Dollar Tree 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 31

NOTE 1 – SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Description of Business

At January 29, 2005, Dollar Tree Stores, Inc. (DTS or

the Company) owned and operated 2,735 discount

variety retail stores that sell substantially all items for

$1.00 or less. The Company’s stores operate under the

names of Dollar Tree, Dollar Bills, Dollar Express, Only

One Dollar, and Only $One. Our stores average

approximately 7,475 selling square feet.

The Company’s headquarters and one of its

distribution centers are located in Chesapeake, Virginia.

The Company also operates distribution centers in

Mississippi, Illinois, California, Pennsylvania, Georgia,

Oklahoma, Utah, and Washington. The Company’s

stores are located in all 48 contiguous states. The

Company’s merchandise includes candy, food,

housewares, health and beauty care, seasonal goods, party

goods, toys, stationery, gifts, and other consumer items.

Approximately 40% of the Company’s merchandise is

imported, primarily from China.

Principles of Consolidation

The consolidated financial statements include the

financial statements of Dollar Tree Stores, Inc., and

its wholly owned subsidiaries. All significant

intercompany balances and transactions have been

eliminated in consolidation.

Fiscal Year

The Company’s fiscal year was a calendar year in 2002.

The Company changed its fiscal year end from

December 31 to the Saturday closest to January 31,

effective for the fiscal year beginning February 2, 2003

and ending January 31, 2004. The one-month period of

January 1, 2003 through February 1, 2003 (the Transition

Period) is presented separately in these consolidated

financial statements. Unless specifically indicated

otherwise, any reference herein to “2004” or “Fiscal 2004”

and “2003”or “Fiscal 2003”relates to as of or for the

years ended January 29, 2005 and January 31, 2004,

respectively. Any references to “2002” or “Fiscal 2002”

relate to as of or for the year ended December 31, 2002.

Use of Estimates

The preparation of financial statements in conformity

with accounting principles generally accepted in the

United States of America requires management to make

estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of the

consolidated financial statements and the reported

amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

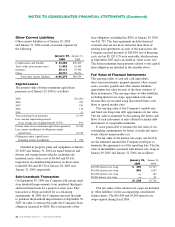

Lease Accounting

The Company recognized a one-time non-cash, after-tax

adjustment of $5,751, or $0.05 per diluted share, in the

fourth quarter of 2004 to reflect the cumulative impact of

a correction of its accounting practices related to leased

properties. Of the aforementioned amount, approximately

$1,230 million, or $0.01 per diluted share, relates to the

current year. Consistent with industry practices, in prior

periods, the Company had reported its straight line

expenses for leases beginning on the earlier of the store

opening date or the commencement date of the lease.

This had the effect of excluding the pre-opening or

build-out period of its stores (generally 60 days) from

the calculation of the period over which it expenses rent.

In addition, amounts received as tenant allowances were

reflected in the balance sheet as a reduction to store

leasehold improvement costs instead of being classified

as deferred lease credits. The adjustment made to correct

these practices does not affect historical or future net cash

flows or the timing of payments under related leases.

Rather, this change affected the classification of costs on

the statement of operations and cash flows by increasing

depreciation and decreasing rent expense, which is

included in cost of sales. In addition, fixed assets and

deferred liabilities increased due to the net cumulative

unamortized allowances and abatements.

Reclassifications

Certain 2003 and 2002 amounts have been reclassified

for comparability with the current period presentation,

including the reclasses noted in the lease accounting

discussion above.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except number of stores, share and per share data)