Dollar Tree 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

programs from internally generated funds and seasonal

borrowings under our credit facilities.

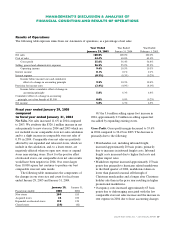

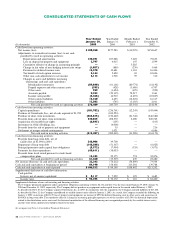

The following table compares cash-related

information for the years ended January 29, 2005, and

January 31, 2004:

Year Ended Year Ended

January 29, January 31,

(In millions) 2005 2004

Net cash provided by (used in):

Operating activities $276.5 $243.7

Investing activities (315.4) (282.4)

Financing activities 61.3 (35.5)

The $32.8 million increase in cash provided by

operating activities in 2004 was primarily due to

increased profitability before non-cash depreciation and

amortization expense. Increased non-cash depreciation

expense was primarily attributed to our square footage

growth in 2004, two new distribution centers in the

current year and our continued installation of our

point-of-sale systems and other technology assets.

Cash used in investing activities is generally

expended to open new stores and to expand or relocate

existing stores. The $33.0 million increase in 2004

compared to 2003 was primarily due to the following:

• increased investment of cash from borrowings under

our Facility in the current year;

• this increase was partially offset by the acquisition

of Greenbacks for approximately $100.5 million

in 2003; and

• decreased capital expenditures due to higher

expenditures in the prior year on our distribution

center projects that were completed in the first

half of 2004.

The $96.8 million change in cash provided by

financing activities in 2004 compared to 2003 was

primarily the result of the following:

• increased borrowings under our Facility, net of

the repayment of our variable rate debt for our

distribution centers;

• partially offsetting this increase in cash is a $10.6

million increase in stock repurchases in the current

year under a $200.0 million authorization granted by

our Board of Directors in November 2002 and $7.1

million decrease in cash proceeds from stock issued

under stock-based compensation plans.

In March 2004, we entered into a five-year $450.0

million Revolving Credit Facility. This facility bears

interest at LIBOR, plus 0.475% spread. We used

availability under this facility to repay $142.6 million

of variable rate debt related to our variable interest

entity and to invest in certain short-term securities. As

of January 29, 2005, we had $200.0 million available

under this facility.

At January 29, 2005, our long-term borrowings

were $269.0 million and our capital lease commitments

were $12.7 million. We also have a $125.0 million Letter

of Credit Reimbursement and Security Agreement,

under which approximately $88.9 million was committed

to letters of credit issued for routine purchases of

imported merchandise.

In March 2005, our Board of Directors authorized

the repurchase of up to $300.0 million of our common

stock during the next three years. This new authorization

terminated the previous November 2002 authorization.

As of the termination date, we had repurchased 5,065,495

shares for approximately $142.0 million under the

November 2002 authorization. As of April 13, 2005,

we had repurchased 2,048,900 shares for approximately

$55.6 million under the March 2005 authorization.

Funding Requirements

Overview

In 2004, the average investment per new store, including

capital expenditures, initial inventory and pre-opening

costs, was approximately $469,000. We expect our cash

needs for opening new stores and expanding existing

stores in fiscal 2005 to total approximately $138.6

million, which includes capital expenditures and initial

inventory and pre-opening costs. Our estimated capital

expenditures for fiscal 2005 are between $125.0 and

$140.0 million, including planned expenditures for new

and expanded stores and investments in technology. We

believe that we can adequately fund our working capital

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS