Entergy 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

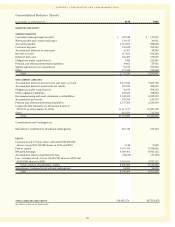

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Consolidated Balance Sheets

In thousands, as of December 31, 2010 2009

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Currently maturing long-term debt $ 299,548 $ 711,957

Notes payable and commercial paper 154,135 30,031

Accounts payable 1,181,099 998,228

Customer deposits 335,058 323,342

Accumulated deferred income taxes 49,307 48,584

Interest accrued 217,685 192,283

Deferred fuel costs 166,409 219,639

Obligations under capital leases 3,388 212,496

Pension and other postretirement liabilities 39,862 55,031

System agreement cost equalization 52,160 187,204

Other 277,598 215,202

Total 2,776,249 3,193,997

NON-CURRENT LIABILITIES

Accumulated deferred income taxes and taxes accrued 8,573,646 7,662,798

Accumulated deferred investment tax credits 292,330 308,395

Obligations under capital leases 42,078 354,233

Other regulatory liabilities 539,026 378,862

Decommissioning and asset retirement cost liabilities 3,148,479 2,939,539

Accumulated provisions 395,250 141,315

Pension and other postretirement liabilities 2,175,364 2,241,039

Long-term debt (includes securitization bonds of

$931,131 as of December 31, 2010) 11,317,157 10,705,738

Other 618,559 711,334

Total 27,101,889 25,443,253

Commitments and Contingencies

Subsidiaries’ preferred stock without sinking fund 216,738 217,343

EQUITY

Common stock, $.01 par value, authorized 500,000,000

shares; issued 254,752,788 shares in 2010 and 2009 2,548 2,548

Paid-in capital 5,367,474 5,370,042

Retained earnings 8,689,401 8,043,122

Accumulated other comprehensive loss (38,212) (75,185)

Less - treasury stock, at cost (76,006,920 shares in 2010 and

65,634,580 shares in 2009) 5,524,811 4,727,167

Total common shareholders’ equity 8,496,400 8,613,360

Subsidiaries’ preferred stock without sinking fund 94,000 94,000

Total 8,590,400 8,707,360

TOTAL LIABILITIES AND EQUITY $38,685,276 $37,561,953

See Notes to Financial Statements.

59