Dollar Tree 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 33

to write down certain assets. No charges were recorded in

the month ended February 1, 2003 or the year ended

December 31, 2002. These charges are recorded as a

component of “selling, general and administrative expenses”

in the accompanying consolidated statements of operations.

Intangible Assets

Goodwill and intangible assets with indefinite useful lives

are not amortized, but rather tested for impairment at

least annually. Intangible assets with definite useful lives

are amortized over their respective estimated useful lives

and reviewed for impairment in accordance with SFAS

No. 144. The Company performs its annual assessment

of impairment following the finalization of each

November’s financial statements.

Financial Instruments

The Company utilizes derivative financial instruments

to reduce its exposure to market risks from changes in

interest rates. By entering into receive-variable, pay-fixed

interest rate swaps, the Company limits its exposure to

changes in variable interest rates. The Company is exposed

to credit related losses in the event of non-performance

by the counterparty to the interest rate swaps; however,

the counterparties are major financial institutions, and the

risk of loss due to non-performance is considered remote.

Interest rate differentials paid or received on the swap are

recognized as adjustments to expense in the period earned

or incurred. The Company formally documents all

hedging relationships, if applicable, and assesses hedge

effectiveness both at inception and on an ongoing basis.

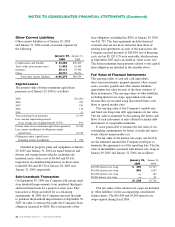

As of January 29, 2005, one of the Company’s

interest rate swaps does not qualify for hedge accounting

treatment pursuant to the provisions of SFAS No. 133,

Accounting for Derivative Instruments and Hedging

Activities. As a result, this interest rate swap is recorded

at its fair value in the consolidated balance sheets as a

component of “other liabilities”(see Note 6). During

fiscal 2004, two additional interest rate swaps that did not

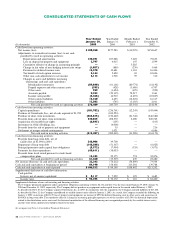

qualify for hedge accounting expired. Changes in the fair

values of these three interest rate swaps are recorded as

“change in the fair value of non-hedging interest rate

swaps”in the accompanying consolidated statements of

cash flows and the consolidated statements of operations.

The Company is party to one interest rate swap that

qualifies for hedge accounting treatment pursuant to the

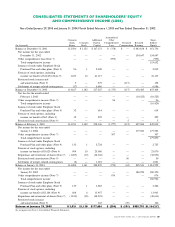

provisions of SFAS No. 133. Accordingly, the liability is

recorded at fair value in the accompanying consolidated

balance sheets and changes in the fair value are recorded

as a component of “accumulated other comprehensive

loss.”These amounts are subsequently reclassified into

earnings as a yield adjustment in the period in which

the related interest on the variable-rate obligations affects

earnings. If the swap is terminated prior to its expiration

date, the amount recorded in accumulated other compre-

hensive loss will be recorded as a yield adjustment over

the term of the forecasted transaction.

Revenue Recognition

The Company recognizes sales revenue at the time a sale

is made to its customer.

Cost of Sales

The Company includes the cost of merchandise,

warehousing and distribution costs, and certain

occupancy costs in cost of sales.

Pre-Opening Costs

The Company expenses pre-opening costs for new,

expanded and relocated stores, as incurred.

Advertising Costs

The Company expenses advertising costs as they are

incurred. Advertising costs approximated $11,042 and

$5,681 for the years ended January 29, 2005 and January

31, 2004, respectively, and $789 in the month ended

February 1, 2003. The Company did not incur significant

advertising costs in the year ended December 31, 2002.

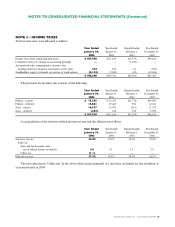

Income Taxes

Income taxes are accounted for under the asset and

liability method. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to

differences between financial statement carrying amounts

of existing assets and liabilities and their respective tax

bases. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences

are expected to be recovered or settled. The effect on

deferred tax assets and liabilities of a change in tax rates

is recognized in income in the period that includes the

enactment date of such change.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)