Dollar Tree 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 15

Key Events and Recent Developments

Several key events have had or are expected to have a

significant effect on our results of operations. You should

keep in mind that:

• In March 2005, our Board of Directors authorized

the repurchase of up to $300 million of our common

stock during the next three years. This authorization

superseded the previous repurchase program

authorized by the Board in November 2002.

• In 2004, we completed construction and began

operations in two new distribution centers. In June

2004, we began operations in our new distribution

center in Joliet, Illinois. The Joliet distribution center

is a 1.2 million square foot, fully automated facility

that replaced our Chicago distribution center. In

February 2004, we began operations in our Ridgefield,

Washington distribution center. The Ridgefield

distribution center is a 665,000 square foot facility

that can be expanded to accommodate future growth

needs. With the completion of these two distribution

centers, we now have nine distribution centers that

will support approximately $4.5 billion in sales

annually. We do not plan to expand our distribution

center capacity until at least fiscal 2006.

• In March 2004, we entered into a five-year $450.0

million Unsecured Revolving Credit Facility

(Facility). We used availability under this Facility to

repay the $142.6 million of variable rate debt related

to our variable interest entity. This Facility also

replaced our $150.0 million revolving credit facility.

• In June 2003, we completed our acquisition of

Greenbacks, Inc., based in Salt Lake City, Utah.

Greenbacks operated 100 stores in 10 western states

and an expandable 252,000 square foot distribution

center in Salt Lake City. We accounted for this

acquisition under the purchase method of accounting

and as a result, Greenbacks is included in our results

since the date of acquisition, which was June 29, 2003.

• In January 2003, we changed our fiscal year from

a calendar year to a retail fiscal year ending on the

Saturday closest to January 31. Our first fiscal

year reported is fiscal 2003. Fiscal 2003 is the

period beginning February 2, 2003 and ending

January 31, 2004.

Overview

Our net sales are derived from the sale of merchandise.

Two major factors tend to affect our net sales trends. First

is our success at opening new stores or adding new stores

through mergers or acquisitions. Second, sales vary at our

existing stores from one year to the next. We refer to this

change as a change in comparable store net sales, because

we compare only those stores that are open throughout

both of the periods being compared. We include sales

from stores expanded during the year in the calculation

of comparable store net sales, which has the effect of

increasing our comparable store net sales. The term

‘expanded’also includes stores that are relocated.

In fiscal 2004, we increased our selling square footage

by approximately 21%. Of this 3.6 million selling square

foot increase, approximately 0.9 million was added by

expanding existing stores. While we met our square

footage growth target in 2004, many of these stores opened

later than planned during the year, resulting in lower

overall sales than planned. Our net comparable store net

sales increase for fiscal 2004 was 0.5%, which was lower

than planned. If not for the positive effect of relocated

stores, our comparable store net sales results would have

been negative. In 2005, we will focus on reengineering our

real estate process, which includes timely opening of new

stores and relocated stores and have therefore planned for

square footage growth of 14%-16%.

Most retailers have the ability to increase their

merchandise prices or alter the mix of their merchandise

to favor higher-priced items in order to increase their

comparable store net sales. As a fixed-price point retailer,

we do not have the ability to raise our prices. Generally,

our comparable store net sales will increase only if we

sell more units per transaction or experience an increase

in transactions.

We expect the substantial majority of our future

net sales growth to come from square footage growth

resulting from new store openings and expansion of

existing stores. We expect the average size of new stores

opened in fiscal 2005 to be approximately 10,000 selling

square feet per store (or about 12,500 gross square feet).

We believe this size allows us to achieve our objectives in

the markets in which we plan to expand. Larger stores

take longer to negotiate, build out and open and generally

have lower net sales per square foot than our smaller stores.

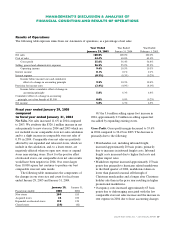

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS