Dollar Tree 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

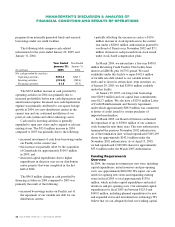

30 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

Year Ended Year Ended Month Ended Year Ended

January 29, January 31, February 1, December 31,

(In thousands) 2005 2004 2003 2002

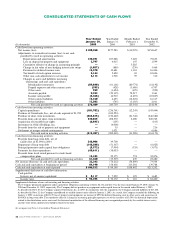

Cash flows from operating activities:

Net income (loss) $ 180,250 $177,583 $(10,525) $154,647

Adjustments to reconcile net income (loss) to net cash

provided by (used in) operating activities:

Depreciation and amortization 129,291 107,088 7,625 75,633

Loss on disposal of property and equipment 2,797 4,015 107 1,599

Cumulative effective of change in accounting principle —— 5,285 —

Change in fair value of non-hedging interest rate swaps (1,057) (889) (239) 1,469

Provision for deferred income taxes 15,578 19,681 1,110 16,436

Tax benefit of stock option exercises 2,144 5,620 65 10,696

Other non-cash adjustments to net income 2,113 1,965 59 316

Changes in assets and liabilities increasing

(decreasing) cash and cash equivalents:

Merchandise inventories (89,840) (61,166) (80,774) (61,192)

Prepaid expenses and other current assets (395) (428) (3,689) 6,707

Other assets 929 (1,424) (679) (999)

Accounts payable 9,223 (29,135) 78,217 1,361

Income taxes payable (3,366) 16,910 (4,493) (10,807)

Other current liabilities 15,320 4,655 (12,225) 16,317

Other liabilities 13,502 (745) (3,185) 2,011

Net cash provided by (used in) operating activities 276,489 243,730 (23,341) 214,194

Cash flows from investing activities:

Capital expenditures (181,782) (236,761) (12,243) (143,444)

Purchase of Greenbacks, Inc., net of cash acquired of $1,250 —(100,523) — —

Purchase of short-term investments (465,815) (150,640) (21,745) (246,580)

Proceeds from sales of short-term investments 339,035 208,570 2,000 220,765

Acquisition of favorable lease rights (6,845) (105) — (813)

Investment in Ollie’s Holdings, Inc. —(4,000) — —

Proceeds from the sale of property and equipment —35 — 216

Settlement of merger-related contingencies —1,021 — 6,686

Net cash used in investing activities (315,407) (282,403) (31,988) (163,170)

Cash flows from financing activities:

Proceeds from long-term debt, net of

facility fees of $1,094 in 2004 248,906 39,700 — —

Repayment of long-term debt (148,568) (51,367) — (6,025)

Principal payments under capital lease obligations (5,572) (7,994) (335) (3,971)

Payments for share repurchases (48,611) (38,053) — —

Proceeds from stock issued pursuant to stock-based

compensation plans 15,105 22,175 774 32,476

Net cash provided by (used in) financing activities 61,260 (35,539) 439 22,480

Net increase (decrease) in cash and cash equivalents 22,342 (74,212) (54,890) 73,504

Cash and cash equivalents at beginning of period 84,190 158,402 213,292 139,788

Cash and cash equivalents at end of period $ 106,532 $ 84,190 $158,402 $213,292

Supplemental disclosure of cash flow information:

Cash paid for:

Interest, net of amount capitalized $ 8,117 $ 7,252 $ 195 $ 3,685

Income taxes $ 93,395 $ 70,172 $ 110 $ 82,420

Supplemental disclosure of non-cash investing and financing activities:

The Company purchased equipment under capital lease obligations amounting to $484, $2,134 and $2,177 in the years ended January 29, 2005, January 31,

2004 and December 31, 2002, respectively. The Company did not purchase any equipment under capital leases in the month ended February 1, 2003.

As described in Note 10, the Company acquired Greenbacks, Inc. in 2003. In conjunction with the acquisition, the Company assumed liabilities of $17,886.

As described in Note 12, the Company consolidated its variable-interest entity effective January 1, 2003. As a result, the Company recorded the following on

January 1, 2003: an increase of $128,791 in net property and equipment; an increase of $970 for deferred financing costs in other assets; and an increase of

$140,628 in long-term debt. The cumulative effect of a change in accounting principle represents, net of the tax effect of $3,309, the historical depreciation

related to the distribution center assets and, the historical amortization of the deferred financing costs recognized previously by the variable-interest entity

and the write-off of a deferred rent liability related to the lease.

See accompanying Notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS