Dollar Tree 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 17

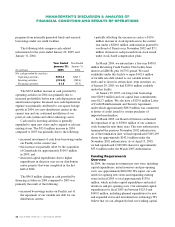

MANAGEMENT’S DISCUSSION & ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Results of Operations

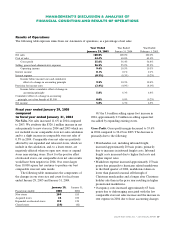

The following table expresses items from our statements of operations, as a percentage of net sales:

Year Ended Year Ended Year Ended

January 29, 2005 January 31, 2004 February 1, 2003

Net sales 100.0% 100.0% 100.0%

Cost of sales 64.4% 63.6% 63.6%

Gross profit 35.6% 36.4% 36.4%

Selling, general and administrative expenses 26.2% 25.9% 25.9%

Operating income 9.4% 10.5% 10.5%

Interest income 0.1% 0.1% 0.1%

Interest expense (0.3%) (0.3%) (0.2%)

Income before income taxes and cumulative

effect of a change in accounting principle 9.2% 10.3% 10.4%

Provision for income taxes (3.4%) (4.0%) (4.0%)

Income before cumulative effect of change in

accounting principle 5.8% 6.3% 6.4%

Cumulative effect of a change in accounting

principle, net of tax benefit of $3,309 0.0% 0.0% (0.2%)

Net income 5.8% 6.3% 6.2%

Fiscal year ended January 29, 2005

compared

to fiscal year ended January 31, 2004

Net Sales. Net sales increased 11.6% in 2004 compared

to 2003. We attribute this $326.1 million increase in net

sales primarily to new stores in 2004 and 2003 which are

not included in our comparable store net sales calculation

and to a slight increase in comparable store net sales of

0.5% in 2004. Comparable store net sales are positively

affected by our expanded and relocated stores, which we

include in the calculation, and, to a lesser extent, are

negatively affected when we open new stores or expand

stores near existing stores. If not for the positive effect

of relocated stores, our comparable store net sales results

would have been negative in 2004. Our stores larger

than 10,000 square feet continue to produce our best

comparable store net sales results.

The following table summarizes the components of

the changes in our store size and count for fiscal years

ended January 29, 2005 and January 31, 2004.

January 29, January 31,

Fiscal years ended 2005 2004

New stores 209 183

Acquired stores 42 100

Expanded or relocated stores 129 124

Closed stores (29) (42)

Of the 3.6 million selling square foot increase in

2004, approximately 0.9 million in selling square feet

was added by expanding existing stores.

Gross Profit. Gross profit margin decreased to 35.6%

in 2004 compared to 36.4% in 2003. The decrease is

primarily due to the following:

• Merchandise cost, including inbound freight,

increased approximately 20 basis points, primarily

due to increases in inbound freight costs. Inbound

freight costs increased due to higher fuel costs and

higher import rates.

• Markdown expense increased approximately 15 basis

points due primarily to hurricane related markdowns

in the third quarter of 2004, markdowns taken on

lower than planned seasonal sell through of

Christmas merchandise and a longer after Christmas

holiday sale than in the prior year resulting in higher

promotional markdowns.

• Occupancy costs increased approximately 65 basis

points due to deleveraging associated with the low

comparable store net sales increase and the increase in

rent expense in 2004 due to lease accounting changes