Dollar Tree 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 29

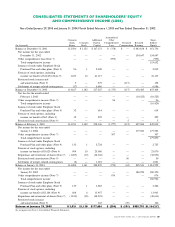

Accumulated

Common Additional Other Share-

Stock Common Paid-in Comprehensive Unearned Retained holders’

(In thousands) Shares Stock Capital Loss Compensation Earnings Equity

Balance at December 31, 2001 112,506 $ 1,125 $ 167,151 $ (378) $ — $ 483,838 $ 651,736

Net income for the year ended

December 31, 2002 — — — — — 154,647 154,647

Other comprehensive loss (Note 7) — — — (995) — — (995)

Total comprehensive income 153,652

Issuance of stock under Employee Stock

Purchase Plan and other plans (Note 9) 96 1 2,038 — — — 2,039

Exercise of stock options, including

income tax benefit of $10,696 (Note 9) 1,633 16 41,117 — — — 41,133

Restricted stock issuance and

and amortization (Note 9) 9 — 275 — (117) — 158

Settlement of merger-related contingencies (57) — 6,686 — — — 6,686

Balance at December 31, 2002 114,187 1,142 217,267 (1,373) (117) 638,485 855,404

Net loss for the month ended

February 1, 2003 — — — — — (10,525) (10,525)

Other comprehensive income (Note 7) — — — 96 — — 96

Total comprehensive income (10,429)

Issuance of stock under Employee Stock

Purchase Plan and other plans (Note 9) 32 — 614 — — — 614

Exercise of stock options, including

income tax benefit of $65 (Note 9) 12 — 225 — — — 225

Restricted stock amortization (Note 9) — — — — 5 — 5

Balance at February 1, 2003 114,231 1,142 218,106 (1,277) (112) 627,960 845,819

Net income for the year ended

January 31, 2004 — — — — — 177,583 177,583

Other comprehensive income (Note 7) — — — 307 — — 307

Total comprehensive income 177,890

Issuance of stock under Employee Stock

Purchase Plan and other plans (Note 9) 132 1 2,724 — — — 2,725

Exercise of stock options, including

income tax benefit of $5,620 (Note 9) 994 10 25,060 — — — 25,070

Repurchase and retirement of shares (Note 7) (1,265) (12) (38,041) — — — (38,053)

Restricted stock amortization (Note 9) — — — — 50 — 50

Settlement of merger-related contingencies (8) — 1,021 — — — 1,021

Balance at January 31, 2004 114,084 1,141 208,870 (970) (62) 805,543 1,014,522

Net income for the year ended

January 29, 2005 — — — — — 180,250 180,250

Other comprehensive income (Note 7) — — — 676 — — 676

Total comprehensive income 180,926

Issuance of stock under Employee Stock

Purchase Plan and other plans (Note 9) 139 1 3,285 — — — 3,286

Exercise of stock options, including

income tax benefit of $2,144 (Note 9) 608 6 13,957 — — — 13,963

Repurchase and retirement of shares (Note 7) (1,810) (18) (48,593) — — — (48,611)

Restricted stock issuance

and amortization (Note 9) — — 165 — (39) — 126

Balance at January 29, 2005 113,021 $1,130 $177,684 $ (294) $ (101) $985,793 $1,164,212

See accompanying Notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME (LOSS)

Years Ended January 29, 2005 and January 31, 2004, Month Ended February 1, 2003 and Year Ended December 31, 2002