Dollar Tree 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT

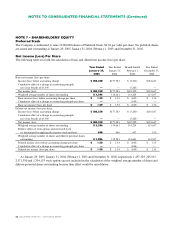

Restricted Stock

In 2002, the Company adopted a restricted stock plan,

under which a maximum of 4,500 shares of common

stock may be awarded to certain employees with no cash

payments required by the recipient. Under this plan, the

Company awarded 4,500 shares of common stock to an

employee during 2002, which vest ratably over a three-

year period. The $150 market value of the shares awarded

was recorded as unearned compensation and is shown as

a separate component of shareholders’equity. The

unearned compensation is being amortized to

compensation expense over the three-year vesting period.

In 2004, the Company awarded an employee 5,000

restricted stock units from the 2003 Equity Incentive

Plan, which vest ratably over a five-year period. The

$165 market value of the units awarded was recorded

as unearned compensation and is shown as a separate

component of shareholders’equity. The unearned

compensation is being amortized to compensation

expense over the five-year vesting period.

Total amortization for these awards for the years

ended January 29, 2005 and January 31, 2004, the one-

month period ended February 1, 2003 and the year ended

December 2002 was approximately $126, $50, $5 and

$33, respectively.

In 2002, the Company issued 4,000 shares of

restricted stock to non-employees in recognition of past

services provided to the Company. The shares vested

immediately upon issuance. The market value of the

shares awarded was approximately $125 and was recorded

as a component of operating expenses during 2002.

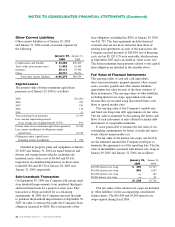

Options Outstanding Options Exercisable

Options Weighted Weighted Options Weighted

Range of Outstanding Average Average Exercisable Average

Exercise at January 29, Remaining Exercise at January 29, Exercise

Prices 2005 Contractual Life Price 2005 Price

0.86 15,923 (1) $ 0.86 15,923 $ 0.86

$2.95 to $10.98 67,208 2.2 9.43 67,208 9.43

$10.99 to $21.28 2,073,488 7.2 19.21 951,914 18.59

$21.29 to $29.79 2,951,662 7.0 24.83 1,337,427 24.27

$29.80 to $42.56 1,439,138 6.9 32.29 909,630 32.61

$0.86 to $42.56 6,547,419 3,282,102

(1) Represents options granted under the SOP in 1993 and 1994. These options have no expiration date.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Employee Stock Purchase Plan

Under the Dollar Tree Stores, Inc. Employee Stock

Purchase Plan (ESPP), the Company is authorized to

issue up to 759,375 shares of common stock to eligible

employees. Under the terms of the ESPP, employees can

choose to have up to 10% of their annual base earnings

withheld to purchase the Company’s common stock. The

purchase price of the stock is 85% of the lower of the

price at the beginning or the end of the quarterly offering

period. Under the ESPP, the Company has sold 645,097

shares as of January 29, 2005.

The fair value of the employees’purchase rights is

estimated on the date of grant using the Black-Scholes

option-pricing model with the following weighted

average assumptions:

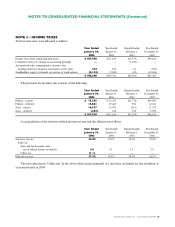

Fiscal Fiscal Fiscal

2004 2003 2002

Expected term 3 months 3 months 3 months

Expected volatility 15.6% 19.8% 28.2%

Annual dividend yield ———

Risk free interest rate 2.1% 1.1% 1.6%

The weighted average per share fair value of those

purchase rights granted in 2004, 2003 and 2002 was

$4.93, $4.60 and $5.02, respectively.

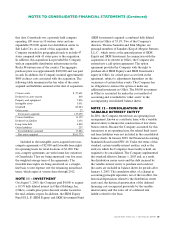

NOTE 10 – ACQUISITION

On June 29, 2003, the Company acquired 100% of the

outstanding capital stock of Greenbacks, Inc. (Greenbacks).

The results of Greenbacks’operations are included in the

accompanying consolidated financial statements since