Dollar Tree 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 39

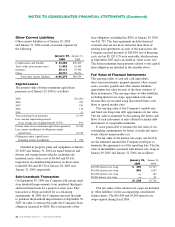

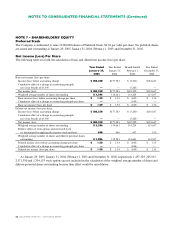

Minimum and Contingent Rentals

Rental expense for store, distribution center and former corporate headquarters operating leases (including payments to

related parties) included in the accompanying consolidated statements of operations are as follows:

Year Ended Year Ended Month Ended Year Ended

January 29, 2005 January 31, 2004 February 1, 2003 December 31, 2002

Minimum rentals $200,718 $167,127 $12,410 $138,656

Contingent rentals 899 1,229 1 1,277

Technology Assets

The Company has commitments totaling approximately

$5,831 to purchase store technology assets for its stores

during 2005.

Letters of Credit

In March 2001, the Company entered into a Letter of

Credit Reimbursement and Security Agreement. The

agreement provides $125,000 for letters of credit, which

are generally issued for the routine purchase of imported

merchandise. Approximately $88,941 of this agreement

was committed to letters of credit at January 29, 2005.

The Company also has approximately $37,735

in letters of credit that serve as collateral for its high-

deductible insurance programs and expire in fiscal 2005.

Surety Bonds

The Company has issued various surety bonds that

primarily serve as collateral for utility payments at the

Company’s stores. The total amount of the commitment

is approximately $2,275, which is committed through

various dates through 2008.

Contingencies

The Company was sued in California in 2003 by a former

employee who alleged that employees did not properly

receive sufficient meal period breaks and paid rest periods.

He also alleged other wage and hourly violations. The suit

requests that the California state court certify the case as a

class action. In 2005, the Company was threatened with a

suit by former employees in Oregon who allege that they

did not properly receive sufficient meal period breaks and

paid rest periods. They also allege other wage and hour

violations. The Company anticipates that they will request

the Oregon state court to certify the case as a class action.

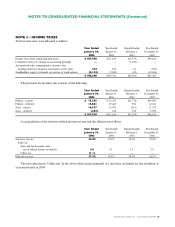

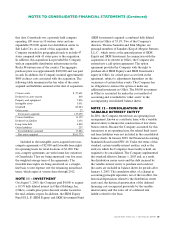

Non-Operating Facilities

The Company is responsible for payments under leases

for two former distribution center and certain closed

stores. The leases for the two distribution centers expire

in June 2005 and September 2005. The Company

accounts for abandoned lease facilities in accordance with

SFAS No. 146, Accounting for Costs Associated with Exit

or Disposal Activities. Facilities are considered abandoned

on the date that the Company ceases to use the facility.

On this date, the Company records an expense for the

present value of the total remaining costs for the

abandoned facility reduced by any actual or probable

sublease income. Due to the uncertainty regarding the

ultimate recovery of the future lease and related payments,

the Company recorded charges of $1,472, $470 and $364

in 2004, 2003 and 2002, respectively. There was no charge

recorded in the month ended February 1, 2003. The total

accrual for these vacated facilities was $1,472 and $2,171

at January 29, 2005 and January 31, 2004, respectively.

Related Parties

The Company also leases properties for six of its stores

from partnerships owned by related parties. The total

rental payments related to these leases were $484, $469,

$31 and $1,222 for the years ended January 29, 2005 and

January 31, 2004, the month ended February 1, 2003 and

the year ended December 31, 2002, respectively.

Freight Services

The Company has contracted outbound freight services

from various contract carriers with contracts expiring

through January 2007. The total amount of these

commitments is approximately $35,500, of which

approximately $25,500 is committed in 2005 and

$10,000 is committed in 2006.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)