Dollar Tree 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

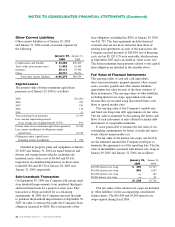

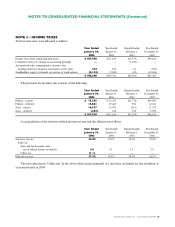

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets and liabilities

are classified on the accompanying consolidated balance sheets based on the classification of the underlying asset or

liability. Significant components of the Company’s net deferred tax assets (liabilities) follows:

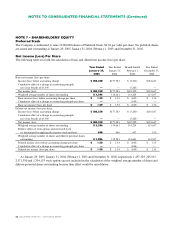

Year Ended Year Ended

January 29, January 31,

2005 2004

Deferred tax assets:

Accrued expenses and other liabilities principally due to

differences in the timing of deductions for reserves $ 14,744 $ 16,836

Other 169 1,092

Total deferred tax assets 14,913 17,928

Deferred tax liabilities:

Intangible assets due to differences in amortization methods and lives (6,963) (6,169)

Deferred compensation primarily due to timing of contributions to the profit sharing plan (855) (1,087)

Property and equipment due to difference in depreciation and amortization methods and lives (39,435) (27,864)

Other (1,663) (809)

Total deferred tax liabilities (48,916) (35,929)

Net deferred tax liability $ (34,003) $(18,001)

In assessing the realizability of deferred tax assets, management considers whether it is more likely than not that

some portion or all of the deferred taxes will not be realized. Based upon the availability of carrybacks of future

deductible amounts to the past two years’taxable income and management’s projections for future taxable income over

the periods in which the deferred tax assets are deductible, management believes it is more likely than not the existing

deductible temporary differences will reverse during periods in which carrybacks are available or in which the Company

generates net taxable income. However, there can be no assurance that the Company will generate any income or any

specific level of continuing income in future years.

The above future minimum lease payments include

amounts for leases that were signed prior to January 29,

2005 for stores that were not open as of January 29, 2005.

Minimum rental payments for operating leases do not

include contingent rentals that may be paid under certain

store leases based on a percentage of sales in excess of

stipulated amounts. Future minimum lease payments have

not been reduced by expected future minimum sublease

rentals of $1,239 under operating leases.

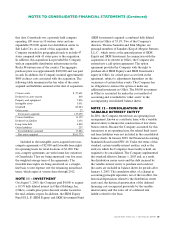

NOTE 4 – COMMITMENTS AND

CONTINGENCIES

Operating Lease Commitments

Future minimum lease payments under noncancelable

store, distribution center and former corporate head-

quarters operating leases (including leases with related

parties) are as follows:

2005 $216,874

2006 188,638

2007 156,280

2008 119,189

2009 83,555

Thereafter 150,413

Total minimum lease payments $914,949

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)