Entergy 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2010

Notes to Consolidated Financial Statements continued

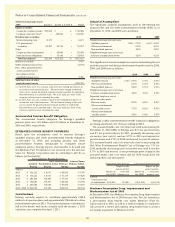

Electricity over-the-counter swaps that financially settle against

day-ahead power pool prices are used to manage price exposure

for Entergy Wholesale Commodities generation. Based on market

prices as of December 31, 2010, cash flow hedges relating to power

sales totaled $190 million of net gains, of which approximately

$155 million are expected to be reclassified from accumulated

other comprehensive income (OCI) to operating revenues in

the next twelve months. The actual amount reclassified from

accumulated OCI, however, could vary due to future changes

in market prices. Gains totaling approximately $220 million and

$322 million were realized on the maturity of cash flow hedges,

before taxes of $77 million and $113 million, for December 31,

2010 and 2009, respectively. Unrealized gains or losses recorded

in OCI result from hedging power output at the Entergy Wholesale

Commodities power plants. The related gains or losses from

hedging power are included in operating revenues when realized.

The maximum length of time over which Entergy is currently

hedging the variability in future cash flows with derivatives

(Palisades is price hedged through April 2022) for forecasted

power transactions at December 31, 2010 is approximately four

years. Planned generation currently sold forward from Entergy

Wholesale Commodities power plants as of December 31, 2010 is

96% for 2011 of which approximately 47% is sold under financial

derivatives and the remainder under normal purchase/sale

contracts. The ineffective portion of the change in the value of

Entergy’s cash flow hedges for 2010 and 2009 was insignificant.

Certain of the agreements to sell the power produced by Entergy

Wholesale Commodities power plants contain provisions that

require an Entergy subsidiary to provide collateral to secure

its obligations when the current market prices exceed the

contracted power prices. The primary form of collateral to satisfy

these requirements is an Entergy Corporation guaranty. As of

December 31, 2010, hedge contracts with two counterparties were

in a liability position (approximately $17 million total), but were

significantly below the amount of the guarantee provided under

the contract and no cash collateral was required. If the Entergy

Corporation credit rating falls below investment grade, the

impact of the corporate guarantee is ignored and Entergy would

have to post collateral equal to the estimated outstanding liability

under the contract at the applicable date. From time to time,

Entergy may effectively liquidate a cash flow hedge instrument

by entering into a contract offsetting the original hedge, and then

de-designating the original hedge. Gains or losses accumulated in

OCI prior to de-designation continue to be deferred in OCI until

they are included in income as the original hedged transaction

occurs. From the point of de-designation, the gains or losses on

the original hedge and the offsetting contract are recorded as

assets or liabilities on the balance sheet and offset as they flow

through to earnings.

Natural gas over-the-counter swaps that financially settle

against NYMEX futures are used to manage fuel price volatility for

the Utility’s Louisiana and Mississippi customers. All benefits or

costs of the program are recorded in fuel costs. The total volume

of natural gas swaps outstanding as of December 31, 2010 is

37,120,000 MMBtu for Entergy. Credit support for these natural

gas swaps is covered by master agreements that do not require

collateralization based on mark-to-market value, but do carry

adequate assurance language that may lead to collateralization

requests.

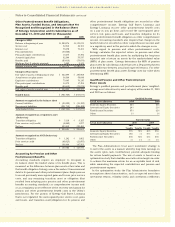

The effect of Entergy’s derivative instruments not designated

as hedging instruments on the consolidated income statements

for the years ended December 31, 2010 and 2009 is as follows

(in millions):

Amount of gain (loss)

recognized in OCI Amount of gain (loss)

(de-designated Income Statement recorded in

Instrument hedges) location income

2010

Natural gas swaps $ – Fuel, fuel-related $ (95)

expenses, and gas

purchased for resale

Electricity futures, fowards, Competitive

swaps, and options de- businesses operating

designated as hedged items $15 revenues $ –

2009

Natural gas swaps $ – Fuel, fuel-related $(160)

expenses, and gas

purchased for resale

Due to regulatory treatment, the natural gas swaps are marked to

market through fuel, fuel-related expenses, and gas purchased for

resale and then such amounts are simultaneously reversed and

recorded as offsetting regulatory assets or liabilities. The gains or

losses recorded as fuel expenses when the swaps are settled are

recovered through fuel cost recovery mechanisms.

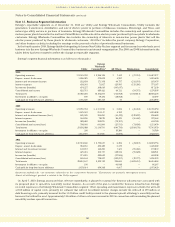

Fair Values

The estimated fair values of Entergy’s financial instruments and

derivatives are determined using bid prices, market quotes,

and financial modeling. Considerable judgment is required in

developing the estimates of fair value. Therefore, estimates are

not necessarily indicative of the amounts that Entergy could

realize in a current market exchange. Gains or losses realized

on financial instruments other than forward energy contracts

held by competitive businesses are reflected in future rates

and therefore do not accrue to the benefit or detriment of

shareholders. Entergy considers the carrying amounts of most

financial instruments classified as current assets and liabilities to

be a reasonable estimate of their fair value because of the short

maturity of these instruments.

Accounting standards define fair value as an exit price, or the

price that would be received to sell an asset or the amount that

would be paid to transfer a liability in an orderly transaction

between knowledgeable market participants at the date of

measurement. Entergy and the Registrant Subsidiaries use

assumptions or market input data that market participants would

use in pricing assets or liabilities at fair value. The inputs can

be readily observable, corroborated by market data, or generally

unobservable. Entergy and the Registrant Subsidiaries endeavor

to use the best available information to determine fair value.

105