Dollar Tree 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

• Our profitability is vulnerable to future increases in

operating and merchandise costs including shipping

rates, freight costs, fuel costs, wage levels, inflation,

competition and other adverse economic factors

because we sell goods at the fixed $1.00 price point.

• Our merchandise mix relies heavily on imported

goods. An increase in the cost of these goods, for

example because of inflation in their country of origin

or currency revaluations, or disruption in the flow of

these goods may significantly decrease our sales and

profits because any transition to alternative sources

may not occur in time to meet our demands. In

addition, products and alternative sources may also

be of lesser quality or more expensive than those we

currently import.

• Our sales may be below expectations during the

Christmas and Easter selling seasons, which may

cause our operating results to suffer materially.

• The performance of our distribution system is critical

to our operations. Unforeseen disruptions or costs in

our receiving and distribution systems could harm our

sales and profitability.

• Disruptions in the availability of quality, low-cost

merchandise in sufficient quantities to maintain our

growth may reduce sales and profits.

Our forward-looking statements could be wrong

in light of these and other risks, uncertainties and

assumptions. The future events, developments or results

described in this report could turn out to be materially

different. We have no obligation to publicly update or

revise our forward-looking statements after the date of

this annual report and you should not expect us to do so.

Investors should also be aware that while we do, from

time to time, communicate with securities analysts and

others, we do not, by policy, selectively disclose to them

any material nonpublic information or other confidential

commercial information. Accordingly, shareholders

should not assume that we agree with any statement or

report issued by any securities analyst regardless of the

content of the statement or report. We generally do not

issue financial forecasts or projections and we do not, by

policy, confirm those issued by others. Thus, to the extent

that reports issued by securities analysts contain any

projections, forecasts or opinions, such reports are not

our responsibility.

INTRODUCTORY NOTE: Unless otherwise stated, references to

“we,”“our”and “Dollar Tree”generally refer to Dollar Tree

Stores, Inc. and its direct and indirect subsidiaries on a

consolidated basis. Unless specifically indicated otherwise, any

references to “2005”or “fiscal 2005,”“2004”or “fiscal 2004,”

and “2003”or “fiscal 2003”relate to as of or for the years

ended January 28, 2006, January 29, 2005 and January 31,

2004, respectively. Any reference to “2002”or “fiscal 2002”

relates to as of or for the year ended December 31, 2002.

Available Information

Our annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and

amendments to those reports filed or furnished pursuant

to Section 13(a) or 15(d) of the Securities Exchange

Act are available free of charge on our website at

www.dollartree.com as soon as reasonably practicable

after electronic filing of such reports with the SEC.

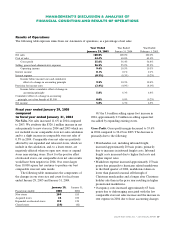

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

In Management’s Discussion and Analysis, we explain

the general financial condition and the results of

operations for our company, including:

• what factors affect our business;

• what our earnings and costs were in 2004 and 2003;

• why those earnings and costs were different from

the year before;

• how all of this affects our overall financial condition;

• what our expenditures for capital projects were in

2004 and what we expect them to be in 2005; and

• where funds will come from to pay for future

expenditures.

As you read Management’s Discussion and Analysis,

please refer to our consolidated financial statements,

included in Item 8 of this Form 10-K, which present the

results of operations for the fiscal years ended January 29,

2005 and January 31, 2004, the one-month period ended

February 1, 2003, and the calendar year ended December

31, 2002. In Management’s Discussion and Analysis, we

analyze and explain the annual changes in some specific

line items in the consolidated financial statements for

the fiscal year 2004 compared to the comparable fiscal

year 2003 and the fiscal year 2003 compared to the

fiscal year 2002.

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS