Dollar Tree 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 13

A WARNING ABOUT FORWARD

LOOKING STATEMENTS:

This document contains “forward-looking statements”

as that term is used in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements address

future events, developments and results. They include

statements preceded by, followed by or including words

such as “believe,”“anticipate,”“expect,”“intend,”“plan,”

“view,”“target”or “estimate.”For example, our forward-

looking statements include statements regarding:

• our anticipated sales, including comparable store

net sales, net sales growth and earnings growth;

• our growth plans, including our plans to add, expand

or relocate stores, our anticipated square footage

increase, and our ability to renew leases at existing

store locations;

• the average size of our stores to be added in

2005 and beyond;

• the net sales per square foot, net sales and operating

income attributable to smaller and larger stores and

store-level cash payback periods;

• the anticipated effect on 2005 earnings related to

the lease accounting changes;

• the possible effect of inflation and other economic

changes on our costs and profitability, including the

possible effect of future changes in shipping rates,

domestic and foreign freight costs, fuel costs,

minimum wage rates and wage and benefit costs;

• our cash needs, including our ability to fund

our future capital expenditures and working

capital requirements;

• our gross profit margin, earnings, inventory

levels and ability to leverage selling, general and

administrative costs;

• our seasonal sales patterns including those relating

to the length of the holiday selling seasons;

• changes in our merchandise mix and the effect on

gross profit margin and sales;

• the capabilities of our inventory supply chain

technology, planned labor management system and

other new systems;

• the future reliability of, and cost associated with, our

sources of supply, particularly imported goods such as

those sourced from China;

• the capacity, performance and cost of our existing and

planned distribution centers, including opening and

expansion schedules;

• our expectations regarding competition and growth

in our retail sector;

• costs of pending and possible future legal claims;

• management’s estimates associated with our critical

accounting policies, including inventory valuation,

accrued expenses, and income taxes;

• the adequacy of our internal controls over

financial reporting;

• the possible effect on our financial results of changes

in generally accepted accounting principles relating

to accounting for stock-based compensation.

You should assume that the information appearing

in this annual report is accurate only as of the date it

was issued. Our business, financial condition, results

of operations and prospects may have changed since

that date.

For a discussion of the risks, uncertainties and

assumptions that could affect our future events,

developments or results, you should carefully review the

risk factors described below, as well as “Management’s

Discussion and Analysis of Financial Condition and

Results of Operations”beginning on page 14. Our risk

factors include:

• Failure to meet our goals for opening or expanding

stores on a timely basis could cause our sales to suffer.

We may not anticipate all the challenges that

expanding our operations will impose and, as a result,

we may not meet our targets for opening new stores

and expanding profitably. In addition, new stores or

expanded stores may cause sales at nearby stores to

suffer, and we could have difficulties profitably

renewing or replacing expiring leases.

• Adverse economic conditions, such as reduced

spending due to lack of consumer confidence,

inflation, gasoline prices or other factors, or bad

weather could significantly reduce our sales. The

outbreak of war and other national and international

events, such as terrorism, could lead to disruptions in

our supply chain or the economy.

• The resolution of certain legal matters discussed in

Part I, Item 3, of this Form 10-K, could have

a material adverse effect on our results of operations,

accrued liabilities and cash.

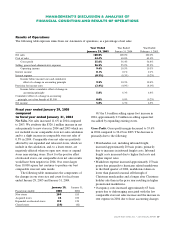

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS