Entergy 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pursuing Effective Regulatory Constructs

The utility operating companies’ approach to regulation is multi-

dimensional and includes Formula Rate Plans, capacity and

transmission riders, storm securitization and acquisition preapprovals.

We believe that FRPs are effi cient and effective regulatory constructs,

enabling the utility operating companies to earn a return on equity

suffi cient to attract capital to support investment while providing timely

resets if earnings fall above or below a specifi ed band.

Four of Entergy’s utility operating companies operate under FRPs –

Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi

and Entergy New Orleans. In early 2010, Entergy Mississippi obtained a

revised FRP that simplifi es setting base rates, stabilizes customer bills

and provides a return on capital opportunity similar to that of other

Mississippi utilities. Entergy New Orleans completed its fi rst FRP fi ling

under its new structure, resulting in an $18 million electric rate decrease

on an annualized basis. In Louisiana, both utility operating companies

earned within their authorized ROE bandwidths for the 2009 test year,

following one-time ROE midpoint resets for the 2008 test year.

In Arkansas and Texas, two jurisdictions that use periodic rate cases,

signifi cant progress was realized in 2010. In June, the Arkansas Public

Service Commission approved a settlement and subsequent compliance

tariffs that provide for a $63.7 million rate increase and authorized an

ROE of 10.2 percent, up from 9.9 percent previously. This is the fi rst

base rate increase approved for Entergy Arkansas since 1985. In Texas,

the Public Utility Commission of Texas unanimously approved a

$68 million rate increase in December and authorized an ROE of

10.125 percent. In addition, the rate case set a baseline for future

annual fi lings under a transmission rider. However, Entergy Texas

intends to continue to work with Texas stakeholders to achieve rate

recovery mechanisms that permit full recognition of its cost structure

and investment and power needs to meet growing customer demand.

The utility operating companies have learned many practical lessons

over the past 12 years in how to effectively manage storm risk. Event

risk from hurricanes and other major storms was reduced after securing

recovery of $2.4 billion in storm costs, primarily through the use of

securitization, and establishing cash storm reserves of nearly $330

million as of Dec. 31, 2010. This track record, along with three state

evergreen securitization laws in place, provides a recovery framework

should it be needed in the future.

Going forward, the utility operating companies will work toward

creating a constructive regulatory environment that benefi ts their

customers and shareholders.

Investing in Strategic Resources

Through the portfolio transformation strategy, the Utility continues

to pursue opportunities to procure the right generating technologies

for its customers in the most effi cient manner possible. It continues to

Over the past 12 years and again in 2010,

the utility operating companies

improved

their customer service performance

and identifi ed productive investment

opportunities to enable continued

delivery of reliable, affordable power.

Customer Service Metrics

1998 vs. 2010, % change

53%

Outage

Frequency

33%

Outage

Duration

89%

Regulatory

Outage Complaints

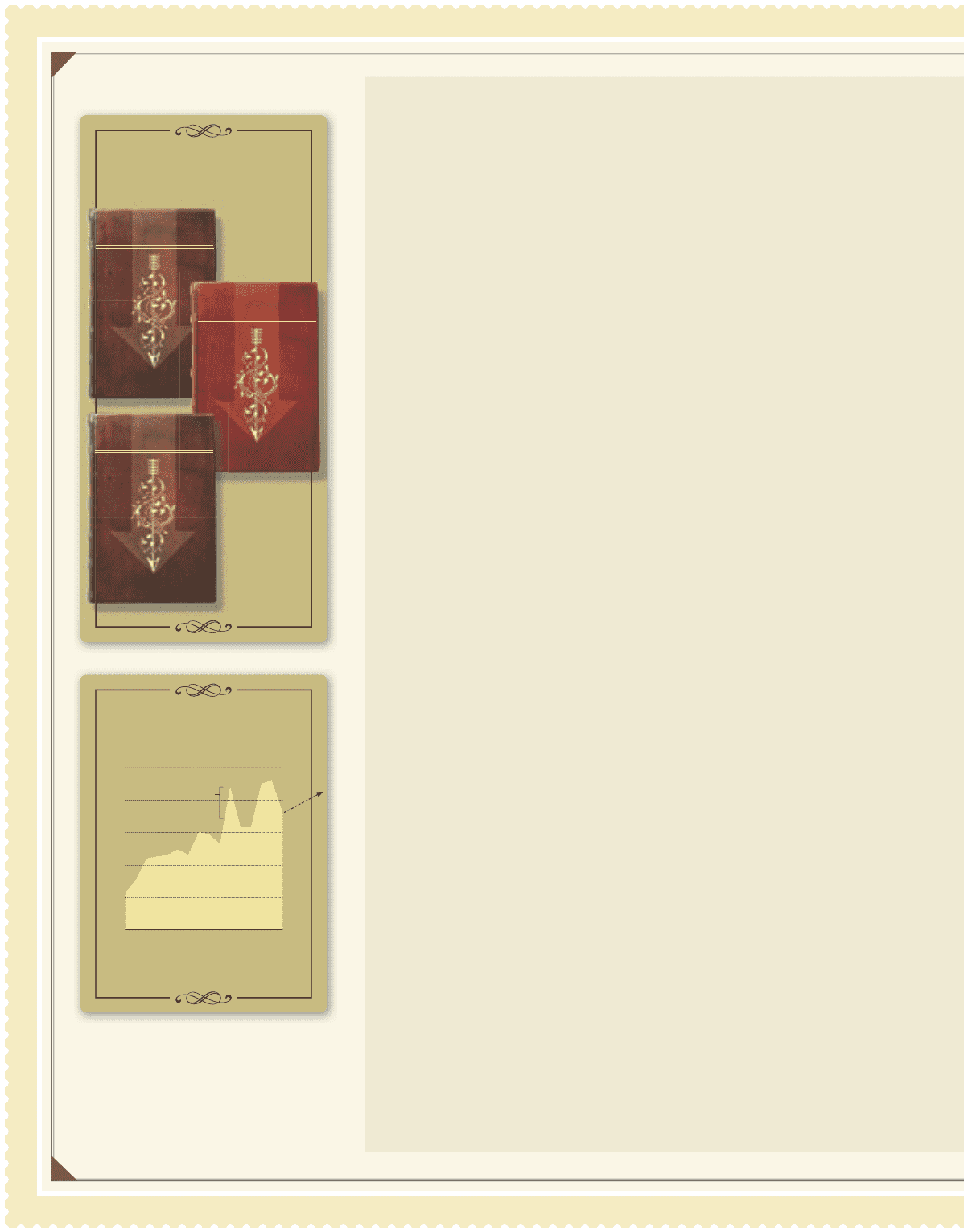

Utility Capital Plan

1998-2013E, $ in billions

0

2.0

2.5

1.5

1.0

0.5

Hurricanes

Gustav/Ike

13E

10

07

04

01

98

Investment Opportunity

18