Entergy 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

EWC employees achieved impressive

nuclear results in 2010. Due in part to

the increased focus of the new EWC

organization, 2010 hedging activities

were aggressively stepped up.

to an abundance of shale gas production. While shale gas may continue

to limit power prices, possible environmental restrictions on hydraulic

fracturing could exert upward pressure on production costs. Some recent

announcements by U.S. natural gas producers to shift focus to wet or oil-

focused plays and expiring cash-generating hedges will help drive natural

gas rig count reductions and an eventual return to a balanced market.

EWC continues to monitor developments in natural gas markets as part

of maintaining a well-informed point of view on forward power prices.

Forward prices for 2011 through 2014 ended the year $9.25 to $12.50 per

MWh below 2009 levels in the New York Independent System Operator and

ISO-New England regions.

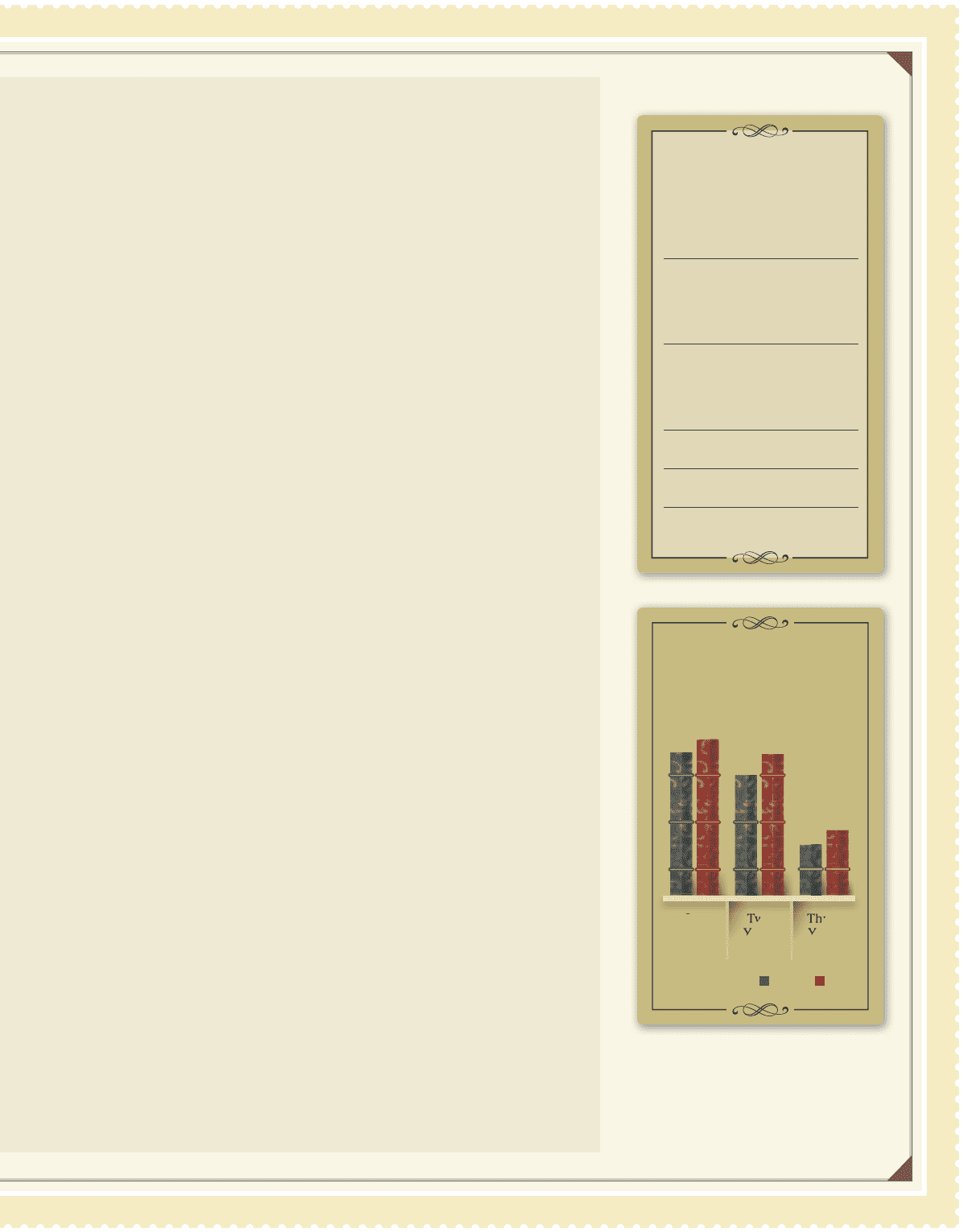

In light of a bearish point of view on power prices, EWC increased its

sold-forward position on planned nuclear production in 2010. A greater

percentage of planned generation equating to nearly 13 terawatt hours for

the three-year forward period was under contract at year-end 2010 than

at year-end 2009. EWC is currently one of the best-positioned non-utility

generators in the country relative to near-term commodity prices.

Evaluating Growth Opportunities

At current forward prices with its existing asset portfolio and in-the-

money hedges that will roll off in the coming few years, EWC is expected

to deliver declining adjusted earnings before interest, taxes, depreciation

and amortization for the period through 2014 compared to 2010. However,

several growth opportunities and potential upsides exist for this business.

On an ongoing basis, EWC evaluates opportunities to acquire and

develop other generation assets including nuclear, hydro, natural gas and

other fossil assets. In addition, Entergy’s experienced nuclear team is well

positioned to offer construction management, operations, license renewal

and decommissioning services to other nuclear operators. EWC continues

to believe expanding nuclear services is a viable growth strategy.

EWC also offers a valuable long-term option from the potential positive

effects of ongoing economic growth (driving increased load, market

heat rates, capacity prices and natural gas prices), new environmental

legislation and/or enforcement of additional environmental regulation.

As the economic recovery gains traction, increased demand for power

is expected to have a positive impact on power prices. In addition,

environmental legislation and regulation represents a substantial

upside for clean and affordable nuclear power. We are strong advocates

for effective public policy to stabilize and then reduce emissions of

greenhouse gases to mitigate the extreme and very real risks posed by

climate change. We continue to believe global leaders will eventually

recognize the risks and act. Regardless, EWC remains focused on the safe

and secure operations of its vital generation assets.

Nuclear Generation

Sold-Forward Position

2009 vs. 2010

% of planned generation

96

88

87

74

40

31

2009

2010

One

Year

Out

Two

Years

Out

Three

Years

Out

2010 Nuclear Plant

Operational Successes

■

Palisades

recorded its best

refueling outage generation

performance and second longest

run in its 38-year history.

■

Indian Point Unit 2

recorded the

highest generation for a cycle

and

Indian Point Unit 3

set a

new run record for Westinghouse 4

loop plants.

■

FitzPatrick

entered a refueling

outage after its longest run ever

of 702 days – the seventh longest

run for a reactor of its type in

U.S. history.

■

Pilgrim

completed a record run

of 642 days in early 2011.

■

Vermont Yankee

recorded its

second longest run ever of 532 days.

■

Cooper

was online in its longest

Cooper

run ever of 413 days as of year-end.

23