Entergy 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

Note 7. Common Equity

Common Stock

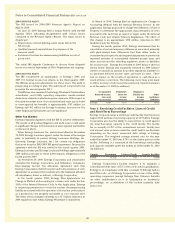

Common stock and treasury stock shares activity for Entergy for 2010, 2009, and 2008 is as follows:

2010 2009 2008

Common Shares Treasury Common Shares Treasury Common Shares Treasury

Issued Shares Issued Shares Issued Shares

Beginning Balance, January 1 254,752,788 65,634,580 248,174,087 58,815,518 248,174,087 55,053,847

Equity Unit Transaction – – 6,578,701 – – –

Repurchases – 11,490,551 – 7,680,000 – 4,792,299

Issuances:

Employee Stock-Based Compensation Plans – (1,113,411) – (856,390) – (1,025,408)

Directors’ Plan – (4,800) – (4,548) – (5,220)

Ending Balance, December 31 254,752,788 76,006,920 254,752,788 65,634,580 248,174,087 58,815,518

In December 2005, Entergy Corporation sold 10 million equity units with a stated amount of $50 each. An equity unit consisted of (1)

a note, initially due February 2011 and initially bearing interest at an annual rate of 5.75%, and (2) a purchase contract that obligated

the holder of the equity unit to purchase for $50 between 0.5705 and 0.7074 shares of Entergy Corporation common stock on or before

February 17, 2009. Entergy paid the holders quarterly contract adjustment payments of 1.875% per year on the stated amount of $50 per

equity unit. Under the terms of the purchase contracts, Entergy attempted to remarket the notes in February 2009 but was unsuccessful,

the note holders put the notes to Entergy, Entergy retired the notes, and Entergy issued shares of common stock to settle the purchase

contracts.

Entergy Corporation reissues treasury shares to meet the requirements of the Stock Plan for Outside Directors (Directors’ Plan), two

Equity Ownership Plans of Entergy Corporation and Subsidiaries, the Equity Awards Plan of Entergy Corporation and Subsidiaries, and

certain other stock benefit plans. The Directors’ Plan awards to non-employee directors a portion of their compensation in the form of

a fixed number of shares of Entergy Corporation common stock.

In January 2007, the Board approved a repurchase program that authorized Entergy to repurchase up to $1.5 billion of its common

stock. In January 2008, the Board authorized an incremental $500 million share repurchase program to enable Entergy to consider

opportunistic purchases in response to equity market conditions. Entergy completed both the $1.5 billion and $500 million programs

in the third quarter 2009. In October 2009, the Board granted authority for an additional $750 million share repurchase program

which was completed in the fourth quarter 2010. In October 2010, the Board granted authority for an additional $500 million share

repurchase program.

Retained Earnings and Dividend Restrictions

Provisions within the articles of incorporation or pertinent indentures and various other agreements relating to the long-term debt and

preferred stock of certain of Entergy Corporation’s subsidiaries could restrict the payment of cash dividends or other distributions

on their common and preferred equity. As of December 31, 2010, under provisions in their mortgage indentures, Entergy Arkansas

and Entergy Mississippi had retained earnings unavailable for distribution to Entergy Corporation of $458 million and $241 million,

respectively, and Entergy Louisiana had member’s equity unavailable for distribution to Entergy Corporation of $465 million. Entergy

Corporation received dividend payments from subsidiaries totaling $580 million in 2010, $417 million in 2009, and $313 million in 2008.

87