Dollar Tree 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 19

in our larger, newer stores, particularly the stores over

10,000 square feet, have been stronger than those in our

smaller, older stores.

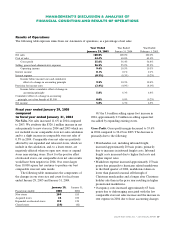

The following table summarizes the components of

the changes in our store size and count for fiscal years

ended January 31, 2004 and February 1, 2003.

January 31, February 1,

Fiscal years ended 2004 2003

New stores 183 314

Acquired stores 100 —

Expanded or relocated stores 124 110

Closed stores (42) (36)

Of the 3.6 million selling square foot increase in

2003, approximately 0.9 million selling square feet was

added by expanding existing stores.

Gross Profit. Gross profit margin was 36.4% in 2003 and

2002. While gross profit margin remained consistent year

to year, the changes in the components of gross margin

are detailed below:

• Markdown expense decreased approximately 20 basis

points due to better seasonal sell-through, use of

point-of-sale data to better manage the buying process

and better allocated merchandise across store classes;

• Offsetting the markdown improvement was a 20

basis point increase in occupancy costs. This increase

was the result of two fewer selling days in 2003

compared to 2002 and increased occupancy rates in

our smaller stores which generally experience lower

comparable store net sales;

• In addition, during 2003, gross profit margin was

affected by approximately $3.8 million of additional

non-cash depreciation expense in cost of sales

associated with the adoption of Financial Accounting

Standards Board Interpretation No. 46, Consolidation

of Variable Interest Entities. By adopting FIN 46, four

of our distribution centers, previously accounted for

as operating leases, were consolidated in our financial

statements effective January 1, 2003.

Selling, General and Administrative Expenses. Selling,

general and administrative expenses, as a percentage of

net sales, remained unchanged at 25.9% in 2003; the

changes in the components of selling, general and

administrative expenses are detailed below:

• Depreciation expense increased approximately 50

basis points due to our larger new and expanded

stores and the continued installation of our new

point-of-sale systems and other technology assets.

• This increase was partially offset by a decrease of

approximately 40 basis points in payroll-related and

store operating expenses. Continued improvements

in store-level labor productivity and store supply

expenses were the primary drivers of our lower

payroll-related and store operating expenses, as a

percentage of net sales.

Operating Income. Due to the reasons discussed above,

operating income margin was consistent at 10.5% for

2003 and 2002.

Interest Income and Expense. Interest income, as a

percentage of net sales, was consistent at 0.1% in

2003 and 2002. Interest expense increased $3.6 million

primarily due to the consolidation of our variable-interest

entity effective January 1, 2003.

Income Taxes. Our effective tax rate was 38.5% in

2003 and 2002.

Liquidity and Capital Resources

Our business requires capital to build and open new

stores, expand our distribution network and operate

existing stores. Our working capital requirements for

existing stores are seasonal and usually reach their peak

in September and October. Historically, we have satisfied

our seasonal working capital requirements for existing

stores and have funded our store opening and expansion

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS