Entergy 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

that are based on employees’ credited service and compensation

during the final years before retirement. The Entergy Corporation

Retirement Plan III includes a mandatory employee contribution

of 3% of earnings during the first 10 years of plan participation,

and allows voluntary contributions from 1% to 10% of earnings

for a limited group of employees.

The assets of the seven qualified pension plans are held

in a master trust established by Entergy. Each pension plan

maintains an undivided beneficial interest in each of the

investment accounts of the master trust that is maintained by

a trustee. Use of the master trust permits the commingling of

the trust assets of the pension plans of Entergy Corporation and

its Registrant Subsidiaries for investment and administrative

purposes. Although assets are commingled in the master trust,

the trustee maintains supporting records for the purpose of

allocating the equity in net earnings (loss) and the administrative

expenses of the investment accounts to the various participating

pension plans. The trustee determines the fair value of the fund

and calculates a daily earnings factor, including realized and

unrealized gains or losses, collected and accrued income, and

administrative expenses, and allocates earnings to each plan in

the master trust on a pro rata basis.

Further, within each pension plan, the record of each Registrant

Subsidiary’s beneficial interest in the plan assets is maintained

by the plan’s actuary and is updated quarterly. Assets for each

Registrant Subsidiary are increased for investment income and

contributions, and decreased for benefit payments. A plan’s

investment net income/(loss) (i.e. interest and dividends,

realized gains and losses and expenses) is allocated to the

Registrant Subsidiaries participating in that plan based on the

value of assets for each Registrant Subsidiary at the beginning

of the quarter adjusted for contributions and benefit payments

made during the quarter.

Entergy Corporation and its subsidiaries fund pension costs

in accordance with contribution guidelines established by the

Employee Retirement Income Security Act of 1974, as amended,

and the Internal Revenue Code of 1986, as amended. The assets

of the plans include common and preferred stocks, fixed-income

securities, interest in a money market fund, and insurance

contracts. The Registrant Subsidiaries’ pension costs are

recovered from customers as a component of cost of service in

each of their respective jurisdictions.

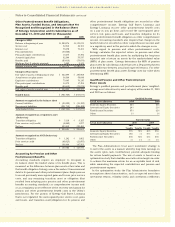

Components of Qualified Net Pension Cost and Other

Amounts Recognized as a Regulatory Asset and/or

Accumulated Other Comprehensive Income (AOCI)

Entergy Corporation and its subsidiaries’ total 2010, 2009, and

2008 qualified pension costs and amounts recognized as a

regulatory asset and/or other comprehensive income, including

amounts capitalized, included the following components

(in thousands):

2010 2009 2008

Net periodic pension cost:

Service cost - benefits earned

during the period $ 104,956 $ 89,646 $ 90,392

Interest cost on projected

benefit obligation 231,206 218,172 206,586

Expected return on assets (259,608) (249,220) (230,558)

Amortization of prior

service cost 4,658 4,997 5,063

Recognized net loss 65,901 22,401 26,834

Net periodic pension costs $ 147,113 $ 85,996 $ 98,317

Other changes in plan assets

and benefit obligations

recognized as a regulatory asset

and/or AOCI (before tax)

Arising this period:

Net (gain)/loss $ 232,279 $ 76,799 $ 965,069

Amounts reclassified from

regulatory asset and/or

accumulated AOCI

to net periodic pension cost in

the current year:

Amortization of prior

service cost (4,658) (4,997) (5,063)

Amortization of net loss (65,901) (22,401) (26,834)

Total $ 161,720 $ 49,401 $ 933,172

Total recognized as net periodic

pension cost, regulatory asset,

and/or AOCI (before tax) $ 308,834 $ 135,397 $1,031,489

Estimated amortization

amounts from regulatory

asset and/or AOCI to net

periodic cost in

the following year

Prior service cost $ 3,350 $ 4,658 $ 4,997

Net loss $ 92,977 $ 65,900 $ 22,401

93