATIONS OF

CONSOLIDATED ENTITIES (IN MILLIONS):

2012- 2014- After

Contractual Obligations 2011 2013 2015 2015 Total

Long-term debt(1) $ 830 $3,659 $2,027 $11,159 $17,675

Capital lease payments(2) $ 6 $ 13 $ 9 $ 44 $ 72

Operating leases(2) $ 88 $ 146 $ 124 $ 188 $ 546

Purchase obligations(3) $1,772 $3,114 $2,663 $ 5,061 $12,610

˜

(1) Includes estimated interest payments. Long-term debt is discussed in

Note 5 to the financial statements.

(2) Lease obligations are discussed in Note 10 to the financial statements.

(3) Purchase obligations represent the minimum purchase obligation or

cancellation charge for contractual obligations to purchase goods or

services. Almost all of the total are fuel and purchased power obligations.

In addition to the contractual obligations, Entergy currently

expects to contribute approximately $368.8 million to its pen-

sion plans and approximately $78 million to other postretirement

plans in 2011; although the required pension contributions will

not be known with more certainty until the January 1, 2011 valu-

ations are completed by April 1, 2011.

Also in addition to the contractual obligations, Entergy has

$805 million of unrecognized tax benefits and interest net of

unused tax attributes for which the timing of payments beyond

12 months cannot be reasonably estimated due to uncertainties

in the timing of effective settlement of tax positions. See Note 3

to the financial statements for additional information regarding

unrecognized tax benefits.

CAPITAL FUNDS AGREEMENT

Pursuant to an agreement with certain creditors, Entergy

Corporation has agreed to supply System Energy with sufficient

capital to:

n maintain System Energy’s equity capital at a minimum of 35%

of its total capitalization (excluding short-term debt);

n permit the continued commercial operation of Grand Gulf;

n pay in full all System Energy indebtedness for borrowed

money when due; and

n enable System Energy to make payments on specific System

Energy debt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specific debt.

Capital Expenditure Plans and Other Uses of Capital

Following are the amounts of Entergy’s planned construction and

other capital investments by operating segment for 2011 through

2013 (in millions):

Planned construction and capital investments 2011 2012 2013

Maintenance Capital:

Utility:

Generation $ 126 $ 135 $ 123

Transmission 193 209 207

Distribution 440 451 448

Other 89 100 90

Total 848 895 868

Entergy Wholesale Commodities 93 93 111

Total $ 941 $ 988 $ 979

Capital Commitments:

Utility:

Generation $ 1,098 $ 1,071 $ 628

Transmission 213 252 223

Distribution 30 26 14

Other 44 46 57

Total 1,385 1,395 922

Entergy Wholesale Commodities 273 268 264

Total $ 1,658 $ 1,663 $ 1,186

Total $2,599 $2,651 $2,165

Maintenance Capital refers to amounts Entergy plans to

spend on routine capital projects that are necessary to support

reliability of its service, equipment, or systems and to support

normal customer growth.

Capital Commitments refers to non-routine capital investments

for which Entergy is either contractually obligated, has Board

approval, or otherwise expects to make to satisfy regulatory or

legal requirements. Amounts reflected in this category include

the following:

n The currently planned construction or purchase of additional

generation supply sources within the Utility’s service

territory through the Utility’s portfolio transformation

strategy, including Entergy Louisiana’s planned purchase of

Acadia Unit 2, which is discussed below, and three resources

identified in the Summer 2009 Request for Proposal, including

a self-build option at Entergy Louisiana’s Ninemile site.

n Entergy Louisiana’s Waterford 3 steam generators replace-

ment project, which is discussed in further detail below.

n System Energy’s planned approximate 178 MW uprate of the

Grand Gulf nuclear plant. The project is currently expected

to cost $575 million, including transmission upgrades. On

November 30, 2009, the MPSC issued a Certificate of Public

Convenience and Necessity for implementation of the uprate.

n Transmission improvements and upgrades designed to

provide greater transmission flexibility in the Entergy System.

n Spending to comply with current and anticipated North

American Electric Reliability Corporation transmission

planning requirements.

n Entergy Wholesale Commodities investments is associated

with specific investments such as dry cask storage, nuclear

license renewal efforts, component replacement across the

fleet, NYPA value sharing, wedgewire screens at Indian Point,

and spending in response to the Indian Point Independent

Safety Evaluation.

39