Dollar Tree 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2004 ANNUAL REPORT 41

one of the Company’s existing lending banks. The letter of credit is renewable annually. The Letter of Credit and

Reimbursement Agreement requires, among other things, the maintenance of certain specified ratios and restricts the

payment of dividends. The Bonds contain a demand provision and, therefore, are classified as current liabilities.

Variable-Rate Debt

As indicated in Note 12, in 2001, the Company entered into an operating lease facility with a variable interest entity.

Effective with the implementation of Financial Accounting Standards Board Interpretation No. 46, Consolidation of

Variable Interest Entities (FIN 46), the Company consolidated the variable interest entity. As a result, the balance sheet at

January 31, 2004 includes the debt incurred by the variable interest entity to construct the Company’s distribution center

assets. This debt was repaid in 2004 with proceeds from the Facility.

NOTE 6 – DERIVATIVE FINANCIAL INSTRUMENTS

The fair value of interest rate swaps at January 29, 2005 and January 31, 2004, is approximately $1,548 and $3,718,

respectively, and is recorded in “other liabilities” on the accompanying consolidated balance sheets.

Non-Hedging Derivatives

At January 29, 2005, the Company was party to a derivative instrument in the form of an interest rate swap that does

not qualify for hedge accounting treatment pursuant to the provisions of SFAS No. 133 because it contains a knock-out

provision. The swap creates the economic equivalent of a fixed rate obligation by converting the variable-interest rate to a

fixed rate. Under this interest rate swap, the Company pays interest to a financial institution at a fixed rate, as defined in

the agreement. In exchange, the financial institution pays the Company at a variable-interest rate, which approximates

the floating rate on the variable-rate obligation, excluding the credit spread. The interest rate on the swap is subject to

adjustment monthly. No payments are made by either party for months in which the variable-interest rate, as calculated

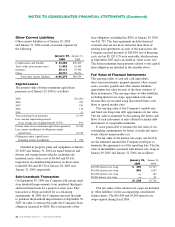

under the swap agreement, is greater than the “knock-out rate.”The following table summarizes the terms of the interest

rate swap:

Derivative Origination Expiration Pay Fixed Knock-out

Instrument Date Date Rate Rate

$19,000 swap 4/1/99 4/1/09 4.88% 7.75%

The $19,000 swap reduces the Company’s exposure to the variable-interest rate related to the Demand Revenue

Bonds (see Note 5).

At January 31, 2004, the Company had a $10,000 and a $5,000 interest rate swap that did not qualify for hedge

accounting. These swaps expired in fiscal 2004.

Hedging Derivative

The Company is party to one derivative instrument in the form of an interest rate swap that qualifies for hedge

accounting treatment pursuant to the provisions of SFAS No. 133.

In 2001, the Company entered into a $25,000 interest rate swap agreement (swap) to manage the risk associated

with interest rate fluctuations on a portion of the Company’s variable-interest entity debt. In March 2004, the Company

repaid all of the variable-interest entity debt with borrowings from the Facility (see Note 5). The Company redesignated

this swap to borrowings under the Facility. This redesignation does not affect the accounting treatment used for this

interest rate swap. The swap creates the economic equivalent of fixed-rate debt by converting the variable-interest rate

to a fixed-rate. Under this agreement, the Company pays interest to a financial institution at a fixed-rate of 5.43%. In

exchange, the financial institution pays the Company at a variable-interest rate, which approximates the floating rate on

the debt, excluding the credit spread. The interest rate on the swap is subject to adjustment monthly consistent with the

interest rate adjustment on the debt. The swap is effective through March 2006.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)