Entergy 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

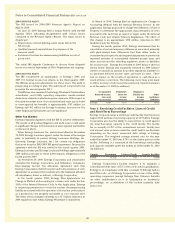

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, Entergy Mississippi, and Entergy Texas each had

credit facilities available as of December 31, 2010 as follows

(in millions):

Amount

Expiration Amount of Interest Drawn as of

Company Date Facility Rate(a) Dec. 31, 2010

Entergy Arkansas April 2011 $75.125(b) 2.75% –

Entergy Gulf

States Louisiana August 2012 $100(c) 0.67% –

Entergy Louisiana August 2012 $200(d) 0.67% –

Entergy

Mississippi May 2011 $ 35(e) 2.01% –

Entergy

Mississippi May 2011 $ 25(e) 2.01% –

Entergy

Mississippi May 2011 $ 10(e) 2.01% –

Entergy Texas August 2012 $ 100(f) 0.74% –

(a) The interest rate is the weighted average interest rate as of December 31,

2010 applied, or that would be applied, to outstanding borrowings under

the facility.

(b) The credit facility requires Entergy Arkansas to maintain a debt ratio

of 65% or less of its total capitalization. Borrowings under the Entergy

Arkansas credit facility may be secured by a security interest in its

accounts receivable.

(c) The credit facility allows Entergy Gulf States Louisiana to issue letters of

credit against the borrowing capacity of the facility. As of December 31,

2010, no letters of credit were outstanding. The credit facility requires

Entergy Gulf States Louisiana to maintain a consolidated debt ratio of 65%

or less of its total capitalization.

(d) The credit facility allows Entergy Louisiana to issue letters of credit against

the borrowing capacity of the facility. As of December 31, 2010, no letters

of credit were outstanding. The credit facility requires Entergy Louisiana to

maintain a consolidated debt ratio of 65% or less of its total capitalization.

(e) Borrowings under the Entergy Mississippi credit facilities may be secured

by a security interest in its accounts receivable. Entergy Mississippi is

required to maintain a consolidated debt ratio of 65% or less of its total

capitalization.

(f) The credit facility allows Entergy Texas to issue letters of credit against

the borrowing capacity of the facility. As of December 31, 2010, no letters

of credit were outstanding. The credit facility requires Entergy Texas to

maintain a consolidated debt ratio of 65% or less of its total capitalization.

Pursuant to the terms of the credit agreement securitization bonds are

excluded from debt and capitalization in calculating the debt ratio.

The facility fees on the credit facilities range from 0.09% to

0.15% of the commitment amount.

The short-term borrowings of the Registrant Subsidiaries are

limited to amounts authorized by the FERC. The current FERC-

authorized limits are effective through October 31, 2011 under

a FERC order dated October 14, 2009. In addition to borrowings

from commercial banks, these companies are authorized under

a FERC order to borrow from the Entergy System money pool.

The money pool is an inter-company borrowing arrangement

designed to reduce the Utility subsidiaries’ dependence on

external short-term borrowings. Borrowings from the money

pool and external short-term borrowings combined may not

exceed the FERC-authorized limits. The following are the FERC-

authorized limits for short-term borrowings and the outstanding

short-term borrowings as of December 31, 2010 (aggregating

both money pool and external short-term borrowings) for the

Registrant Subsidiaries (in millions):

Authorized Borrowings

Entergy Arkansas $250 _

Entergy Gulf States Louisiana $200 –

Entergy Louisiana $250 –

Entergy Mississippi $175 $33

Entergy New Orleans $100 –

Entergy Texas $200 –

System Energy $200 –

Variable Interest Entities

See Note 18 to the financial statements for a discussion of the

consolidation of the nuclear fuel company variable interest

entities (VIE) effective in the first quarter 2010. The variable

interest entities have short-term credit facilities and also

issue commercial paper to finance the acquisition and owner-

ship of nuclear fuel as follows as of December 31, 2010 (dollars

in millions):

Weighted Amount

Average Outstanding

Interest as of

Expiration Amount of Rate on December

Company Date Facility Borrowings(a) 31, 2010

Entergy Arkansas

VIE July 2013 $ 85 2.45% $62.8

Entergy Gulf States

Louisiana VIE July 2013 $ 85 2.125% $24.2

Entergy

Louisiana VIE July 2013 $ 90 2.42% $23.1

System Energy VIE July 2013 $100 2.40% $38.3

(a) Includes letter of credit fees and bank fronting fees on commercial paper

issuances by the VIEs for Entergy Arkansas, Entergy Louisiana, and

System Energy. The VIE for Entergy Gulf States Louisiana does not issue

commercial paper, but borrows directly on its bank credit facility.

The amount outstanding on the Entergy Gulf States Louisiana

credit facility is included in long-term debt on its balance sheet

and the commercial paper outstanding for the other VIEs is

classified as a current liability on the respective balance sheets.

The commitment fees on the credit facilities are 0.20% of the

commitment amount. Each credit facility requires the respective

lessee (Entergy Arkansas, Entergy Gulf States Louisiana, Entergy

Louisiana, or Entergy Corporation as Guarantor for System

Energy) to maintain a consolidated debt ratio of 70% or less of its

total capitalization.

The variable interest entities had long-term notes payable that

are included in long-term debt on the respective balance sheets

as of December 31, 2010 as follows (dollars in millions):

Company Description Amount

Entergy Arkansas VIE 5.60% Series G

due September 2011 $35

Entergy Arkansas VIE 9% Series H due June 2013 $30

Entergy Arkansas VIE 5.69% Series I due July 2014 $70

Entergy Gulf States Louisiana VIE 5.56% Series N due May 2013 $75

Entergy Gulf States Louisiana VIE 5.41% Series O due July 2012 $60

Entergy Louisiana VIE 5.69% Series E due July 2014 $50

System Energy VIE 6.29% Series F due

September 2013 $70

System Energy VIE 5.33% Series G due April 2015 $60

In accordance with regulatory treatment, interest on the

nuclear fuel company variable interest entities’ credit facilities,

commercial paper, and long-term notes payable is included as

fuel expense.

83