Entergy 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements continued

The calculation of diluted earnings per share excluded

5,380,262 options outstanding at December 31, 2010, 4,368,614

options outstanding at December 31, 2009, and 3,326,835 options

outstanding at December 31, 2008 that could potentially dilute

basic earnings per share in the future. Those options were not

included in the calculation of diluted earnings per share because

the exercise price of those options exceeded the average market

price for the year.

See Note 7 to the financial statements for a discussion of the

equity units.

Stock-Based Compensation Plans

Entergy grants stock options to key employees of the Entergy

subsidiaries, which is described more fully in Note 12 to

the financial statements. Effective January 1, 2003, Entergy

prospectively adopted the fair value based method of accounting

for stock options. Awards under Entergy’s plans generally vest

over three years. Stock-based compensation expense included in

consolidated net income, net of related tax effects, is $9.2 million

for 2010, is $10.4 million for 2009, and is $10.7 million for 2008 for

Entergy’s stock options granted.

Accounting for the Effects of Regulation

Entergy’s Utility operating companies and System Energy are rate-

regulated enterprises whose rates meet three criteria specified in

accounting standards. The Utility operating companies and System

Energy have rates that (i) are approved by a body empowered to

set rates that bind customers (its regulator); (ii) are cost-based;

and (iii) can be charged to and collected from customers. These

criteria may also be applied to separable portions of a utility’s

business, such as the generation or transmission functions, or

to specific classes of customers. Because the Utility operating

companies and System Energy meet these criteria, each of them

capitalizes costs that would otherwise be charged to expense

if the rate actions of its regulator make it probable that those

costs will be recovered in future revenue. Such capitalized costs

are reflected as regulatory assets in the accompanying financial

statements. When an enterprise concludes that recovery of a

regulatory asset is no longer probable, the regulatory asset must

be removed from the entity’s balance sheet.

An enterprise that ceases to meet the three criteria for all or

part of its operations should report that event in its financial

statements. In general, the enterprise no longer meeting the

criteria should eliminate from its balance sheet all regulatory

assets and liabilities related to the applicable operations.

Additionally, if it is determined that a regulated enterprise is no

longer recovering all of its costs, it is possible that an impairment

may exist that could require further write-offs of plant assets.

Entergy Gulf States Louisiana does not apply regulatory

accounting standards to the Louisiana retail deregulated portion

of River Bend, the 30% interest in River Bend formerly owned by

Cajun, and its steam business. The Louisiana retail deregulated

portion of River Bend is operated under a deregulated asset plan

representing a portion (approximately 15%) of River Bend plant

costs, generation, revenues, and expenses established under a

1992 LPSC order. The plan allows Entergy Gulf States Louisiana to

sell the electricity from the deregulated assets to Louisiana retail

customers at 4.6 cents per kWh or off-system at higher prices,

with certain provisions for sharing incremental revenue above

4.6 cents per kWh between ratepayers and shareholders.

Cash and Cash Equivalents

Entergy considers all unrestricted highly liquid debt instruments

with an original or remaining maturity of three months or less at

date of purchase to be cash equivalents.

Allowance for Doubtful Accounts

The allowance for doubtful accounts reflects Entergy’s best

estimate of losses on the accounts receivable balances. The

allowance is based on accounts receivable agings, historical

experience, and other currently available evidence. Utility

operating company customer accounts receivable are written off

consistent with approved regulatory requirements.

Investments

Entergy records decommissioning trust funds on the balance

sheet at their fair value. Because of the ability of the Registrant

Subsidiaries to recover decommissioning costs in rates and in

accordance with the regulatory treatment for decommissioning

trust funds, the Registrant Subsidiaries have recorded an offsetting

amount of unrealized gains/(losses) on investment securities in

other regulatory liabilities/assets. For the nonregulated portion

of River Bend, Entergy Gulf States Louisiana has recorded an

offsetting amount of unrealized gains/(losses) in other deferred

credits. Decommissioning trust funds for Pilgrim, Indian Point

2, Vermont Yankee, and Palisades do not meet the criteria for

regulatory accounting treatment. Accordingly, unrealized gains

recorded on the assets in these trust funds are recognized in

the accumulated other comprehensive income component of

shareholders’ equity because these assets are classified as

available for sale. Unrealized losses (where cost exceeds fair

market value) on the assets in these trust funds are also recorded

in the accumulated other comprehensive income component of

shareholders’ equity unless the unrealized loss is other than

temporary and therefore recorded in earnings. Effective January

1, 2009, Entergy adopted an accounting pronouncement providing

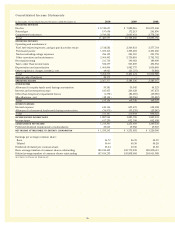

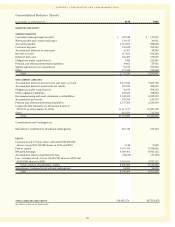

Earnings per Share

The following table presents Entergy’s basic and diluted earnings per share calculation included on the consolidated statements of

income (in millions, except per share data):

For the Years Ended December 31, 2010 2009 2008

Income Shares $/share Income Shares $/share Income Shares $/share

Basic earnings per average common share

Net income attributable to Entergy Corporation $ 1,250.2 186.0 $ 6.72 $ 1,231.1 192.8 $ 6.39 $ 1,220.6 190.9 $ 6.39

Average dilutive effect of:

Stock options – 1.8 (0.06) – 2.2 (0.07) – 4.1 (0.13)

Equity units – – – 3.2 0.8 (0.02) 24.7 6.0 (0.06)

Diluted earnings per average common share $1,250.2 187.8 $6.66 $1,234.3 195.8 $ 6.30 $1,245.3 201.0 $ 6.20

64