Dollar Tree 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 43

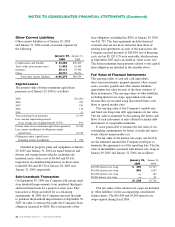

Comprehensive Income (Loss)

The Company’s comprehensive income (loss) reflects the effect of recording derivative financial instruments pursuant to

SFAS No. 133. The following table provides a reconciliation of net income (loss) to total comprehensive income (loss):

Year Ended Year Ended Month Ended Year Ended

January 29, January 31, February 1, December 31,

2005 2004 2003 2004

Net income (loss) $180,250 $177,583 $(10,525) $154,647

Fair value adjustment-derivative cash flow hedging instrument 1,113 475 155 (1,652)

Income tax benefit (expense) (429) (183) (60) 642

Fair value adjustment, net of tax 684 292 95 (1,010)

Amortization of SFAS No. 133 cumulative effect (13) 24 2 24

Income tax benefit (expense) 5(9) (1) (9)

Amortization of SFAS No. 133 cumulative effect, net of tax (8) 15 1 15

Total comprehensive income (loss) $180,926 $177,890 $(10,429) $153,652

The cumulative effect recorded in “accumulated other comprehensive loss”is being amortized over the remaining

lives of the related interest rate swaps.

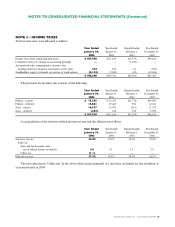

Contributions to and reimbursements by the

Company of expenses of the plans included in the

accompanying consolidated statements of operations

were as follows:

Year Ended January 29, 2005 $8,530

Year Ended January 31, 2004 10,964

Month Ended February 1, 2003 755

Year Ended December 31, 2002 9,862

Deferred Compensation Plan

The Company has a deferred compensation plan which

provides certain highly compensated employees and

executives the ability to defer a portion of their base

compensation and bonuses and earn interest on their

deferred amounts. The plan is an unfunded nonqualified

plan; however, the Company may make discretionary

contributions. The deferred amounts and earnings

thereon are payable to participants, or designated

beneficiaries, at specified future dates, upon retirement

or death. Total cumulative participant deferrals were

approximately $1,516 and $1,718, respectively, at January

29, 2005 and January 31, 2004 and are included in “other

liabilities”on the accompanying consolidated balance

sheets. The related assets are included in “other assets,

net” on the accompanying consolidated balance sheets.

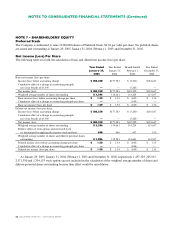

Share Repurchase Programs

In November 2002, the Company’s Board of Directors

authorized the repurchase of up to $200,000 of the

Company’s common stock. Stock repurchases were to be

made until November 2005 either in the open market or

through privately negotiated transactions. During fiscal

2004, the Company repurchased 1,809,953 shares for

approximately $48,611.

In March 2005, the Company’s Board of Directors

authorized the repurchase of up to $300,000 of the

Company’s common stock during the next three years.

The previous November 2002 authorization was

concurrently terminated. As of the termination date,

the Company had repurchased 5,065,495 shares for

approximately $141,965 under the November 2002

authorization. As of April 13, 2005, the Company had

repurchased 2,048,900 shares for approximately $55,596

under the March 2005 authorization.

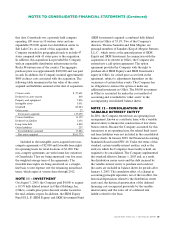

NOTE 8 – EMPLOYEE BENEFIT PLANS

Profit Sharing and 401(k) Retirement Plan

The Company maintains a defined contribution profit

sharing and 401(k) plan which is available to all employees

over 21 years of age who have completed one year of

service in which they have worked at least 1,000 hours.

Eligible employees may make elective salary deferrals.

The Company may make contributions at its discretion.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)