Dollar Tree 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

The Company made no discretionary contributions in the

years ended January 29, 2005 and January 31, 2004, the

month ended February 1, 2003 or in the year ended

December 31, 2002.

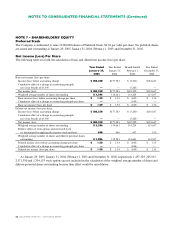

NOTE 9 – STOCK-BASED

COMPENSATION PLANS

At January 29, 2005, the Company has eight stock-based

compensation plans. Each plan and the accounting

method are described below.

Fixed Stock-Option Compensation Plans

Under the Non-Qualified Stock Option Plan (SOP), the

Company granted options to its employees for 1,047,264

shares of Common Stock in 1993 and 1,048,289 shares

in 1994. Options granted under the SOP have an exercise

price of $0.86 and are fully vested at the date of grant.

Under the 1995 Stock Incentive Plan (SIP), the

Company may grant options to its employees for up to

12,600,000 shares of Common Stock. The exercise price

of each option equals the market price of the Company’s

stock at the date of grant, unless a higher price is

established by the Board of Directors, and an option’s

maximum term is 10 years. Options granted under the

SIP generally vested over a three-year period. In

exchange for their options to purchase Dollar Express

Common Stock, certain employees of Dollar Express

were granted 228,072 options to purchase the Company’s

common stock based on an exchange ratio of 0.8772.

Options issued in connection with the merger were

fully vested as of the date of the merger. This plan

was terminated on July 1, 2003 and replaced with the

Company’s 2003 Equity Incentive Plan, discussed below.

The Step Ahead Investments, Inc. Long-Term

Incentive Plan (SAI Plan) provided for the issuance of

stock options, stock appreciation rights, phantom stock

and restricted stock awards to officers and key employees.

Effective with the merger with 98 Cent Clearance

Center and in accordance with the terms of the SAI

Plan, outstanding 98 Cent Clearance Center options

were assumed by the Company and converted, based on

1.6818 Company options for each 98 Cent Clearance

Center option, to options to purchase the Company’s

common stock. Options issued as a result of this

conversion were fully vested as of the date of the merger.

Under the 1998 Special Stock Option Plan (Special

Plan), options to purchase 247,500 shares were granted to

five former officers of 98 Cent Clearance Center who

were serving as employees or consultants of the Company

following the merger. The options were granted as

consideration for entering into non-competition

agreements and a consulting agreement. The exercise

price of each option equals the market price of the

Company’s stock at the date of grant, and the options’

maximum term is 10 years. Options granted under the

Special Plan vest over a five-year period.

The 2003 Equity Incentive Plan (EIP) replaces the

Company’s SIP discussed above. Under the EIP, the

Company may grant up to 6,000,000 shares of its

Common Stock, plus any shares available for future

awards under the SIP, to the Company’s employees,

including executive officers and independent contractors.

The EIP permits the Company to grant equity awards in

the form of stock options, stock appreciation rights and

restricted stock. The exercise price of each stock option

granted equals the market price of the Company’s stock

at the date of grant. The options generally vest over a

three-year period and have a maximum term of 10 years.

The 2004 Executive Officer Equity Plan (EOEP) is

available only to the Chief Executive Officer and certain

other executive officers. These officers no longer receive

awards under the EIP. The EOEP allows the Company

to grant the same type of equity awards as does the EIP.

These awards generally vest over a five-year period, with

a maximum term of 10 years.

Stock appreciation rights may be awarded alone or in

tandem with stock options. When the stock appreciation

rights are exercisable, the holder may surrender all or a

portion of the unexercised stock appreciation right and

receive in exchange an amount equal to the excess of

the fair market value at the date of exercise over the fair

market value at the date of the grant. No stock

appreciation rights have been granted to date.

Any restricted stock awarded is subject to certain

general restrictions. The restricted stock shares may not

be sold, transferred, pledged or disposed of until the

restrictions on the shares have lapsed or have been

removed under the provisions of the plan. In addition, if

a holder of the restricted shares ceases to be employed by

the Company, any shares in which the restrictions have

not lapsed will be forfeited.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)