Dollar Tree 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

noted in the “Overview.”

• Partially offsetting these increases was an

approximate 20 basis point decrease in shrink expense

due to the overall improvement in the shrink rate in

the current year.

Selling, General and Administrative Expenses. Selling,

general and administrative expenses, as a percentage of

net sales, increased to 26.2% in 2004 compared to 25.9%

in 2003. The increase is primarily due to the following:

• Depreciation expense increased approximately

30 basis points as a result of our larger new and

expanded stores and the continued installation of our

point-of-sales systems and other technology assets.

• Advertising costs increased approximately 15 basis

points due to increased electronic media and print

advertising in certain markets in the current year.

• Insurance and benefits expense increased

approximately 10 basis points due to increased

healthcare and workers’compensation expenses

in the current year.

• Partially offsetting these rate increases was an

approximate 15 basis point decrease in store payroll

costs in the current year due to continued

improvements in store-level labor productivity.

Operating Income. Due to the reasons discussed above,

operating income margin decreased to 9.4% in 2004

compared to 10.5% for 2003.

Interest Expense. Interest expense increased $1.9 million

in 2004 as compared to 2003. This increase is due to

increased debt in the current year and $0.7 million of

deferred financing costs that were charged to interest

expense as a result of the refinancing of the $150.0

million credit facility and the repayment of the $142.6

million of variable rate debt in March 2004.

Income Taxes. Our effective tax rate was 37.5% in 2004

compared to 38.5% in 2003. The decreased tax rate for

2004 was due primarily to a one-time tax benefit of $2.3

million, or 80 basis points, related to the resolution of a

tax uncertainty and approximately $0.6 million, or 20 basis

points, related to tax exempt interest on our investments.

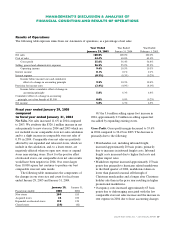

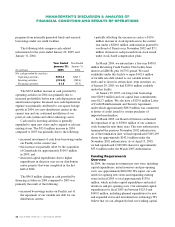

Fiscal year ended January 31, 2004

compared

to fiscal year ended February 1, 2003

The following table is presented to compare statements of

operations amounts for the fiscal year ended January 31,

2004 to the fiscal year ended February 1, 2003. Amounts

for the fiscal year ended February 1, 2003 are not

included in the Consolidated Statements of Operations

on page 27.

Year Ended Year Ended

January 31, February 1,

(In thousands) 2004 2003

Net sales $2,799,872 $2,357,836

Cost of sales 1,781,459 1,499,594

Gross profit 1,018,413 858,242

Selling, general and

administrative expenses 724,816 610,854

Operating income 293,597 247,388

Interest income 2,648 3,445

Interest expense (8,382) (4,812)

Changes in fair value of non-

hedging interest rate swaps 889 (1,297)

Income before income

taxes and cumulative

effect of a change in

accounting principle 288,752 244,724

Provision for income taxes 111,169 94,220

Income before cumulative

effect of a change in

accounting principle 177,583 150,504

Cumulative effect of a change

in accounting principle,

net of tax benefit —(5,285)

Net income $ 177,583 $ 145,219

Net Sales. Net sales increased 18.7% in 2003 compared

to 2002. We attribute this $442.0 million increase in net

sales primarily to new stores in 2003 and 2002 which are

not included in our comparable store net sales calculation

and to a comparable store net sales increase of 2.9% in

2003. Comparable store net sales are positively affected

by our expanded and relocated stores, which we include

in the calculation, and, to a lesser extent, are negatively

affected when we open new stores or expand stores near

existing stores. Our comparable store net sales increase

was due to our expanded and relocated stores. Net sales

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS