Dollar Tree 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 47

that date. Greenbacks was a privately held company

operating 100 stores in 10 western states and one

expandable 252,000 square foot distribution center in

Salt Lake City. As a result of this acquisition, the

Company extended its geographical reach to include 47

states compared with 41 states prior to the acquisition.

In addition, this acquisition has provided the Company

with an expandable distribution infrastructure in the

Rocky Mountain area of the country. The aggregate

purchase price was approximately $100,000 and was paid

in cash. In addition, the Company incurred approximately

$800 in direct costs associated with the acquisition. The

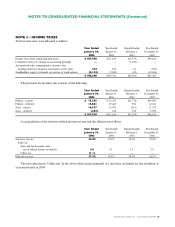

following table summarizes the fair value of the assets

acquired and liabilities assumed at the date of acquisition.

Current assets $ 27,601

Deferred tax asset-current 860

Property and equipment 7,856

Intangible assets 3,031

Goodwill 80,284

Other assets 27

Total assets acquired 119,659

Current liabilities 11,155

Deferred tax liability 1,636

Long-term debt 4,838

Other liabilities 257

Total liabilities assumed 17,886

Net assets acquired $101,773

Included in the intangible assets acquired were non-

compete agreements of $2,000 and favorable lease rights

for operating leases for retail locations of $1,000. The

non-compete agreements are with former key executives

of Greenbacks. They are being amortized over five years,

the weighted average term of the agreements. The

favorable lease rights are being amortized on a straight-

line basis to rent expense over the remaining initial lease

terms, which expire at various dates through 2012.

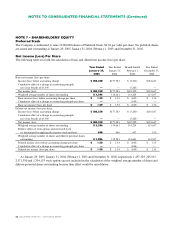

NOTE 11 – INVESTMENT

On August 7, 2003, the Company paid $4,000 to acquire

a 10.5% fully diluted interest in Ollie’s Holdings, Inc.

(Ollie’s), a multi-price point discount retailer located in

the mid-Atlantic region. In addition, the SKM Equity

Fund III, L.P. (SKM Equity) and SKM Investment Fund

(SKM Investment) acquired a combined fully diluted

interest in Ollie’s of 53.1%. Two of the Company’s

directors, Thomas Saunders and John Megrue, are

principal members of Saunders Karp & Megrue Partners,

L.L.C., which serves as the general partner of SKM

Equity and SKM Investment. In conjunction with the

acquisition of its interest in Ollie’s, the Company also

entered into a call option agreement. The option

agreement provides the Company with the right to

purchase all of SKM Equity’s and SKM Investment’s

equity in Ollie’s, for a fixed price as set forth in the

agreement, subject to adjustments dependent on the

occurrence of certain future events. The Company has

no obligation to exercise the option or make any

additional investment in Ollie’s. The $4,000 investment

in Ollie’s is accounted for under the cost method of

accounting and is included in “other assets” in the

accompanying consolidated balance sheets.

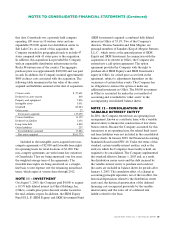

NOTE 12 – CONSOLIDATION OF

VARIABLE INTEREST ENTITY

In 2001, the Company entered into an operating lease

arrangement, known as a synthetic lease, with a variable

interest entity to finance the construction of four distri-

bution centers. Because the Company accounted for this

transaction as an operating lease, the related fixed assets

and lease liabilities were not included in the consolidated

balance sheets. In January 2003, the Financial Accounting

Standards Board issued FIN 46. Under the terms of this

standard, certain variable-interest entities, such as the

entity in which the Company’s lease facility is held, are

required to be consolidated. The Company implemented

this standard effective January 1, 2003 and, as a result,

the distribution center assets and the debt incurred by

the variable-interest entity to purchase and construct

the assets are included in balance sheets for periods after

January 1, 2003. The cumulative effect of a change in

accounting principle represents, net of the tax effect, the

historical depreciation related to the distribution center

assets and, the historical amortization of the deferred

financing costs recognized previously by the variable-

interest entity and the write-off of a deferred rent

liability related to the lease.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)