Dollar Tree 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

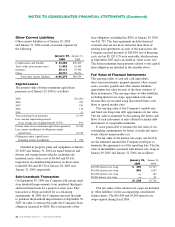

Stock-Based Compensation

The Company applies the intrinsic value-based method of accounting prescribed by Accounting Principles Board

Opinion No. 25, Accounting for Stock Issued to Employees, and related Interpretations in accounting for its fixed stock

option plans. As such, compensation expense would be recorded on the date of grant only if the current market price

of the underlying stock exceeded the exercise price. SFAS No. 123, Accounting for Stock-Based Compensation, established

accounting and disclosure requirements using a fair value-based method of accounting for stock-based employee

compensation plans. As allowed by SFAS No. 123, the Company has elected to continue to apply the intrinsic value-

based method of accounting described above, and has adopted the disclosure only requirements of SFAS No. 123.

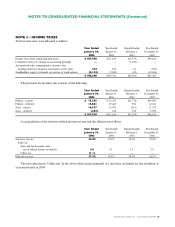

If the accounting provisions of SFAS No. 123 had been adopted, the Company’s net income (loss) and net income

(loss) per share would have been as indicated in the following table:

Year Ended Year Ended Month Ended Year Ended

January 29, January 31, February 1, December 31,

2005 2004 2003 2002

Net income (loss) as reported $ 180,250 $177,583 $(10,525) $154,647

Deduct: Total stock-based employee compensation

expense determined under fair value based method,

net of related tax effects 13,007 13,181 1,108 12,625

Net income (loss) under SFAS No. 123 $ 167,243 $164,402 $(11,633) $142,022

Net income (loss) per share:

Basic, as reported $ 1.59 $ 1.55 $ (0.09) $ 1.36

Basic, pro forma under SFAS No. 123 $ 1.48 $ 1.43 $ (0.10) $ 1.25

Diluted, as reported $ 1.58 $ 1.54 $ (0.09) $ 1.35

Diluted, pro forma under SFAS No. 123 $ 1.47 $ 1.43 $ (0.10) $ 1.24

the amounts previously recognized under SFAS No. 123

for purposes of pro forma disclosures either for all periods

presented or as of the beginning of the year of adoption.

The prospective method requires that compensation

expense be recognized beginning with the effective date,

based on the requirements of this statement, for all share-

based payments granted after the effective date, and

based on the requirements of SFAS No. 123, for all

awards granted to employees prior to the effective date of

this statement that remain unvested on the effective date.

The provisions of this statement are effective for

fiscal 2006 and the Company is currently evaluating the

requirements of this revision and has not determined the

method of adoption.

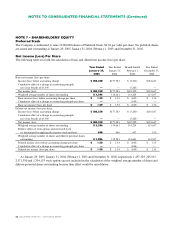

Net Income Per Share

Basic net income per share has been computed by

dividing net income by the weighted average number of

shares outstanding. Diluted net income per share reflects

the potential dilution that could occur assuming the

inclusion of dilutive potential shares and has been

These pro forma amounts for SFAS No. 123 may

not be representative of future disclosures because

compensation cost is reflected over the options’vesting

periods and because additional options may be granted

in future years.

In December 2004, the Financial Accounting

Standards Board issued SFAS No. 123 (revised 2004),

Share-Based Payment (SFAS 123R). This statement is

a revision of SFAS No. 123, Accounting for Stock-Based

Compensation, and supersedes Accounting Principles

Board Opinion No. 25. SFAS 123R requires all share-

based payments to employees, including grants of

employee stock options, to be recognized in the financial

statements based on their fair values. Under the provisions

of this statement, the Company must determine the

appropriate fair value model to be used for valuing share-

based payments, the amortization method for compensation

cost and the transition method to be used at the date of

adoption. The transition alternatives include retrospective

and prospective adoption methods. Under the retro-

spective method, prior periods may be restated based on

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)