Dollar Tree 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

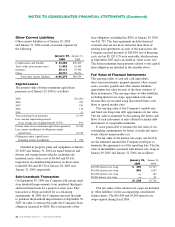

The Company was sued by Mag Instrument (Mag) for damages, including treble damages, for the sale of 850,000 to

1,000,000 flashlights. The United States District Court in California has ruled that the flashlights infringe Mag’s patent.

The Company intends to appeal this ruling. Mag also claims that the flashlights infringe its trademark. Mag Instrument’s

damage expert claims that Mag is owed at least $4.16 for each unit the Company sold, plus enhanced or treble damages

as well as its attorney’s fees. The Company believes that Mag has significantly overstated its damage estimate and that it

is not entitled to an award of treble damages or attorney’s fees.

The Company will vigorously defend itself in these lawsuits. The Company does not believe that any of these

matters will, individually or in the aggregate, have a material adverse effect on its business or financial condition. The

Company cannot give assurance, however, that one or more of these lawsuits will not have a material adverse effect on

its results of operations for the period in which they are resolved.

NOTE 5 – LONG-TERM DEBT

Long-term debt at January 29, 2005 and January 31, 2004 consists of the following:

January 29, January 31,

2005 2004

$450,000 Unsecured Revolving Credit Facility, interest payable monthly at LIBOR, plus 0.475%,

which was 3.0% at January 29, 2005, principal payable upon expiration of the facility in March 2009 $250,000 $—

Demand Revenue Bonds, interest payable monthly at a variable rate which was 2.57% at

January 29, 2005, principal payable on demand, otherwise beginning June 2006 and maturing June 2018 19,000 19,000

Variable-rate debt, interest payable monthly at LIBOR, principal payable upon maturity in March 2006,

repaid in March 2004 —142,568

7.29% unsecured Senior Notes, interest payable semiannually on April 30 and October 30,

matured April 2004 —6,000

Total long-term debt 269,000 167,568

Less: current portion 19,000 25,000

Long-term debt, excluding current portion $250,000 $142,568

Maturities of long-term debt are as follows: 2005 - $19,000 and 2009 - $250,000.

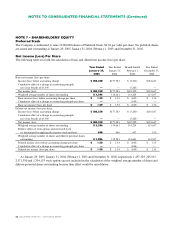

the Facility. The net debt issuance costs related to the

Old Facility and the variable-rate debt, included in

“other assets, net”on the January 31, 2004 consolidated

balance sheet totaling $727, were charged to interest

expense in 2004.

Demand Revenue Bonds

On May 20, 1998, the Company entered into a Loan

Agreement with the Mississippi Business Finance

Corporation (MBFC) under which the MBFC issued

Taxable Variable Rate Demand Revenue Bonds (the

Bonds) in an aggregate principal amount of $19,000

to finance the acquisition, construction, and installation

of land, buildings, machinery and equipment for the

Company’s distribution facility in Olive Branch,

Mississippi. The Bonds do not contain a prepayment

penalty as long as the interest rate remains variable. The

Bonds are secured by a $19,300 letter of credit issued by

Unsecured Revolving Credit Facility

In March 2004, the Company entered into a five-year

Unsecured Revolving Credit Facility (the Facility). The

Facility provides for a $450,000 revolving line of credit,

including up to $50,000 in available letters of credit,

bearing interest at LIBOR, plus 0.475%. The Facility

also bears an annual facilities fee, calculated as a

percentage, as defined, of the amount available under the

line of credit and an annual administrative fee payable

quarterly. The Facility, among other things, requires the

maintenance of certain specified financial ratios restricts

the payment of certain distributions and prohibits the

incurrence of certain new indebtedness. The Company

used availability under the Facility to repay the $142,568

of variable-rate debt and to purchase short-term, state

and local government-sponsored municipal bonds. The

Company’s $150,000 revolving credit facility (Old

Facility) was terminated concurrent with entering into

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)