Entergy 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

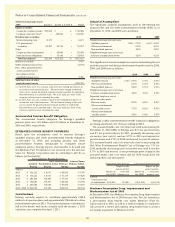

The following table sets forth a reconciliation of changes in the

net assets (liabilities) for the fair value of derivatives classified as

Level 3 in the fair value hierarchy for the years ended December

31, 2010, 2009, and 2008 (in millions):

2010 2009 2008

Balance as of January 1, $ 200 $ 207 $ (12)

Price changes (unrealized gains/losses) 221 310 226

Originated (4) 5 (70)

Settlements (220) (322) 63

Balance as of December 31, $197 $200 $207

Note 17. Decommissioning Trust Funds

Entergy holds debt and equity securities, classified as available-

for-sale, in nuclear decommissioning trust accounts. The NRC

requires Entergy subsidiaries to maintain trusts to fund the costs

of decommissioning ANO 1, ANO 2, River Bend, Waterford 3,

Grand Gulf, Pilgrim, Indian Point 1 and 2, Vermont Yankee, and

Palisades (NYPA currently retains the decommissioning trusts

and liabilities for Indian Point 3 and FitzPatrick). The funds are

invested primarily in equity securities; fixed-rate, fixed-income

securities; and cash and cash equivalents.

Entergy records decommissioning trust funds on the balance

sheet at their fair value. Because of the ability of the Registrant

Subsidiaries to recover decommissioning costs in rates and in

accordance with the regulatory treatment for decommissioning

trust funds, the Registrant Subsidiaries have recorded an offsetting

amount of unrealized gains/(losses) on investment securities in

other regulatory liabilities/assets. For the nonregulated portion

of River Bend, Entergy Gulf States Louisiana has recorded an

offsetting amount of unrealized gains/(losses) in other deferred

credits. Decommissioning trust funds for Pilgrim, Indian Point

2, Vermont Yankee, and Palisades do not meet the criteria for

regulatory accounting treatment. Accordingly, unrealized gains

recorded on the assets in these trust funds are recognized in

the accumulated other comprehensive income component of

shareholders’ equity because these assets are classified as

available for sale. Unrealized losses (where cost exceeds fair

market value) on the assets in these trust funds are also recorded

in the accumulated other comprehensive income component of

shareholders’ equity unless the unrealized loss is other than

temporary and therefore recorded in earnings. Generally, Entergy

records realized gains and losses on its debt and equity securities

using the specific identification method to determine the cost

basis of its securities.

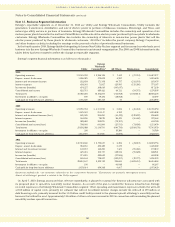

The securities held as of December 31, 2010 and 2009 are

summarized as follows (in millions):

Total Total

Fair Unrealized Unrealized

Value Gains Losses

2010

Equity securities $ 2,076 $ 436 $ 9

Debt securities 1,520 67 12

Total $3,596 $503 $ 21

2009

Equity securities $ 1,788 $ 311 $ 30

Debt securities 1,423 63 8

Total $3,211 $374 $ 38

Deferred taxes on unrealized gains/(losses) are recorded in other

comprehensive income for the decommissioning trusts which

do not meet the criteria for regulatory accounting treatment as

described above. Unrealized gains/(losses) above are reported

before deferred taxes of $130 million and $66 million as of

December 31, 2010 and 2009, respectively. The amortized cost

of debt securities was $1,475 million as of December 31, 2010

and $1,368 million as of December 31, 2009. As of December

31, 2010, the debt securities have an average coupon rate of

approximately 4.34%, an average duration of approximately 5.21

years, and an average maturity of approximately 8.82 years. The

equity securities are generally held in funds that are designed to

approximate or somewhat exceed the return of the Standard &

Poor’s 500 Index. A relatively small percentage of the securities

are held in funds intended to replicate the return of the Wilshire

4500 Index or the Russell 3000 Index.

The fair value and gross unrealized losses of available-for-sale

equity and debt securities, summarized by investment type and

length of time that the securities have been in a continuous loss

position, are as follows as of December 31, 2010 (in millions):

Equity Securities Debt Securities

Gross Gross

Fair Unrealized Fair Unrealized

Value Losses Value Losses

Less than 12 months $ 15 $1 $ 474 $ 11

More than 12 months 105 8 4 1

Total $120 $9 $478 $12

The fair value and gross unrealized losses of available-for-sale

equity and debt securities, summarized by investment type and

length of time that the securities have been in a continuous loss

position, are as follows as of December 31, 2009 (in millions):

Equity Securities Debt Securities

Gross Gross

Fair Unrealized Fair Unrealized

Value Losses Value Losses

Less than 12 months $ 57 $ 1 $311 $ 6

More than 12 months 205 29 18 2

Total $262 $30 $329 $ 8

The unrealized losses in excess of twelve months on equity

securities above relate to Entergy’s Utility operating companies

and System Energy.

The fair value of debt securities, summarized by contractual

maturities, as of December 31, 2010 and 2009 are as follows

(in millions):

2010 2009

Less than 1 year $ 37 $ 31

1 year - 5 years 557 676

5 years - 10 years 512 388

10 years - 15 years 163 131

15 years - 20 years 47 34

20 years+ 204 163

Total $1,520 $1,423

107