Dollar Tree 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 37

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

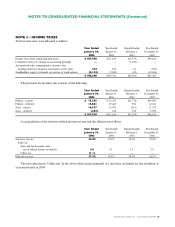

NOTE 3 – INCOME TAXES

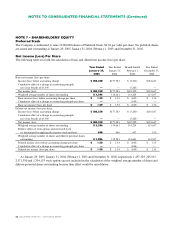

Total income taxes were allocated as follows:

Year Ended Year Ended Month Ended Year Ended

January 29, January 31, February 1, December 31,

2005 2004 2003 2002

Income (loss) from continuing operations $ 107,920 $111,169 $(3,279) $96,812

Cumulative effect of a change in accounting principle —— (3,309) —

Accumulated other comprehensive (income) loss,

marking derivative financial instruments to fair value 424 192 61 (633)

Stockholders’equity, tax benefit on exercise of stock options (2,144) (5,620) (65) (10,696)

$ 106,200 $105,741 $(6,592) $85,483

The provision for income taxes consists of the following:

Year Ended Year Ended Month Ended Year Ended

January 29, January 31, February 1, December 31,

2005 2004 2003 2002

Federal - current $ 75,785 $ 76,017 $(3,778) $69,003

Federal - deferred 15,861 19,465 956 14,141

State - current 16,557 15,471 (611) 11,373

State - deferred (283) 216 154 2,295

$ 107,920 $111,169 $(3,279) $96,812

A reconciliation of the statutory federal income tax rate and the effective rate follows:

Year Ended Year Ended Month Ended Year Ended

January 29, January 31, February 1, December 31,

2005 2004 2003 2002

Statutory tax rate 35.0% 35.0% 35.0% 35.0%

Effect of:

State and local income taxes,

net of federal income tax benefit 3.6 3.5 3.5 3.5

Other, net (1.1) — — —

Effective tax rate 37.5% 38.5% 38.5% 38.5%

The rate reduction in “Other, net”in the above table consists primarily of a one-time tax benefit for the resolution of

a tax uncertainty in 2004.