Entergy 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

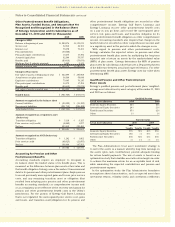

Other Postretirement Trusts

2009 Level 1 Level 2 Level 3 Total

Equity securities:

Corporate common stocks $50,698 $ – $– $ 50,698

Common collective trust(b) – 140,096 – 140,096

Fixed income securities:

Interest-bearing cash 6,115 – – 6,115

U.S. government

securities 25,487 50,714 – 76,201

Other:

Corporate debt instruments – 35,099 – 35,099

State and local obligations – 53,443 – 53,443

Total investments $82,300 $279,352 $– $361,652

Interest receivable 1,567

Other pending transactions (3,156)

Plus: Other postretirement

assets included in the

investments of the

qualified pension trust 2,336

Total fair value of other

postretirement assets $362,399

(a) In 2010, there were two common collective trusts holding investments in

accordance with stated objectives. The investment strategy of the both

trusts was to capture the growth potential of equity markets by replicating

the performance of a specified index. Net asset value per share of the

common collective trusts estimated fair value.

(b) In 2009, there was one common collective trust holding investments in

accordance with stated objectives. The investment strategy of this trust

was to capture the growth potential of equity markets by replicating

the performance of a specified index. Net asset value per share of the

common collective trusts estimated fair value.

Accumulated Pension Benefit Obligation

The accumulated benefit obligation for Entergy’s qualified

pension plans was $3.8 billion and $3.4 billion at December 31,

2010 and 2009, respectively.

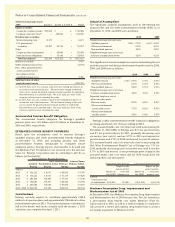

ESTIMATED FUTURE BENEFIT PAYMENTS

Based upon the assumptions used to measure Entergy’s

qualified pension and other postretirement benefit obligation

at December 31, 2010, and including pension and other

postretirement benefits attributable to estimated future

employee service, Entergy expects that benefits to be paid and

the Medicare Part D subsidies to be received over the next ten

years for Entergy Corporation and its subsidiaries will be as

follows (in thousands):

Estimated Future Benefits Payments

Other Postretirement Estimated Future

Qualified Non-Qualified (before Medicare Medicare Subsidy

Pension Pension Subsidy) Receipts

Year(s)

2011 $ 163,212 $ 9,637 $ 68,816 $ 5,991

2012 $ 172,221 $ 8,716 $ 73,119 $ 6,829

2013 $ 183,364 $16,334 $ 77,715 $ 7,736

2014 $ 196,083 $13,451 $ 82,540 $ 8,694

2015 $ 210,586 $13,549 $ 87,629 $ 9,691

2016 - 2020 $1,342,629 $77,109 $523,912 $65,454

Contributions

Entergy currently expects to contribute approximately $368.8

million to its pension plans and approximately $78 million to other

postretirement plans in 2011. The required pension contributions

will not be known with more certainty until the January 1, 2011

valuations are completed by April 1, 2011.

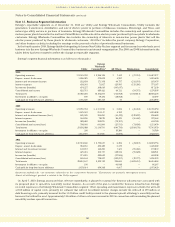

Actuarial Assumptions

The significant actuarial assumptions used in determining the

pension PBO and the other postretirement benefit APBO as of

December 31, 2010, and 2009 were as follows:

2010 2009

Weighted-average discount rate:

Qualified pension 5.60% - 5.70% 6.10% - 6.30%

Other postretirement 5.50% 6.10%

Non-qualified pension 4.90% 5.40%

Weighted-average rate of increase

in future compensation levels 4.23% 4.23%

The significant actuarial assumptions used in determining the net

periodic pension and other postretirement benefit costs for 2010,

2009, and 2008 were as follows:

2010 2009 2008

Weighted-average discount rate:

Qualified pension 6.10% - 6.30% 6.75% 6.50%

Other postretirement 6.10% 6.70% 6.50%

Non-qualified pension 5.40% 6.75% 6.50%

Weighted-average rate of increase

in future compensation levels 4.23% 4.23% 4.23%

Expected long-term rate of

return on plan assets:

Pension assets 8.50% 8.50% 8.50%

Other postretirement

non-taxable assets 7.75% 8.50% 8.50%

Other postretirement

taxable assets 5.50% 6.00% 5.50%

Entergy’s other postretirement benefit transition obligations

are being amortized over 20 years ending in 2012.

The assumed health care cost trend rate used in measuring the

December 31, 2010 APBO of Entergy was 8.5% for pre-65 retirees

and 8% for post-65 retirees for 2011, gradually decreasing each

successive year until it reaches 4.75% in 2019 and beyond for

pre-65 retirees and 4.75% in 2018 and beyond for post-65 retirees.

The assumed health care cost trend rate used in measuring the

Net Other Postretirement Benefit Cost of Entergy was 7.5% for

2010, gradually decreasing each successive year until it reaches

4.75% in 2016 and beyond. A one percentage point change in the

assumed health care cost trend rate for 2010 would have the

following effects (in thousands):

1 Percentage Point Increase 1 Percentage Point Decrease

Impact on the Impact on the

sum of service sum of service

Impact on costs and Impact on costs and

the APBO interest cost the APBO interest cost

Entergy

Corporation and

its subsidiaries $136,203 $13,833 $(121,015) $(11,914)

Medicare Prescription Drug, Improvement and

Modernization Act of 2003

In December 2003, the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 became law. The Act introduces

a prescription drug benefit cost under Medicare (Part D),

which started in 2006, as well as a federal subsidy to employers

who provide a retiree prescription drug benefit that is at least

actuarially equivalent to Medicare Part D.

Notes to Consolidated Financial Statements continued

98